That's a pretty good question that almost everyone in Singapore has asked themselves, at some point in life.

I suppose it boils down to 2 things:

1) Is it a want? Meaning a good-to-have kind of thing because you just want to avoid squeezing with everyone on the trains and buses on your commute to work. Or perhaps you want it as an "indicator" of wealth - a relatively poor one I might add. Then it's a liability.

2) Is it a need? Meaning you depend on it for your livelihood or for your day-today living. A good example would be salespeople who need the speed and convenience a car provides in order to meet clients. Or perhaps you need it to ferry your ailing parents or grandparents to regular checkups and etc. It's still a liability, but also a necessary asset - in some sense.

The problem with owning a car, in Singapore especially, is that it's ridiculously expensive. Especially with the COE prices, road tax, car park fees, fuel, and etc.

If you identify that a car is a want. Then you're better off using the 50% expenses/30% wealth building/20% savings rule to figure out how much you can responsibly allocate to this expense/liability AFTER you have contributed to your wealth building and savings fund. If your peers are driving around when all of you are earning something within the $2,000 to 3,000 range, this probably means that they are over-leveraged and are not saving enough for their future.

If you identify that a car is a need, well... You should still use the above 50/30/20 rule but probably have to consider other equally important things like, does it make more sense to own a car vs. getting a private hire car/taxi to go about your daily life? In terms of:

1) Cost (taxi fees vs owning a car; arguably cheaper for the former but the convenience of a car means you don't have to wait or get cancelled on at the last minute by errant private hire drivers)

2) Time saved by driving vs. taking public transport (will you put it to good use eg. self improvement or exercise or answer 5 more work emails? or waste it on video games and Netflix...)

And potentially more factors, depending on your circumstances and how heavily do you rely on having a set of wheels to get around.

Also, being able to afford a car, is also different from whether you SHOULD buy a car.

