Advertisement

2nd Property for investment returns, is it still worth it given the ABSD is 12%. Your property needs to grow 12% just to match this initial "loss". Go for it or just buy stocks/ REITS?

I have been thinking stocks and reits are still better than property investments, but I am curious why are still so many Singaporeans looking to buy their 2nd property after they meet their HDB 5 years MOP. Any people in similar shoes in 2nd property or sticking to stocks and REITS only?

6

Discussion (6)

Learn how to style your text

Reply

Save

Having looked at friends and assessing the case now, I would say its not worth it.

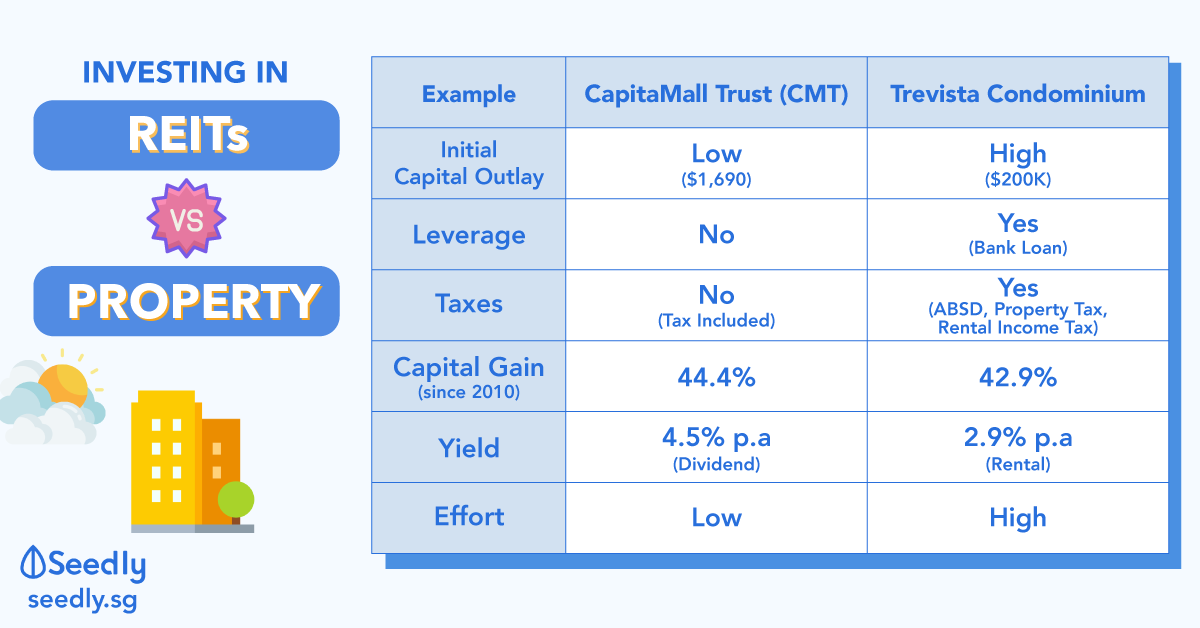

A) diversification - stocks + reits are better

A property is just one. It could be somewhere from 0.3 million to 40 million by itself. Given the market conditions now, its really difficult to get a rental yield that you can say is really impressive?

On the other hand, with 0.3 million, you could pretty much build a decent portfolio that is well diversified and not having the risk of "one".

B) Ease of liquidity - stocks and reits better

Its really easier to sell stocks and reits using a few clicks. With a property you gotta engage an agent, put up listings, look out when govt may raise absd, check whether you are in the time range for seller stamp duty.....

C) debt - stocks and reits better

With property, you usually need to take a loan and that introduces interest rate risk apart from having to ensure you can service the monthly payments.

With stocks and reits, you can adjust the quantity and be decently invested without having to leverage.

D) managing tenants - stocks and reits better

Stocks and reits have entire teams working to get business / tenants and pay you dividends. You dont need to work to get your dividends.

With property, hell no. You look for tenants, negotiate rents, address their needs and complaints. Why you want to do extra work?

E) taxes - stocks and reits better

Property - just the property tax alone, you might be disadvantaged in the p&l / yield already. Then comes rental income. And additional work to incorporate this in your tax filing.

Dividends from stocks and reits are usually not taxed (at least for Singapore stocks). They win hands down.

Reply

Save

James Yeo

10 Jun 2019

Editor at SmallCapAsia.com

I would advise against it. Interest rates can increase dramatically in the event of overheating.

$...

Read 3 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

In today's property market, most will not get breakeven properties let alone cashflow positive.

The mortgage interest rates and the demand for rentals in most areas are not helping. So most of the time, alot of properties will be cashflow negative so if its your second property, I would advice against buying it for now and maybe put the CPF money into CPFIS Reits.

Im not saying there isnt any good properties with positive cashflow but its going to be very hard to find.

By the way, dont look at positive ROI you must calculate positive cashflow. Its important because you can be positive in ROI but bleeding money monthly and cause you more pain than gain.