Advertisement

Anonymous

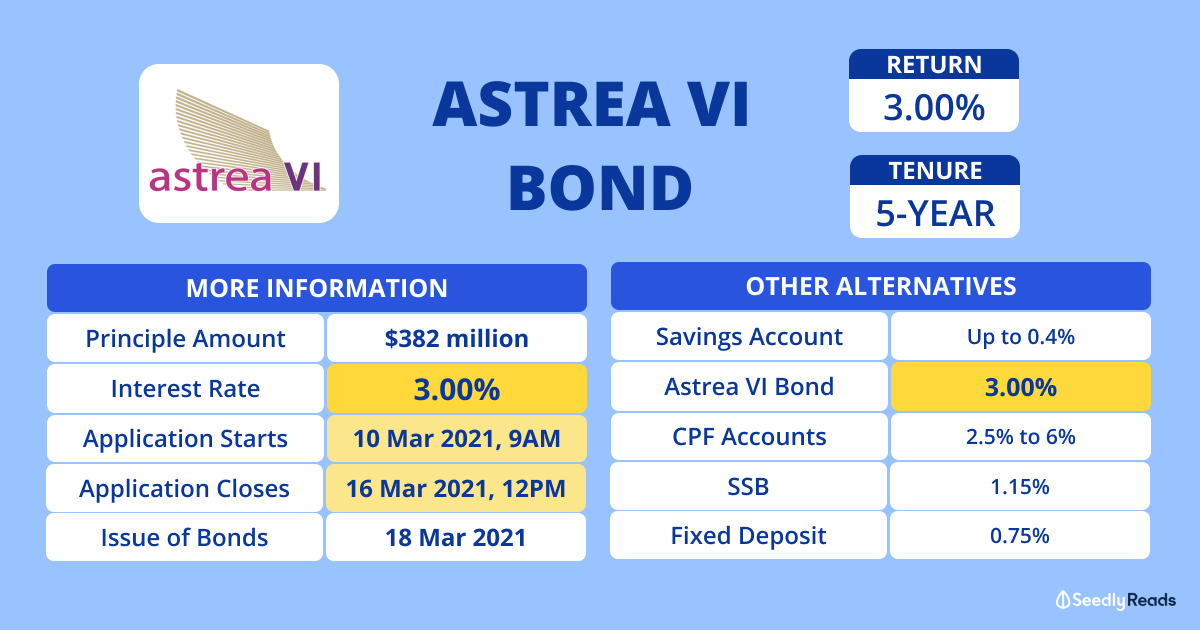

Which is the best brokerage to buy bonds trading on SGX such as Astrea iv and Temasek?

I'm looking to buy bonds which are trading on SGX i.e Astrea iv and Temasek. Hope to have some ideas how to go about doing that. Appreciate any advice on the following questions.?

1) Can I open a CDP account and buy/sell directly via that on SGX?

2) What are the low cost brokerage options available? From reading a few blogs, understand that FSMone does allow retail investors to buy bonds without needing for AI declaration, but its processing fees and quarterly platform fees accumulate to quite a substantiate amount on an annual basis so much so that initial calculation seemed to suggest 6-9mths to breakeven, which is no different from going through banks (least preferred)

7

Discussion (7)

Learn how to style your text

Billy

22 Jan 2021

Development & Acquisitions Manager at Real Estate Private Equity

Reply

Save

CDP account is to hold securities that are bought on SGX. It is not a trading account.

You will need to open a trading account with any of the brokers that allow trading on SGX. If you don’t have a CDP account, some of the brokers can assist to open one when you sign up with them.

For Astrea and Temasek retail bonds, they are traded on the SGX like normal stocks. Buy on the open market through the brokerage. Search on SGX for their ticker symbols.

https://www.sgx.com/fixed-income/retail-fixed-i....

The board lot size is usually 1000.

The bond offerings that you mentioned usually require a minimum $250,000 purchase.

Reply

Save

Write your thoughts

Related Articles

Related Posts

Related Products

Moomoo Singapore

4.7

487 Reviews

From $0

MINIMUM FEE

0.03%

TRADING FEES

Custodian

STOCK HOLDING TYPE

Saxo Markets

4.5

961 Reviews

Syfe Trade

4.9

130 Reviews

Related Posts

Advertisement

1) As what Shaun pointed out, CDP works like a bank account for stocks. It's used for holding of stocks, not as a platform for you to purchase one. If you'd like to purchase bonds that are traded on SGX, you'd have to set up a brokerage account and dependent on the type of brokerage account, determine whether a CDP account is required.

2) I would go for Tiger Brokers as commissions is just 0.08% of your trade value (excl. 0.0075% + 0.0325% for SGX fees). And as you accurately mentioned, those bonds require a min. subscription of 250K, hence it's not really accessible to the layman. If you really would like to buy into corporate bonds, you could try looking at Bond ETFs i.e. ABF Singapore Bond Index Fund - This is a bond ETF traded on SGX that has govt. bonds i.e. LTA, HDB in its portfolio