Anonymous

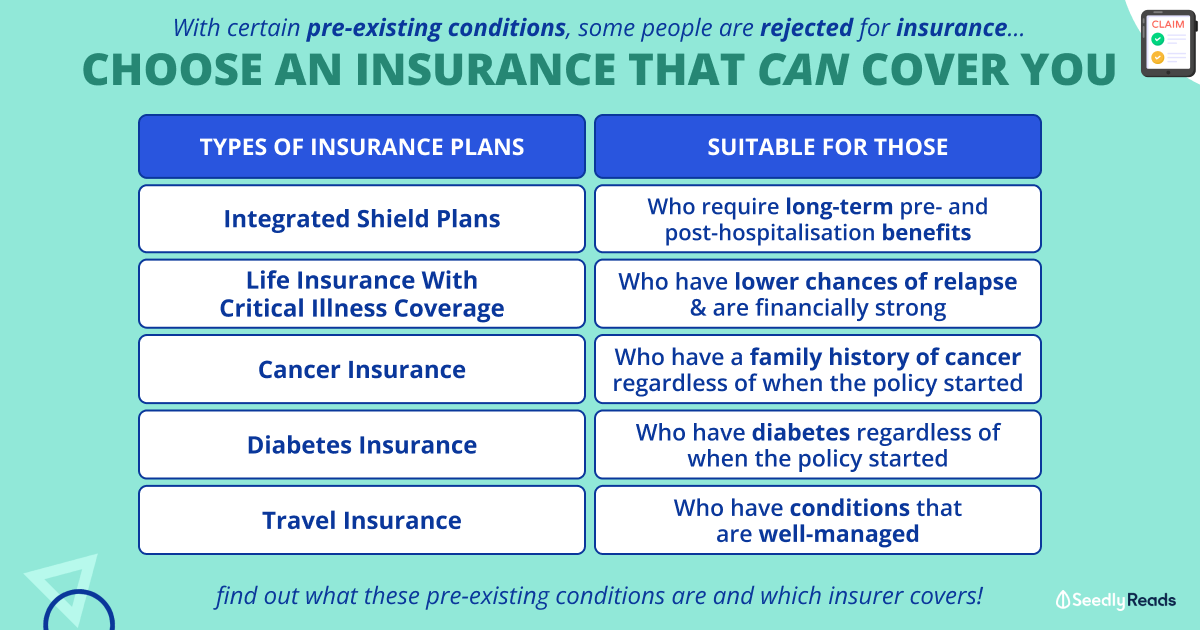

What insurance can someone with pre-existing conditions get?

For someone with pre-existing conditions, what options are there?

6

Discussion (6)

Learn how to style your text

Elijah Lee

06 Mar 2021

Senior Financial Services Manager at Phillip Securities (Jurong East)

Reply

Save

Pang Zhe Liang

05 Mar 2021

Fee-Based Financial Advisory Manager at Financial Alliance Pte Ltd (IFA Firm)

Generally, there are three types of insurance policies and I have summarised the purpose of them here: 3 Types of Insurance Policies in Singapore

Accordingly, the question is, what type of insurance coverage do you need? Rather than to ask, what type of insurance can you get? This is because you may not get what you need, and what you may get what you do not need. (Sounds confusing, but read slowly - it will makes sense.)

With this in mind, we will need to know your pre-existing condition and how each insurer will assess the condition. In the event that you cannot get covered on standard terms, you may be able to get covered on a sub-standard basis, e.g. loading, exclusion.

Despite that, if your condition doesn't allow you to get any form of insurance that requires medical underwriting (e.g. healthcare, life insurance), then you may consider alternative planning, e.g. plans that are guaranteed issurance offer. At this point, you will have to evaluate whether such plans are a need to that end.

Nevertheless, if you are a Singaporean or a Permanent Resident, then there will always be basic insurance coverage that you can fall back onto:

MediShield Life: Is MediShield Life enough in Singapore

CareShield Life: CareShield Life Singapore: Everyone's Basic Disability Income Insurance

This is because the abovementioned insurance will cover those with pre-existing medical condition as well.

I share quality content on estate planning and financial planning here.

Reply

Save

Jun Xi

05 Mar 2021

Financial Advisor at Great Eastern Life

Hi,

For people with pre-existing conditions, CPF’s insurance scheme like MediShield Life, Dependents’ Protection Scheme (DPS) and Eldershield/CareShield Life becomes even more important. These schemes provide coverage even to those with pre-existing conditions.

For private insurance, depending on the pre-existing conditions, some can still buy but the premiums will be subjected to loading. Personal Accident plan is also one way to enhance their coverage, it doesn’t require any health underwriting. Other than that, one can also look into endowment plans to as a way to save up for future financial needs.

Feel free to contact me (email at bio) if you are interested to find out more.

Cheers.

Reply

Save

Hi there,

I'm sorry to hear about your condition. The good thing is that you have your hospital plan in place and hospitalisation coverage is the most basic coverage people need.

You may want to look at CI coverage then since CI coverage is important in all stages of your life, whether single or married. They typically give a lump sum payout upon diagnosis of CI and some even waive off your premiums upon diagnosis of CI eg. AIA Power Critical Cover.

Different insurer companies take on a different underwriting risk. Some companies may reject completely your application after underwriting, some may impose a mere exclusion or loading while some may accept it at standard life terms (no exclusion/loading). The only way you'll know is to submit a preliminary underwriting to assess the underwriting verdict.

If your CI plans do not go through and you've exhausted your options, you may consider getting at least a Personal Accident (PA) plan since they typically do not have health underwriting. However they may impose an exclusion depending on the type of health condition In your records. This is to ensure you at least have a basic form of coverage. PA plans cover accidental death, dismemeberment and even TCM/chiropractor visits for accidental injuries.

Ultimately, do consult a licensed financial advisor to explore your options.

Financial planning is an integral part of life. You can reach me here to find out more.

Reply

Save

If getting the whole CI plans fail, there is an option to insure 1 or 3 major illnesses (i.e. cancer...

Read 4 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Hi anon,

There are still options even if someone has pre-existing conditions.

I'll leave out guaranteed issuance offer plans such as savings plans and retirement income plans from the discussion. Also, there are national schemes such as Careshield Life and Medishield Life that will cover pre existing conditions, but those are compulsory and you can't opt out anyway.

For starters, pre-existing conditions are subjected to insurer's underwriting guidelines. Some pre-existing conditions may not have much of an impact on the underwriting outcome; for example, marginally higher cholesterol may not have any substandard outcome on critical illness coverage coverage.

However, more important is to consider if you need the coverage in the first place; if you are looking at death/TPD coverage for example, do you have dependents and liabilities? If not, you probably don't need the coverage.

One thing you can do is to perform a preliminary underwriting assessment with the insurer; this will give you an indication of what is the likely underwriting outcome, so that you have a better understanding of whether the insurer will offer you.

Ultimately, there are only a few outcomes possible:

Standard

Loading

Exclusion(s)

Exclusion(s) with loading

Postponement

Decline

Standard and loading are probably still acceptable given that the scope of coverage is full; loading just means you are accepted for coverage but you are considered at a higher risk and thus you need to pay a higher premium. Exclusions means certain conditions will not be covered at all. Postponement means that your coverage will be considered again later on (this is usually when you have an on-going condition that isn't stablized yet), and decline is the least desirable outcome.

You can appeal on any loading or exclusion if there is medical evidence to show that your pre-existing condition has improved or recovered completely, but more importantly is to cover yourself adequately first with the right coverage; after all, we do not know how our health will progress in the coming years.