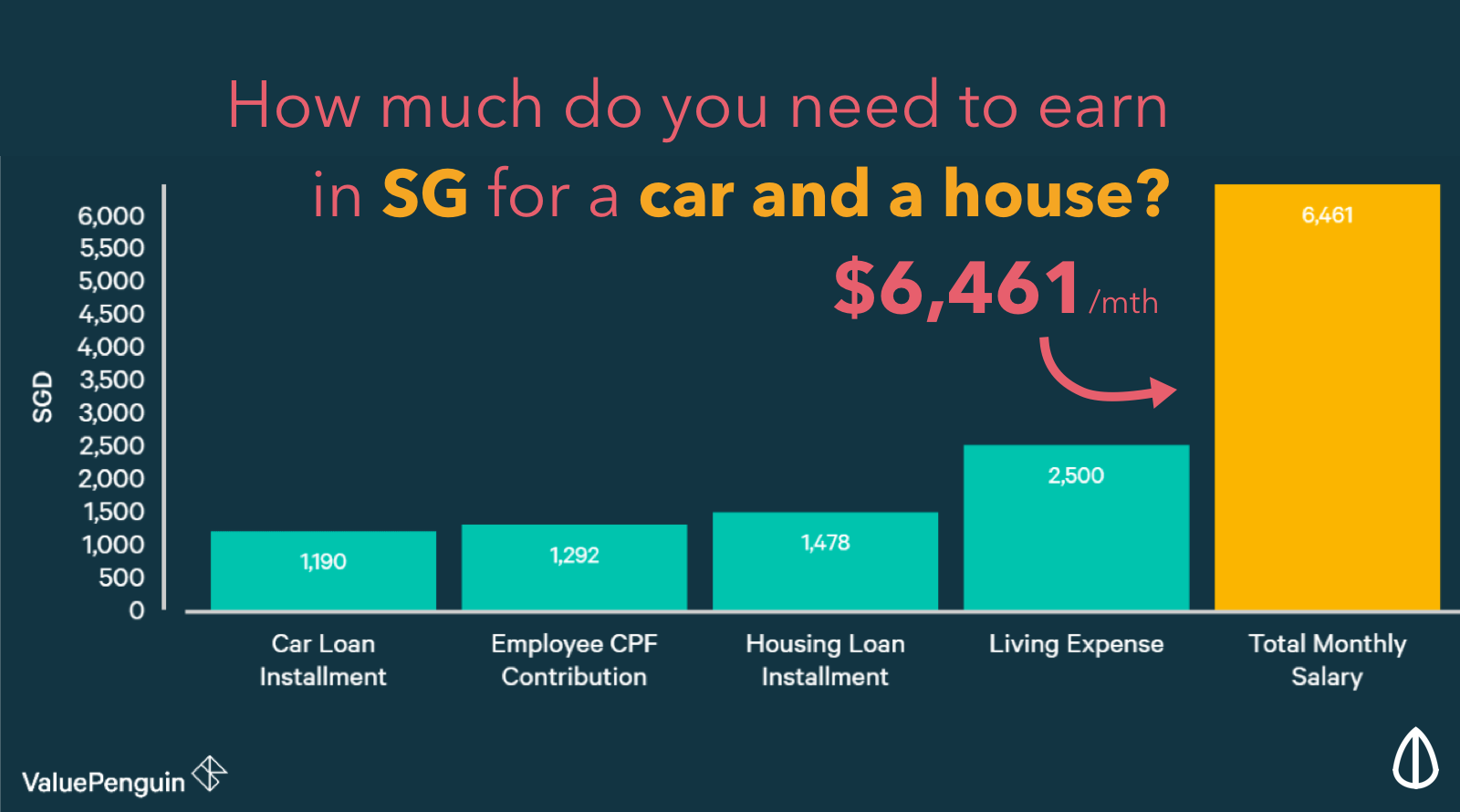

If you're interested to find out how much a car will cost per month, and how much you should realistically be earning if you want to buy a car, Seedly wrote a really good article about this: https://blog.seedly.sg/buy-car-how-much-should-...

That's a pretty good question that almost everyone in Singapore has asked themselves, at some point in life.

I suppose it boils down to 2 things:

1) Is it a want? Meaning a good-to-have kind of thing because you just want to avoid squeezing with everyone on the trains and buses on your commute to work. Or perhaps you want it as an "indicator" of wealth - a relatively poor one I might add. Then it's a liability.

2) Is it a need? Meaning you depend on it for your livelihood or for your day-today living. A good example would be salespeople who need the speed and convenience a car provides in order to meet clients. Or perhaps you need it to ferry your ailing parents or grandparents to regular checkups and etc. It's still a liability, but also a necessary asset - in some sense.

The problem with owning a car, in Singapore especially, is that it's ridiculously expensive. Especially with the COE prices, road tax, car park fees, fuel, and etc.

If you identify that a car is a want. Then you're better off using the 50% expenses/30% wealth building/20% savings rule to figure out how much you can responsibly allocate to this expense/liability AFTER you have contributed to your wealth building and savings fund. If your peers are driving around when all of you are earning something within the $2,000 to 3,000 range, this probably means that they are over-leveraged and are not saving enough for their future.

If you identify that a car is a need, well... You should still use the above 50/30/20 rule but probably have to consider other equally important things like, does it make more sense to own a car vs. getting a private hire car/taxi to go about your daily life? In terms of:

1) Cost (taxi fees vs owning a car; arguably cheaper for the former but the convenience of a car means you don't have to wait or get cancelled on at the last minute by errant private hire drivers)

2) Time saved by driving vs. taking public transport (will you put it to good use eg. self improvement or exercise or answer 5 more work emails? or waste it on video games and Netflix...)

And potentially more factors, depending on your circumstances and how heavily do you rely on having a set of wheels to get around.

Also, being able to afford a car, is also different from whether you SHOULD buy a car.

If you're interested to find out how much a car will cost per month, and how much you should realistically be earning if you want to buy a car, Seedly wrote a really good article about this: https://blog.seedly.sg/buy-car-how-much-should-...