Advertisement

Anonymous

What are the REITs inside Syfe REIT+ portfolio?

What are the REITs inside, and what are their pros and cons? Is it worth investing in Syfe's REIT+ Portfolio then? What are some potential pitfalls to this?

8

Post Merged

This post is no longer accepting new comments because it has been merged with What are the REITs in Syfe’s REIT+ portfolio?

Discussion (8)

Dhruv Arora

26 Feb 2020

Founder & Chief Executive Officer at Syfe

Reply

Save

There are 15 REITS currently inside Syfe portfolio. Basically all are those familiar name like Mapletree, Capitaland, Keppel, Suntec, Frasers, Ascendas, etc....

I have invested in REIT+ because I don't have time and enough knowledge to deal with rights issue all this stuff. So basically Syfe will manage all these for you. Good thing is there is no transaction fees, means you can do DCA on monthly or weekly basis.

But the cons is that you need to pay management fees under your AUM. This is okay for me as I treat it as management fees like ETF.

Another concern is we do not know how long Syfe will sustain in the market, but I don't worry too much on this.

Reply

Save

Snapshot of my syfe reit portfolio as of today:

Read 1 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Products

Syfe

4.6

934 Reviews

Syfe

ETFs, Equities, Bonds, REITs, Gold

INSTRUMENTS

0.4% to 0.65%

ANNUAL MANAGEMENT FEE

None

MINIMUM INVESTMENT

N/A

EXPECTED ANNUAL RETURN

Web and Mobile App

PLATFORMS

Related Posts

Advertisement

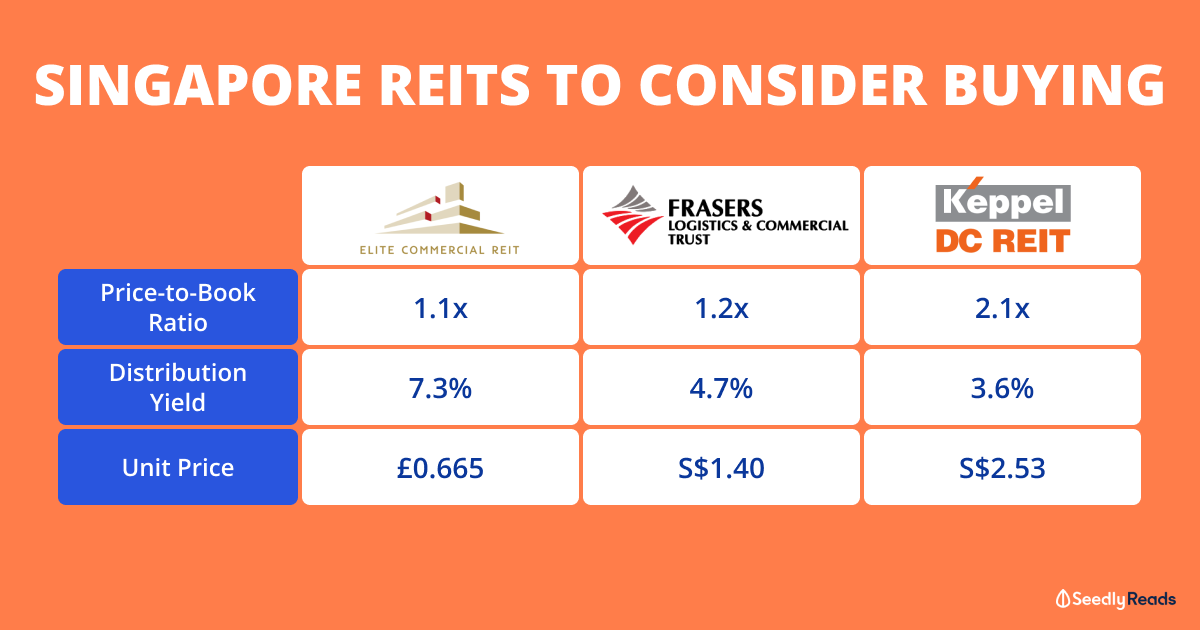

There are 15 S-REITs in the REIT+ portfolio as CH and Davin have mentioned. The REITs include Ascendas REIT, Mapletree Commercial Trust, CapitaLand Mall Trust, Suntec REIT, Keppel REIT, Parkway Life REIT, and more quality S-REITs.

There are several advantages to investing in REIT+.

1) There is no minimum investment, and you gain instant access to 15 S-REITs in one diversified portfolio without the many frictions associated with buying REITS individually such as time spent in researching each REIT, brokerage costs, rebalancing and dividend reinvestment costs. With REIT+, our fee starts from as low as 0.4% per annum.

2) You have the option of choosing quarterly dividend payouts or having dividends reinvested automatically at no extra charge. You can dollar-cost average into the REIT+ portfolio, increasing your REIT assets month by month without incurring further brokerage costs.

3) REIT+ aims to provide Singapore investors with a high-yielding REIT portfolio balanced against the risk of a severe portfolio loss during turbulent markets. That’s why a portion of the portfolio is allocated to Singapore government bonds (through the ABF Singapore Bond Index ETF) to cushion your portfolio impact during adverse market conditions. Our proprietary ARI algorithm also manages the risk in your REIT+ portfolio to defend against rising market volatility and provide higher risk-adjusted returns.

Of course, for investors who have a strong view on individual REITs and who know how they fit with their investment objective, investing in “self-picked” REITs can be a good choice. But for investors who have no time or inclination to select and research REITs, REIT+ is a hassle-free and low-cost option to start investing in real estate.