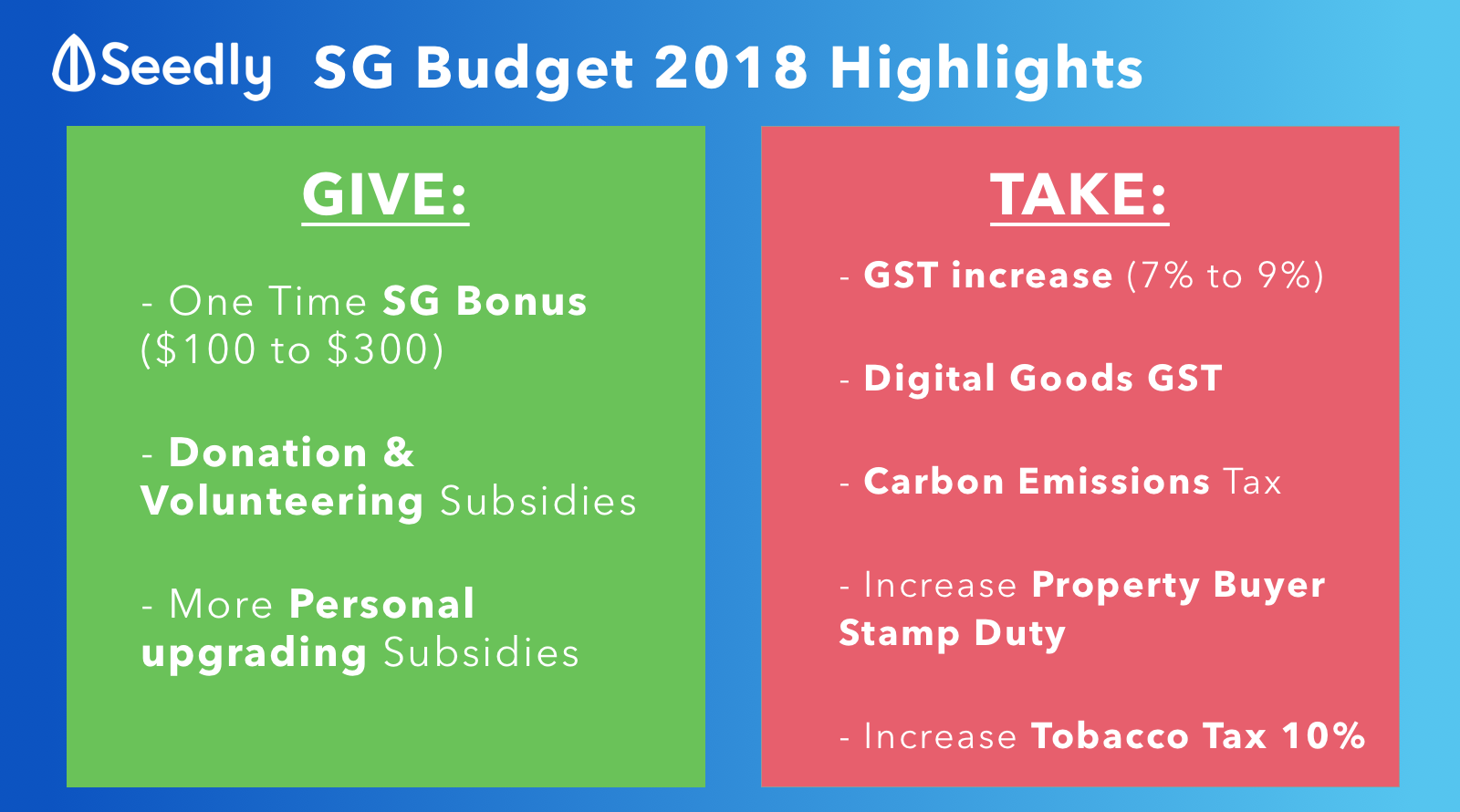

Why do we need to raise GST?

As the population ages, there is a need to spend more on healthcare to support our seniors (parents, grandparents...). More national revenue is required to support the increased spending.

Where does the revenue come from?

Quoting Mr Heng Swee Keat, "Over 60 per cent of GST collected by individuals and households come from foreigners residing here, tourists and the top 20 per cent of households". Therefore, by maintaining the GST rate at 7% we are forgoing potential revenue to be used to improve the lives of Singaporeans.

Is/Are there help given when GST is increased?

Yes, definitely. There will be a $6 billion Assurance Package set aside for Singaporeans when the rate is eventually raised. The permanent GST Voucher scheme will be enhanced. GST on publicly funded education and healthcare will continue to be absorbed by the Government.

Is our tax higher than in other countries?

Singapore's GST is at 7% currently and is one of the lowest compared to other countries' GST/VAT (Indonesia-10%, USA-11.725%, China-13%, Malaysia-10%, Vietnam-10%, Philippines-12%, New Zealand-15%, Netherlands-21%)

Why do we need to raise GST?

As the population ages, there is a need to spend more on healthcare to support our seniors (parents, grandparents...). More national revenue is required to support the increased spending.

Where does the revenue come from?

Quoting Mr Heng Swee Keat, "Over 60 per cent of GST collected by individuals and households come from foreigners residing here, tourists and the top 20 per cent of households". Therefore, by maintaining the GST rate at 7% we are forgoing potential revenue to be used to improve the lives of Singaporeans.

Is/Are there help given when GST is increased?

Yes, definitely. There will be a $6 billion Assurance Package set aside for Singaporeans when the rate is eventually raised. The permanent GST Voucher scheme will be enhanced. GST on publicly funded education and healthcare will continue to be absorbed by the Government.

Is our tax higher than in other countries?

Singapore's GST is at 7% currently and is one of the lowest compared to other countries' GST/VAT (Indonesia-10%, USA-11.725%, China-13%, Malaysia-10%, Vietnam-10%, Philippines-12%, New Zealand-15%, Netherlands-21%)