Advertisement

Anonymous

Beginning as a regular in a uniformed career, what additional insurance policies are recommended?

At the age of 24, I am beginning my life in a uniformed career soon. Based on my understanding, there is the AVIVA insurance that uniform careers typically provide.

1) How much add-ons or insurance coverage should I get with this group insurance?

2) Can I settle all my insurance with the ones provided?

3) Should I also consider getting additional policies outside? I want to be fully covered.

4

Discussion (4)

Learn how to style your text

Pang Zhe Liang

07 Jul 2020

Lead of Research & Solutions at Havend Pte Ltd

Reply

Save

Tan Li Xing

07 Jul 2020

Financial Consultant at Prudential Assurance Company (Singapore)

Hi Anon,

The benefits of being a regular is that you are pretty well-covered during your active years in the force. Some things you definitely should consider is that when you are no longer in the force, would you still have the same kind of coverage?

Some things you should look into if you haven't;

1) Integrated Shield Plan - This is usually the first priority when you are looking at insurance coverage. This plan is for your reimbursement of hospital bills in the event of hospitalisation, and covers up to 95% of the bills based on the current regulations set by MOH.

2) Whole Life Insurance with Critical Illness & Early Stage Critical Illness Coverage - As Critical Illness is something that can happen to us at any phase of life, I do believe this is important to have. I do believe that the Mindef Aviva Group Term can have this included, but as it's a term policy, it will cover you till 70 years old as long as you choose to continue the plan based on what I last read up. The guideline for Critical Illness and Early Stage Critical Illness is;

5x your Annual Income for Critical Illness

2 - 3x your Annual Income for Early Stage Critical Illness

3) Term Insurance - this is something you already have as a regular, so what you can do is to actually enhance the amount of coverage in regards to your full income protection; so you can use the guideline of 10x your annual income. Or if you want to have full protection during your active period you can use your annual income x the number of years till retirement as a gauge. So for example;

36k annual income x 30 years in the force = potential income of 1.08mil

So you can consider having a term insurance of 1 mil actually.

4) Personal Accident Plans - I do believe you would have it with the Aviva Group Plan. This is for coverage in the event of accidents, and would usually reimburse you for visitations due to accidents like sprains, cuts, burns. It might even have coverage for you when you visit a TCM for sprains. Also there might be coverage for dengue and even HFM as well, but it would be better to confirm as I'm not sure sure about the Aviva policy.

I think having these 4 would have a holistic coverage. Then the other forms of insurance you will need would car and travel that your will purchase as needed.

Reply

Save

Hey there!

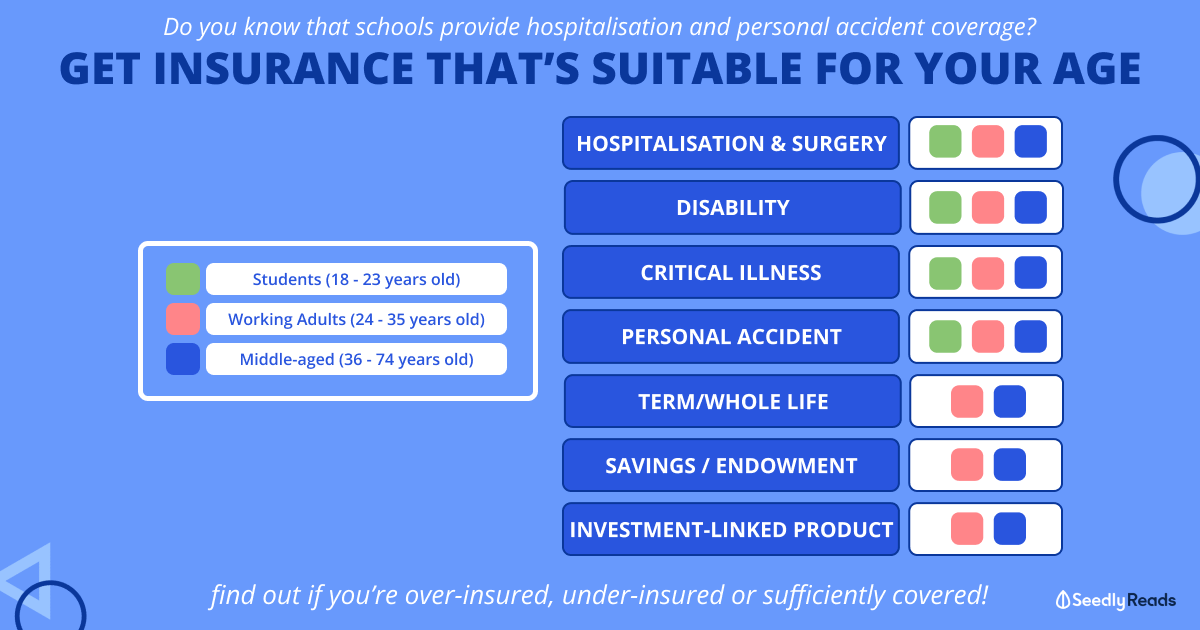

In general, the guideline for coverage will be as such:

10 X for death and total perman...

Read 2 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Products

Income IncomeShield Integrated Shield Plan

4.4

306 Reviews

NTUC Income IncomeShield Integrated Shield Plan Preferred

$1,500,000

LIMIT PER POLICY YEAR

180 / 365 days

PRE & POST HOSPITAL

As Charged

OUTPATIENT BENEFITS

Private Hospital

WARD ENTITLEMENT

Manulife ReadyProtect Personal Accident

4.7

69 Reviews

Great Eastern GREAT CareShield

4.1

18 Reviews

Related Posts

Advertisement

Generally, life insurance coverage can be split into three life's major event,

Pre-Mature Death

Total & Permanent Disability

Critical Illness

Death Coverage

There are a couple of factors that we need to clarify and plan before we can establish whether there is a need for death coverage. For example, do you have any dependents? Do you have any liabilities?

More Details:

5 Reasons why You need Life Insurance - Death Coverage

Total & Permanent Disability

Since you are alive and continues to live, there exists a need to be insured.

More Details:

5 Reasons why You need Life Insurance - Total & Permanent Disability Coverage

Critical Illness

Similar to the rationale for Total & Permanent Disability, there exists a need for you to be insured.

More Details:

5 Reasons why You need Life Insurance - Critical Illness

On the whole, these are general guidelines which may or may not work for you. Therefore, you are encouraged to conduct comprehensive financial planning. Through this process, it ensures that we are well-planned ahead in life.

I share quality content on estate planning and financial planning here.