Advertisement

Anonymous

What are the vehicles I can use to grow my wealth to be able to retire in 20 years' time. I have calculated and would need 4 million dollars to retire?

3

Discussion (3)

Learn how to style your text

Christopher Tan

26 Jan 2019

CEO at Providend Ltd

Reply

Save

Jonathan Chia Guangrong

25 Jan 2019

SOC at Local FI

What is your risk appetite and what is the amount you are willing to set aside to fund your retirement? 4 million over 20 years would mean 200k a year in cash terms (with zero investments). If I were to take SPY's (S&P500 ETF) annualised returns of 8.99% as an example, you will need a principal amount of $750k in USD terms over a period of 20 years to reach your goal of 4 million. Can be a daunting amount. If you have a bigger risk appetite, consider learning to manage an options portfolio where you can look at a possible 30-40% returns rate. 4 million can be reached with a principal of 5k and compounded at 40% over 20 years.

Reply

Save

Hariz Arthur Maloy

24 Jan 2019

Independent Financial Advisor at Promiseland Independent

You'll need to start investing 9K per month in an instrument that gives you 6% returns compounded ov...

Read 1 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Hi anonymous, thanks for your question and sorry for the late reply. $4 million seems like a huge nunber. It will be difficult for me to answer this question unless I know

How much are you able to set aside per month to accumulate towards that?

How much lump sum capital can you set aside now to invest towards that?

What is your risk appetite?

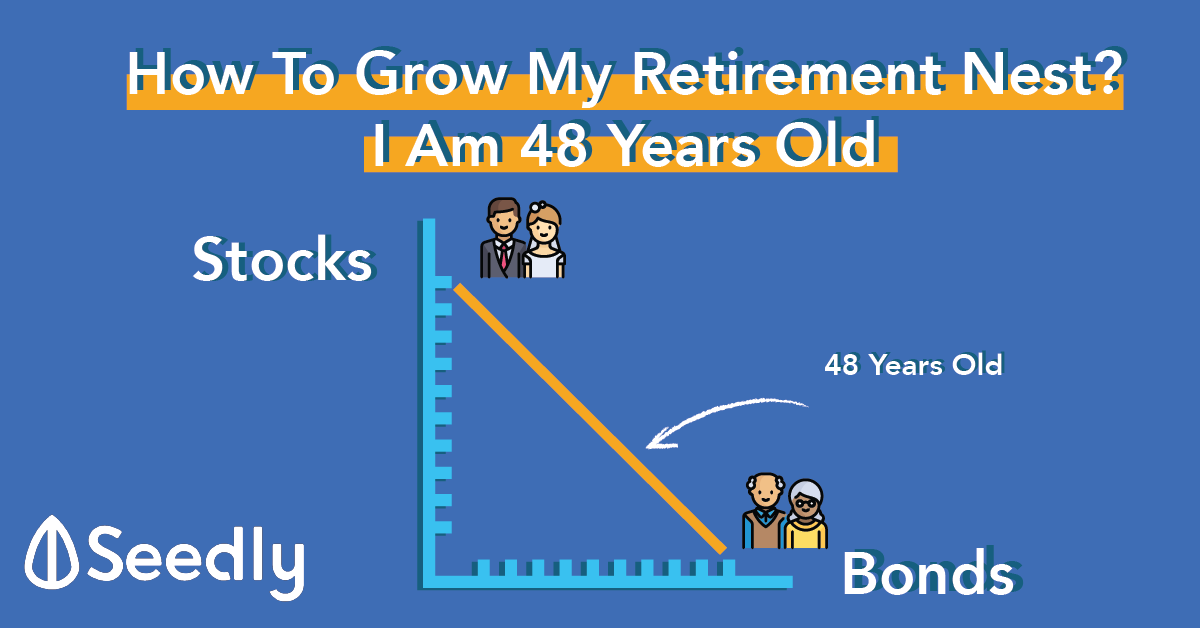

There are various instruments such as bonds, equities and properties that can help you achieve your goals. But without knowing the details as stated above, it would be difficult to suggest.

I generally will not suggest using insurance as an instrument to save towards retirement (except for annuities, which is a useful instrument in retirement). This is because insurance is an expensive instrument and it is really meant more for protection rather than investment.