Advertisement

Anonymous

What are your thoughts on the astronomical valuation on loss-making start-ups like WeWork, Uber, etc?

Would you invest in such companies yourself?

2

Discussion (2)

Learn how to style your text

Reply

Save

Cedric Jamie Soh

16 Sep 2019

Director at Seniorcare.com.sg

Depends on your outlook and risk appetite.

For me, I will invest a sum and take it as $0.

Hence I won't be bothered when the venture goes to $0

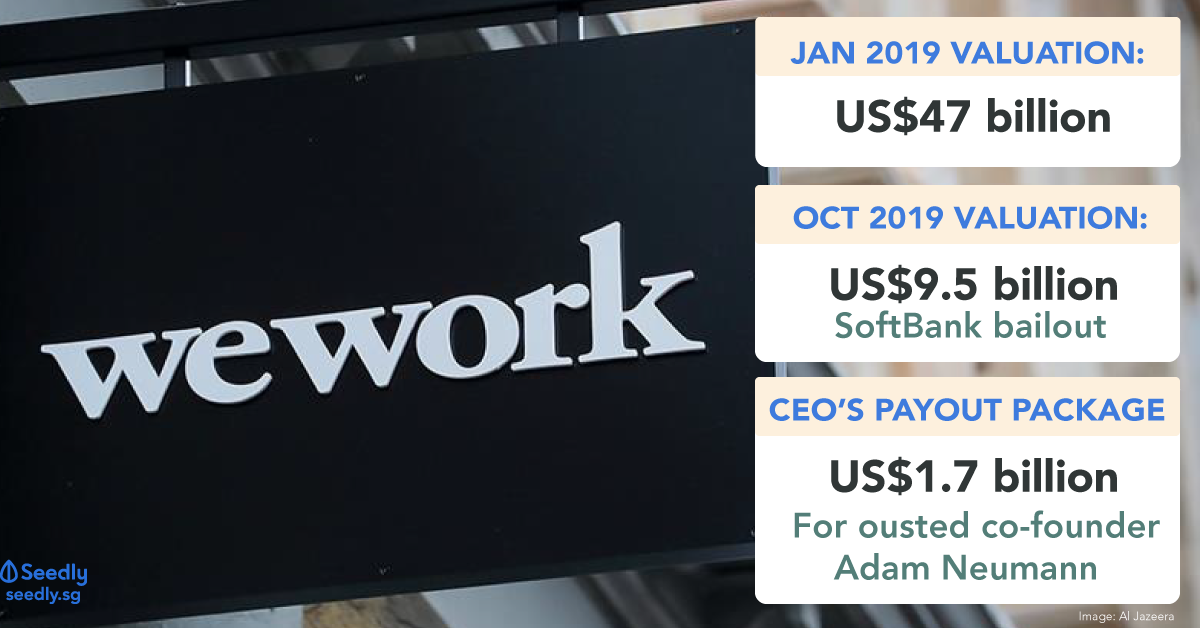

(WeWork is a big mess, so I won't invest in it)

For Uber, 80% of the costs are due to the drivers. Take away the drivers and you have a highly profitable business.

And Uber is spending effort on just that.... they are probably the 2nd best chance of succeeding at self-driving cars.

I put a small sum of money in them expecting nothing.

Uber has many disadvantages too, customers who are not loyal, high steep learning courses, and similar competitors that can erode Uber's advantage with a few proper technology edges.

So yeah.... unless you are SoftBank, you probably shouldn't put all your money in it.

Reply

Save

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

TL:DR: Astronomical valuations are superb for the super early-stage investor with the right protective provisions, and not great for the public investor.

An earlier Bloomberg article mentioned this:

The numbers are sort of made-up. For the most mature startups, investors agree to grant higher valuations, which help the companies with recruitment and building credibility, in exchange for guarantees that they'll get their money back first if the company goes public or sells. They can also negotiate to receive additional free shares if a subsequent round's valuation is less favourable. Interviews with more than a dozen founders, venture capitalists, and the attorneys who draw up investment contracts reveal the most common financial provisions used in private-market technology deals today.

Paywall: https://www.bloomberg.com/news/articles/2015-03...

In consideration of the fact that unicorns in the tech sector have increased exponentially, I definitely would see creative deal-making methods as the big driver in valuations, as opposed to the quality of businesses.