Advertisement

Anonymous

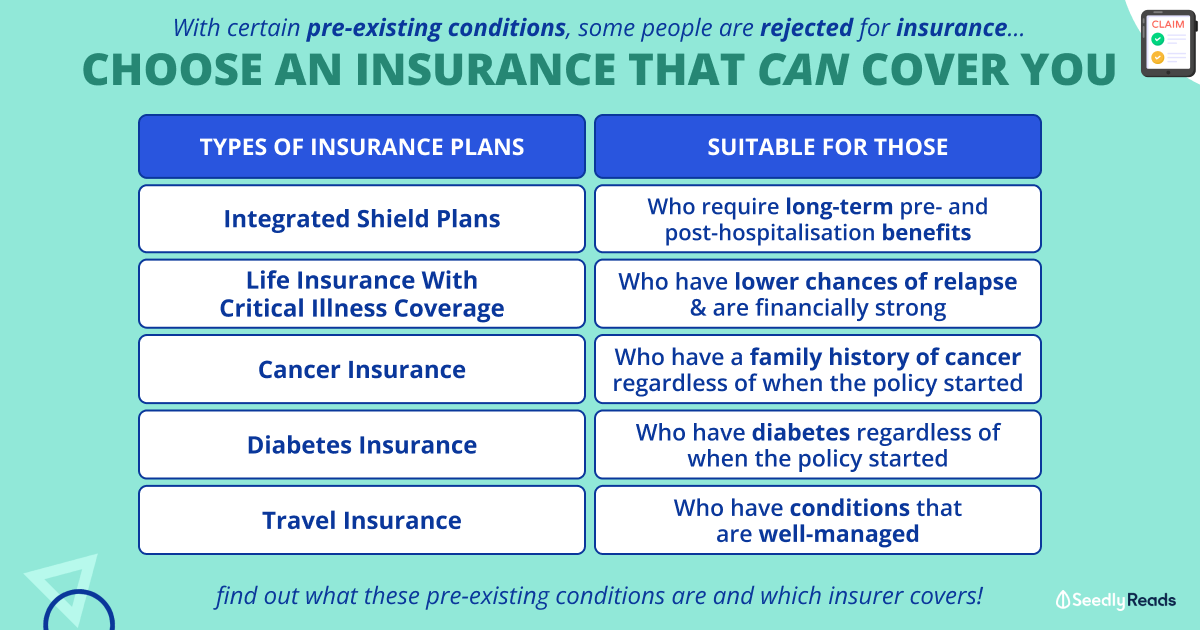

What insurance coverage should a person with pre-existing illness get?

Saw the comic about how insurance is important, I had an illness and my hospital coverage helped me, but now it’s considered as preexisting and I can’t get critical illness without paying a premium... My illness is not a critical illness btw.

What kind of coverage do I need?

Currently I have NTUC income hospitalisation insurance that covers 90% of the inpatient stay and 90 days before after outpatient.

3

Post Merged

This post is no longer accepting new comments because it has been merged with What insurance can someone with pre-existing conditions get?

Discussion (3)

Reply

Save

If getting the whole CI plans fail, there is an option to insure 1 or 3 major illnesses (i.e. cancer, heart attack and stroke that account for the majority of the claims), if your existing illness is unrelated.

Reply

Save

Pang Zhe Liang

25 Jan 2021

Lead of Research & Solutions at Havend Pte Ltd

Generally, personal insurance coverage can be split into two broad categories - accident and health,...

Read 1 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Hi there,

I'm sorry to hear about your condition. The good thing is that you have your hospital plan in place and hospitalisation coverage is the most basic coverage people need.

You may want to look at CI coverage then since CI coverage is important in all stages of your life, whether single or married. They typically give a lump sum payout upon diagnosis of CI and some even waive off your premiums upon diagnosis of CI eg. AIA Power Critical Cover.

Different insurer companies take on a different underwriting risk. Some companies may reject completely your application after underwriting, some may impose a mere exclusion or loading while some may accept it at standard life terms (no exclusion/loading). The only way you'll know is to submit a preliminary underwriting to assess the underwriting verdict.

If your CI plans do not go through and you've exhausted your options, you may consider getting at least a Personal Accident (PA) plan since they typically do not have health underwriting. However they may impose an exclusion depending on the type of health condition In your records. This is to ensure you at least have a basic form of coverage. PA plans cover accidental death, dismemeberment and even TCM/chiropractor visits for accidental injuries.

Ultimately, do consult a licensed financial advisor to explore your options.

Financial planning is an integral part of life. You can reach me here to find out more.