Advertisement

Anonymous

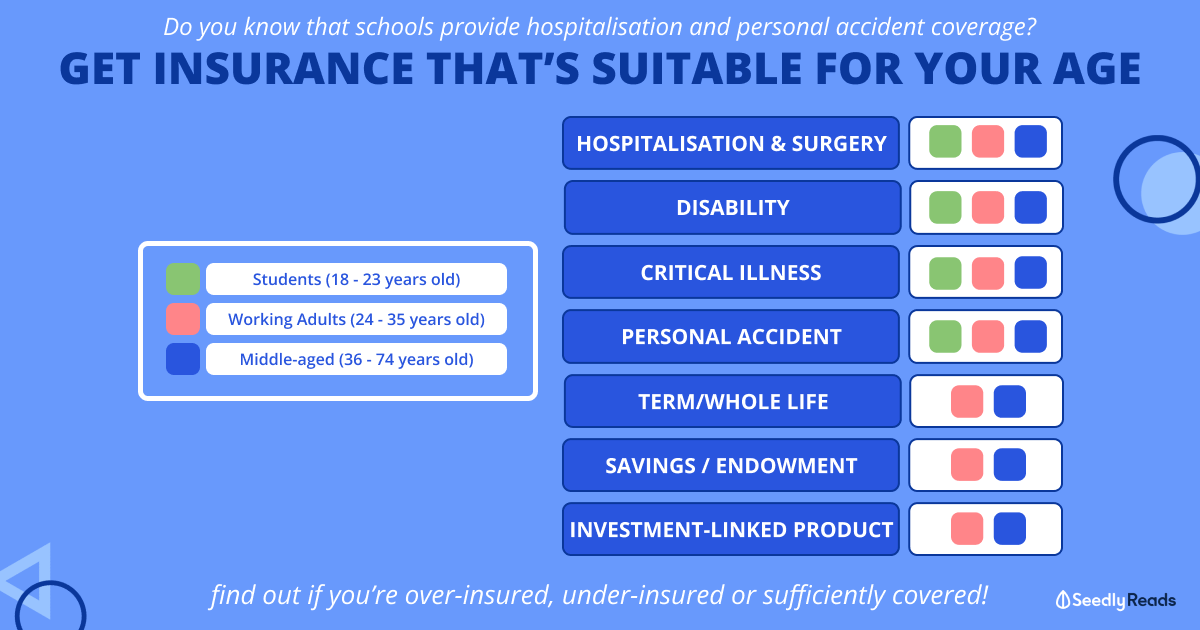

I need a mentor who can guide me on the differences of insurance or policy available?

4

Discussion (4)

Learn how to style your text

Reply

Save

Pang Zhe Liang

02 Aug 2020

Lead of Research & Solutions at Havend Pte Ltd

The basic information on such policies are online, e.g. on MoneySense, finance blogs. These information should give you a basic idea on the insurance policies and why you may need them. Additionally, I will suggest you to either do further research on your own or to speak to a qualified consultant if you have further question. This is to ensure that you are getting the right information to that end.

I share quality content on estate planning and financial planning here.

Reply

Save

Hariz Arthur Maloy

01 Aug 2020

Independent Financial Advisor at Promiseland Independent

Hi Anon, I wouldn't think a mentor that isn't in this industry would be qualified to give you answer...

Read 2 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Hey there!

Ultimately, you'll want someone who can offer objectivity and a holistic form of financial planning. There are different comparisons of plans online but ultimately, the product is only as good as the agent advising you as well. Feel free to reach out if you need.

Financial planning is an integral part of life. You can reach me here to find out more.