Advertisement

Anonymous

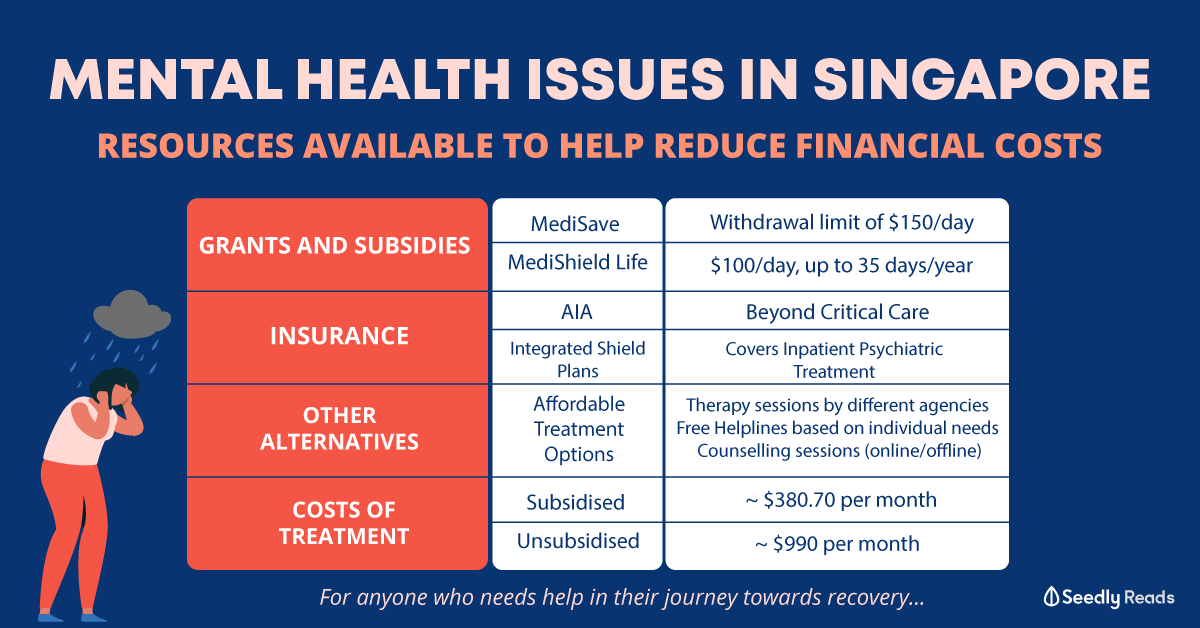

With a few changes taking place such as CareShieldLife and co-payment riders for ISP 2020/2021, how should we prepare ourselves financially? (Bonus: mentally?) ?

CS annual premiums starting $183, but can go as high as $2k depending on age. This is similar to increasing premiums like a H&S plan. Good news is it's payable by Medisave so maybe not so heart pain. Bad news is it's compulsory. Should we consider this factor when getting coverage for TPD (since CareShield criteria is ADL 3 out of 6), or see it as a basic coverage? LTC?

Should we buy healthcare stocks (REITs?) to combat?

Pls feel free to correct me, I am a noob, any advice/opinion is welcomed!

1

Discussion (1)

What are your thoughts?

Learn how to style your text

Hariz Arthur Maloy

24 Mar 2019

Independent Financial Advisor at Promiseland Independent

Reply

Save

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

TPD benefit for most life plans end at age 70. Careshield Life (CSL) covers and pays for life. It doesn't pay a lumpsum. It's meant to be used as Long Term Care Insurance.

It's purpose is to pay for the additional cost of living one would incur if they are disabled, such as hiring a private nurse to take care of you at home, or putting yourself up in a nursing home, plus don't forget transportation costs as well.

So purchase your TPD plans as per normal and see CSL as an additional downside protection in your retirement years. Make sure to also upgrade it once it's finally released. You should aim to get a 3000-4000 per month payout instead of just 600.

Healthcare REITs are not Healthcare stocks. They're still property stocks. Invest in a proper Healthcare fund that includes pharmaceuticals, medical device companies, Healthcare research companies. They should already be part of your portfolio as they are considered slightly defensive in nature and is still rapidly growing.