Advertisement

Any similiarities with DOTcom bust and current Tech boom?

For those who lived through the dotcom bust, do you see any similiarities with the current tech boom and overvalued tech stocks? Tech startups all coming up with insane valuations, tech stocks keep rising too

5

Discussion (5)

Learn how to style your text

Reply

Save

Bjorn Ng

19 Jan 2020

Business Analyst at 10x Capital

Hey there,

Yes, you are right that tech stocks are currently super overvalued - people are looking wayyy ahead of it and even though it's burning through cash quarter after quarter, the market is still pushing the price up because of their insane growth rate.

However for me, I think the difference is right now, information is readily available online and easily accessed. You can actually assess if a business is "all fluff" or if even at the high valuations, it is being justified through the management decisions, future plans, and their growth rate.

Reply

Save

Billy

15 Jan 2020

Development & Acquisitions Manager at Real Estate Private Equity

I am probably too young to recall how markets were like during the dotcom bubble but this time round...

Read 3 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

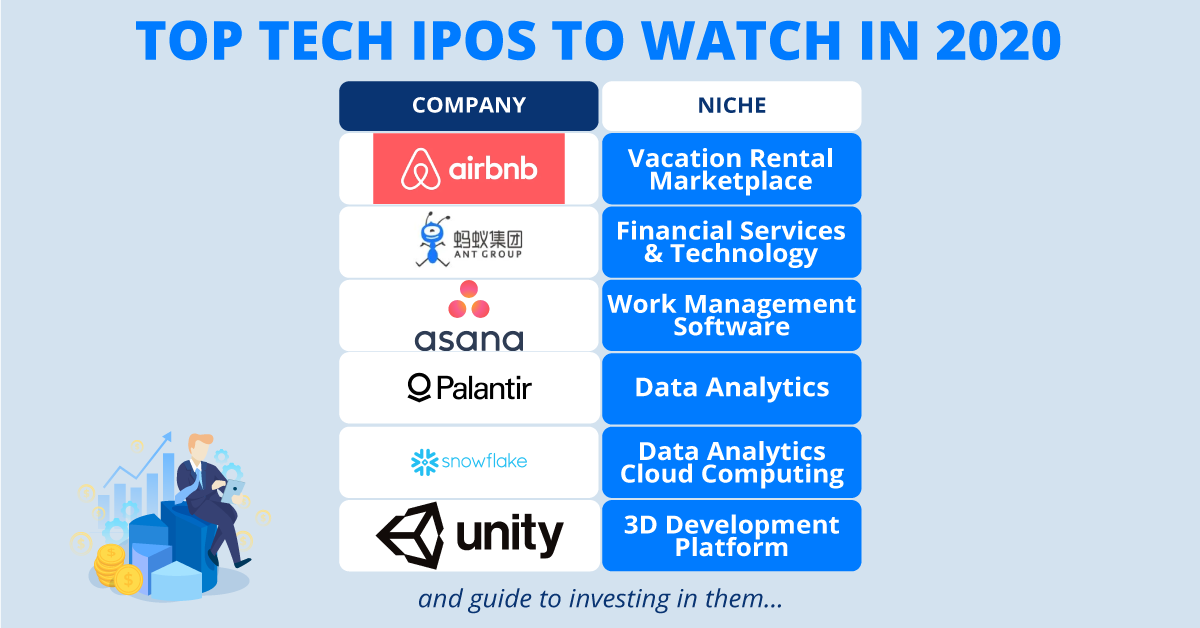

All tech companies are given insane valuation despite their numbers. Any tech companies can come out now and be valuated at an insane price and burn through investors money