Advertisement

Anonymous

How do I tell a good fund from a bad fund manager just from the fact sheet?

To a retail investor on the street, how do we ensure that we are buying into the best funds?

Any tips and things to look out for?

8

Discussion (8)

Learn how to style your text

Reply

Save

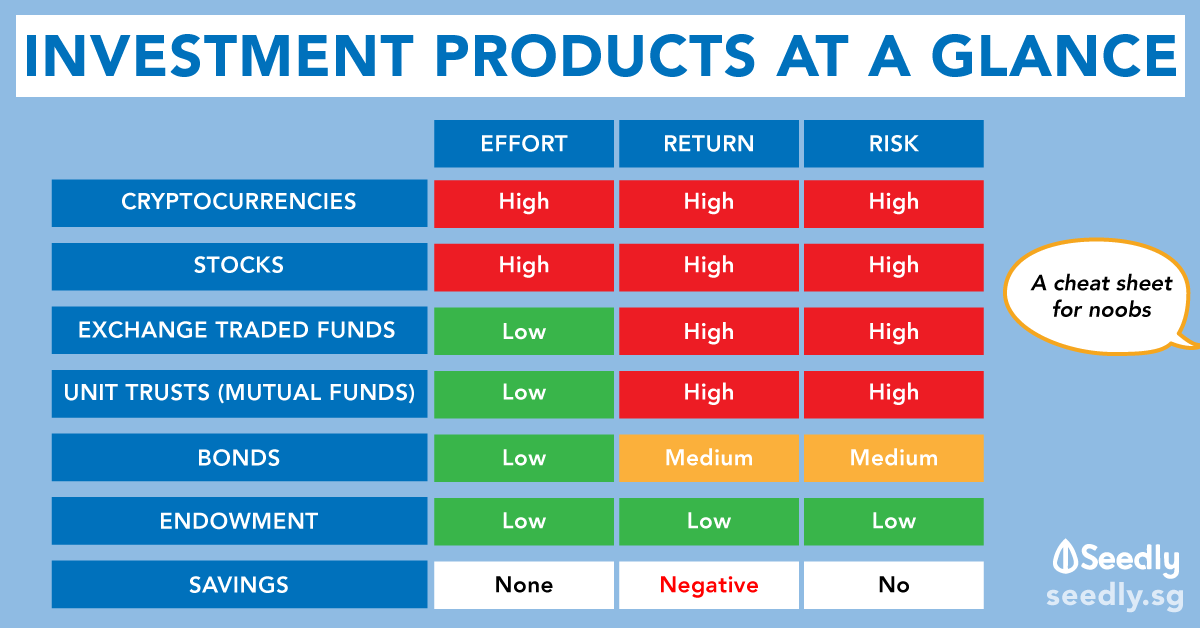

If you investing in an active fund, you cannot really tell if the fund will continue to perform for the next decade or so. The type of active funds that retail investors would have access to, typicallly would not outperform the market consistently.

If you are investing in a passive fund that have a broad market exposure with no style bias, then investing in the cheapest fund. For example, there are a couple of S&P 500 ETFs out in the market, SPY, IVV, VOO.

I believe VOO is the cheapest right now at 0.03%. VOO is no difference from IVV and SPY in terms of its underlying exposure. But note that the above ETFs are US-domiciled ETFs and are subejcted to 30% dividend tax withholding.

But you get the idea. Invest in the cheapest ETFs for broad market exposure with no style bias.

And if you are really interested in thematic ETFs, pay attention to what is the investment objective and what is under the hood.

On a side note, I am starting a financial blog. Do check it out.

Reply

Save

Outperformance by active fund management is very very hard to do year after year, and you would be b...

Read 2 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Technically when You look at the longterm price chart in the fact sheet:

it is rare that the fund price is better than a passive index depicted in the chart,

same thing: 5 y and 10 y performance tables for fund versus index.

there are no really fund manager heroes, at least with stock mutual funds.

try to find the Bill Miller story (Legg Mason) on the internet.

some mutual fund managers are successful,

but only very rarely so robustly for more than 15 years compared to passive indexing

benchmarks.

Conclusion: avoid mutual funds/unit trusts, instead think passive indexing ETFs