What is the thereafter rate of the SBI mortgage?

There thereafter rate after the first few years of low interest is more important than the initial rate.

There are a few points to consider and any good mortgage broker would have brought you through these points.

1) As you already know your loan amount in the future will get lesser and lesser. Meaning you probably will not want to refinance again in the future. (The cost become more and more exorbitant as the subsidies become less)

2) This means you need to find a mortgage package that gives you stability over the WHOLE loan tenure and not just the first few years.

If not you are just going to get "Tok" by the bank after the initial low few years of rates are completed.

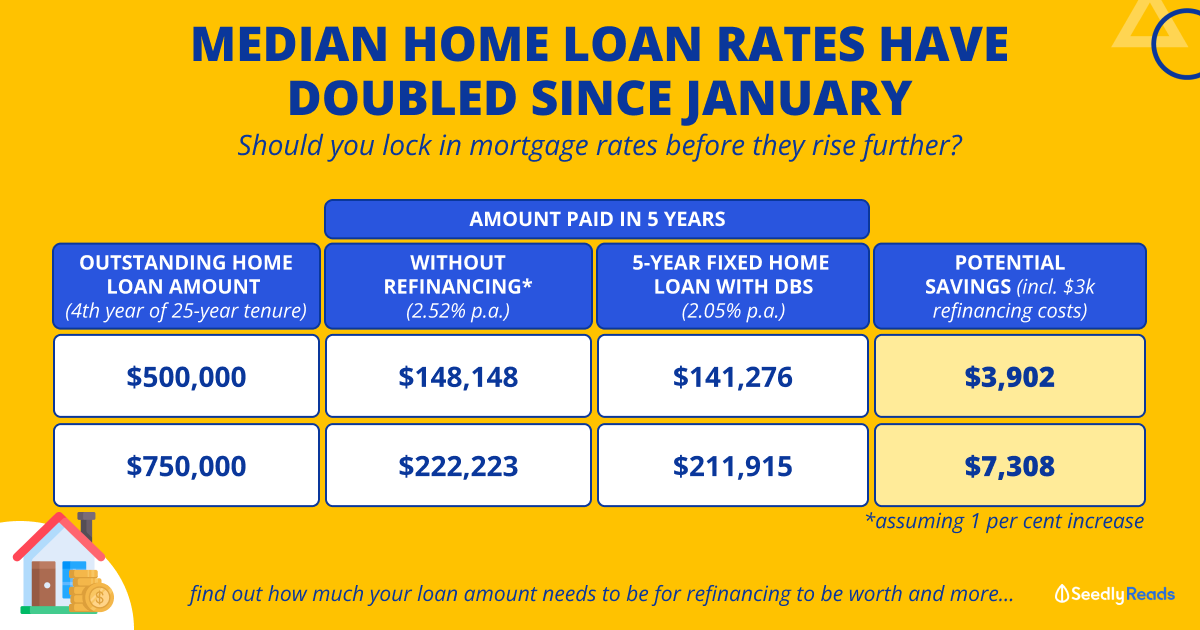

3) I suggest that you go back to DBS and get something like 1.5% five years fixed. And then continue to reprice within DBS / POSB after that.

Their hotline is 6333 0033

Side note : If SBI package is good for the first 3 years (Assuming) and you guarantee chop stamp going to sell your house after 3 years.

Then ok can change to SBI.

What is the thereafter rate of the SBI mortgage?

There thereafter rate after the first few years of low interest is more important than the initial rate.

There are a few points to consider and any good mortgage broker would have brought you through these points.

1) As you already know your loan amount in the future will get lesser and lesser. Meaning you probably will not want to refinance again in the future. (The cost become more and more exorbitant as the subsidies become less)

2) This means you need to find a mortgage package that gives you stability over the WHOLE loan tenure and not just the first few years.

If not you are just going to get "Tok" by the bank after the initial low few years of rates are completed.

3) I suggest that you go back to DBS and get something like 1.5% five years fixed. And then continue to reprice within DBS / POSB after that.

Their hotline is 6333 0033

Side note : If SBI package is good for the first 3 years (Assuming) and you guarantee chop stamp going to sell your house after 3 years.

Then ok can change to SBI.