Advertisement

Anonymous

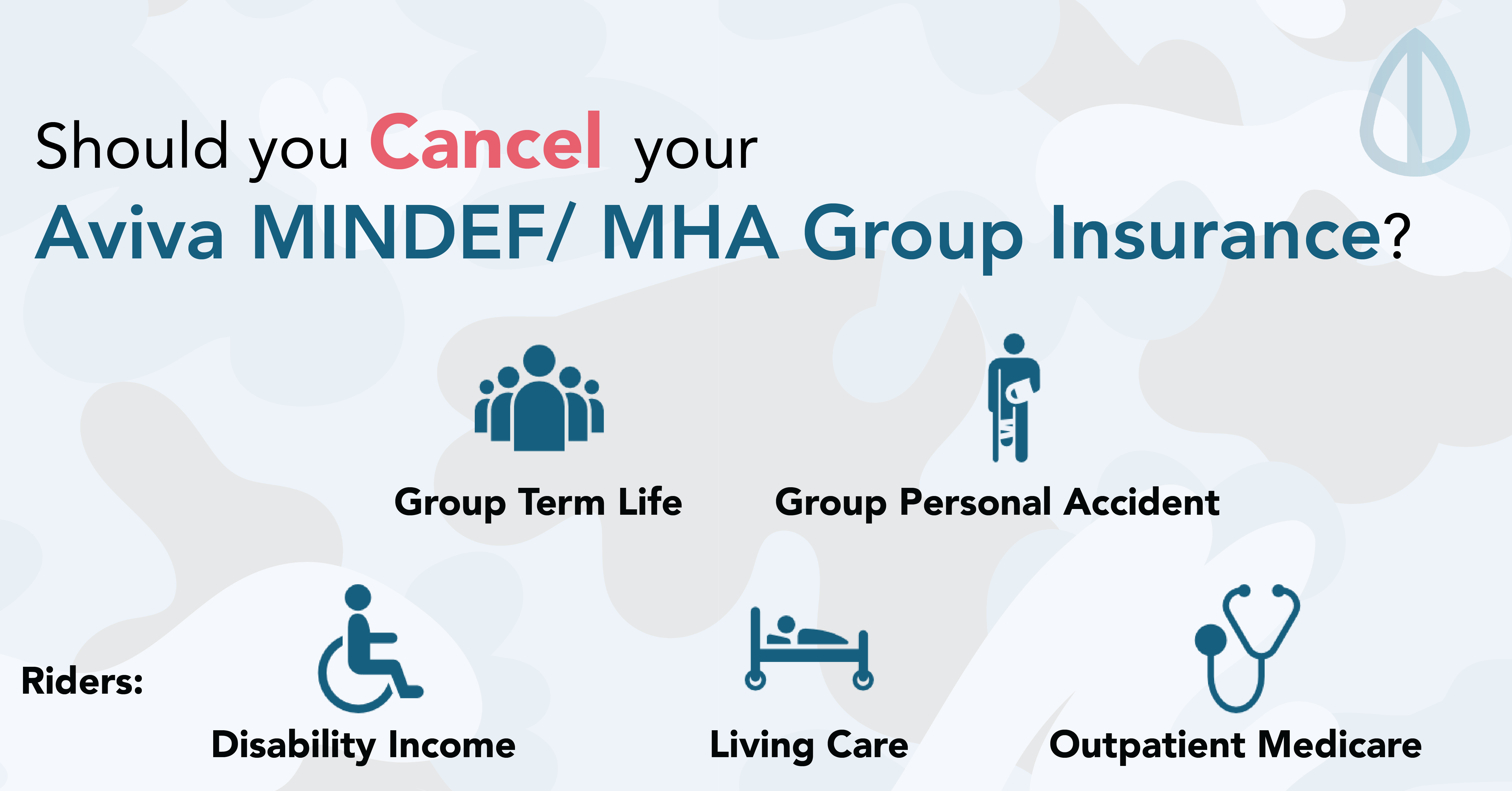

What do you guys think of the AVIVA MINDEF Group Insurance Volunteer Scheme?

Hi all, anyone purchased the Volunteer Scheme for this Group Insurance? Is it still the same premium after I ORD? Any views on whether is it rly worth? I just feel a bit insecure without a personal financial planner if I were to get this insurance plan😅

2

Discussion (2)

Learn how to style your text

Loh Tat Tian

26 May 2020

Founder at PolicyWoke (We Buy Insurance Policies)

Reply

Save

Hi. Similar question was asked before and discussed

https://seedly.sg/questions/is-aviva-group-term...

This was my answer.

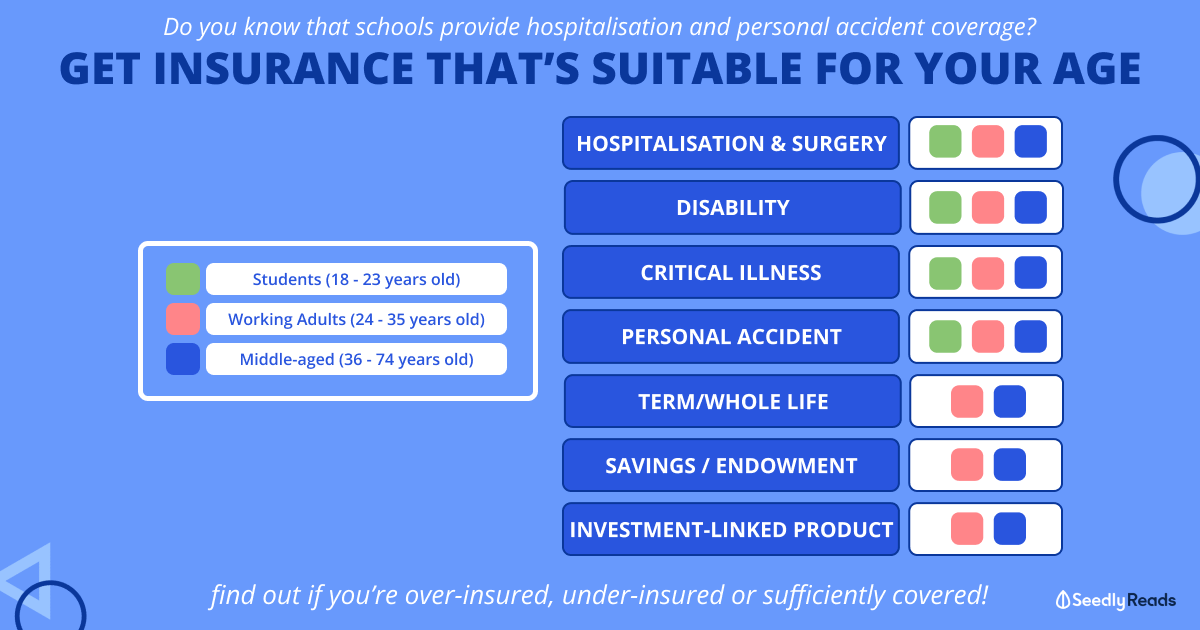

If you are asking this, I am assuming you are around the same age as me. 21-22.

Aviva Personal Accident can keep. Get max coverage 600k. Its cheap and WONT INCREASE IN COST as you age (for now). Worth it as it also cover TPD 150% which means if you get into accident and TPD, you get 900k.

Forget the rest of the policies. You can get cheaper ones with better coverage out there. You must be wondering 'This guy is kidding me. How can outside be cheaper than that.' But yes. Its cheaper. Let me tell you why.

For MINDEF Aviva Group Term Life, if you get at a young age, its more expensive then Personal Plan.

For Living Care and Living Care Plus, it's premium increases over time. If you get a personal term life outside with CI and ECI riders, the premium cost is FIXED.

Let me share with you my example.

Assuming I'm age 21, Term Life $750k for 30 years.

MINDEF GROUP TERM LIFE

Total cost for 30 years = $369/ yr

AVIVA MyProtector Term Plan

Total cost for 30 years = $334.55/ yr

^ You can contact any Financial consultant on the above data to clarify.

You must be wondering why Group Term Life are more expensive in this case? Reason is simple. The pricing for Group Term Life is based on ANB 65 AND BELOW and for this MINDEF one, you can get it ANYTIME before 65 and enjoy the same rate. This means that if you are starting young, you can get something better.

Does this means MINDEF GROUP TERM LIFE is bad? NO. Its for people that starts planning at a later stage. Maybe age 30+ where their cost of 750k term life will definitely be more than $369/yr.

Next is on CI/ECI. Lets start with the premium cost of Living Care (CI).

Assuming age 21, coverage 300k for 30 years.

Living Care premium increases every 5 year. For more info can check out on Aviva website.

Age 21 to 25: 8.4 x 12 = 100.80

Age 26 to 30: 12.3 x 12 = 147.60

Age 31 to 35: 18 x 12 = 216

Age 36 to 40: 29.7 x 12 = 356.40

Age 41 to 45: 29.7 x 12 = 356.40

Age 46 to 50: 82.5 x 12 = 990

Total cost over 30 years = $10836

Average per year = $361.20

As for Aviva CI Advance Cover Plus II, a rider for the above mentioned Aviva MyProtector Term Plan, the yearly premium cost for 300k CI is ONLY $172.60.

With the above example, it's half the total cost. As mentioned above, because Living Care and Living Care Plus price increase over age and you can see the exponential increase in cost after age 46.

Reply

Save

Write your thoughts

Related Articles

Related Posts

Related Products

Manulife ReadyProtect Personal Accident

4.7

69 Reviews

ReadyProtect Signature

$1,000,000

ACCIDENTAL DEATH

$500 / week

TEMPORARY DISABILITY

Up to $10,000

MEDICAL BENEFITS

$1500

TCM & CHIROPRACTOR

Income PA Assurance

4.2

27 Reviews

Income PA Guard

4.1

17 Reviews

Related Posts

Advertisement

As mentioned by Wenhao, he has covered most of the grounds. I would just like to add this in.

IF you are able to invest the remaining amount, future premiums are actually cheaper in present value, especially if you make sure you buy term and invest the rest. The future premiums can be serviced partly by the investment returns.

Hence its a matter of will you invest or not. If not, get a levelled term.

If yes, and you can get higher returns of 6% p.a, sure, mindef Aviva looks ok.

Of course, do have a end point and calculate them properly on the present value and future value.