Advertisement

Anonymous

What are the must have insurances? And is Mindef Group insurance considered as one too?

Saw that we need a few insurances like hospitalisation, life, accident, CI, disbility, etc.

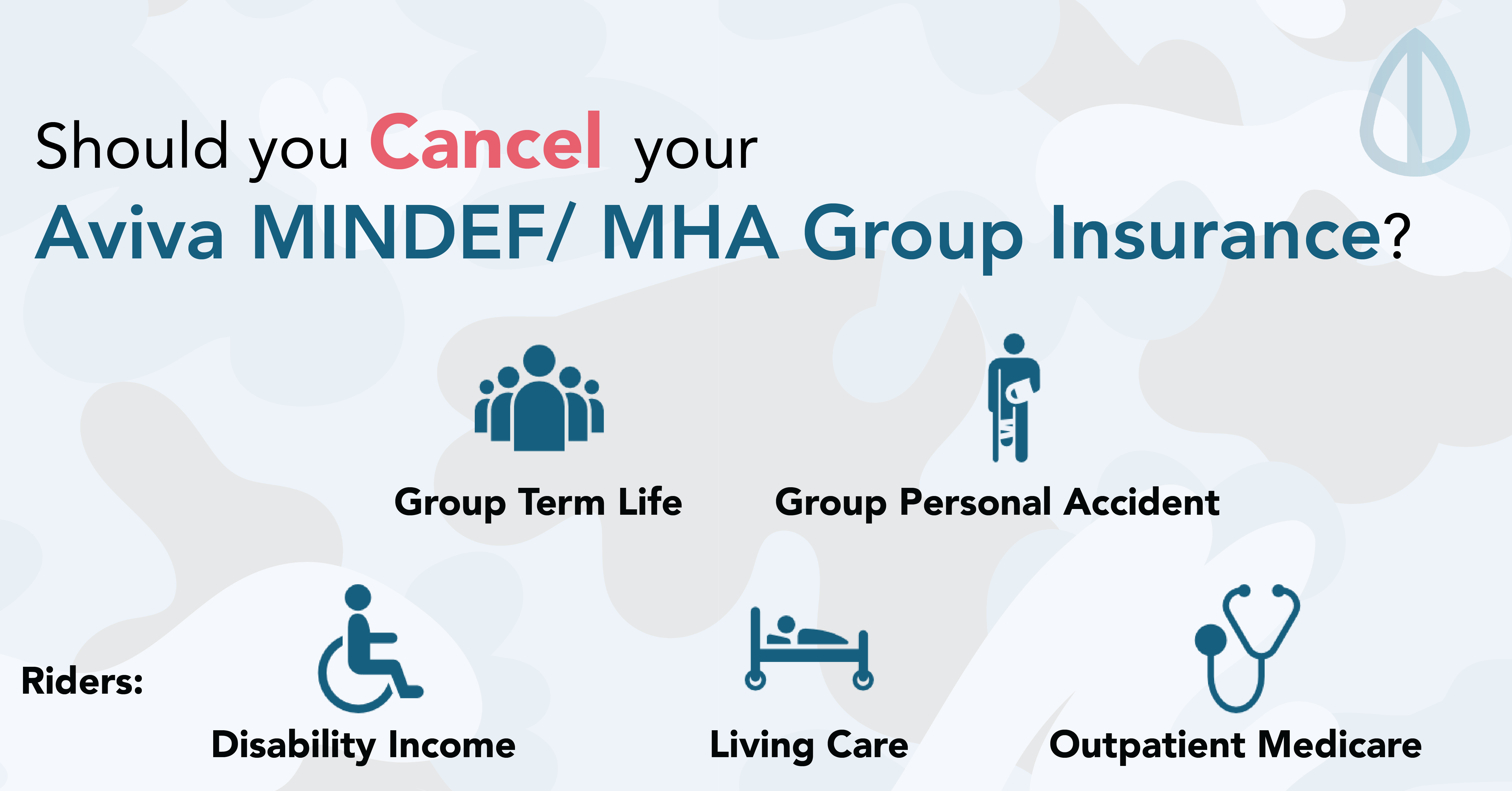

Am 27 now and I have hospitalisation insurance. Under Mindef Aviva, I have both Group Term Life and Group Personal Accident minimum. Are these two considered under life and accident already? Or I should get insurance coverage for these 2 categories?

Are there any insurance that I should be getting as well?

6

Discussion (6)

Learn how to style your text

Elijah Lee

16 Feb 2021

Senior Financial Services Manager at Phillip Securities (Jurong East)

Reply

Save

Hi there,

There are these things everyone should find coverage for:

1) Hospitalization

2) Critical Illness (CI)

3) Death/TPD

4) Personal Accident

You've sorted out the hospitalisation part so kudos to you!

As a rule of thumb, death/TPD coverage should range approximately 10x your annual income and CI coverage should range approximately 5x your annual income. This is because statistically it takes a few years for people to recover from their CI incidence (depending on CI type and severity) And find employment after.

The two Group plans you have cover death/TPD and Personal accident coverage. They typically come with their limitations so you might want to opt to get a personal plan instead. Some of the limitations include a maximum cap per payout, inability for nomination of beneficiaries etc.

The first thing is to obtain coverage for CI. CI coverage is really more for yourself while death/TPD is more for your family. There are different strategies to go about it. You can either get a whole life plan that covers death/TPD and CI OR get a multi-pay CI plan.

Your CI coverage for a life plan comes through a CI rider. If you are looking for limited payment (paying only for say 12 or 20 years) with cash value, you can look at a whole life plan. Do note that your CI rider is by default accelerating ie. it accelerates your CI benefits and reduces your death benefit as a result. And for this reason, people may want to look at getting a term plan instead since they may want to separate their death and CI coverage

You can look also at getting a pure term plan that covers only death/TPD and get a multi-pay CI plan to cover for CI. Term plans are highly affordable and offers high coverage And is great for hedging against liabilities. Multi-pay CI plans typically cover for multiple claims for relapses or different CI occurrences and some even has a premium-waiver riders that waive off your premiums in the event of a CI occurrence so this ensures your plan continues even if you're unable to finance it.

Getting a multi-pay CI plan first is typically a more affordable way (at the start) of insuring yourself compared to getting a whole life plan. The reason is because your payments are spread out over the period you're insured while for whole life plans, your payments are compressed.

Which strategy ultimately depends on your preferences and needs. If you feel you may need a major cash outlay soon, then you may want to opt for the latter strategy. However if you feel you want a limited payment because you're not confident if you can continue paying for your plans all the way, a whole life plan will work.

Ultimately do seek the advice of a licensed financial advisor to explore your options. All the best!

Financial planning is an integral part of life. You can reach me here to find out more.

Reply

Save

Pang Zhe Liang

15 Feb 2021

Lead of Research & Solutions at Havend Pte Ltd

Healthcare

As a start, the first priority should always be healthcare. The reason is simple - m...

Read 1 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Products

Manulife ReadyProtect Personal Accident

4.7

69 Reviews

ReadyProtect Signature

$1,000,000

ACCIDENTAL DEATH

$500 / week

TEMPORARY DISABILITY

Up to $10,000

MEDICAL BENEFITS

$1500

TCM & CHIROPRACTOR

Income PA Assurance

4.2

27 Reviews

Income PA Guard

4.1

17 Reviews

Related Posts

Advertisement

Hi anon,

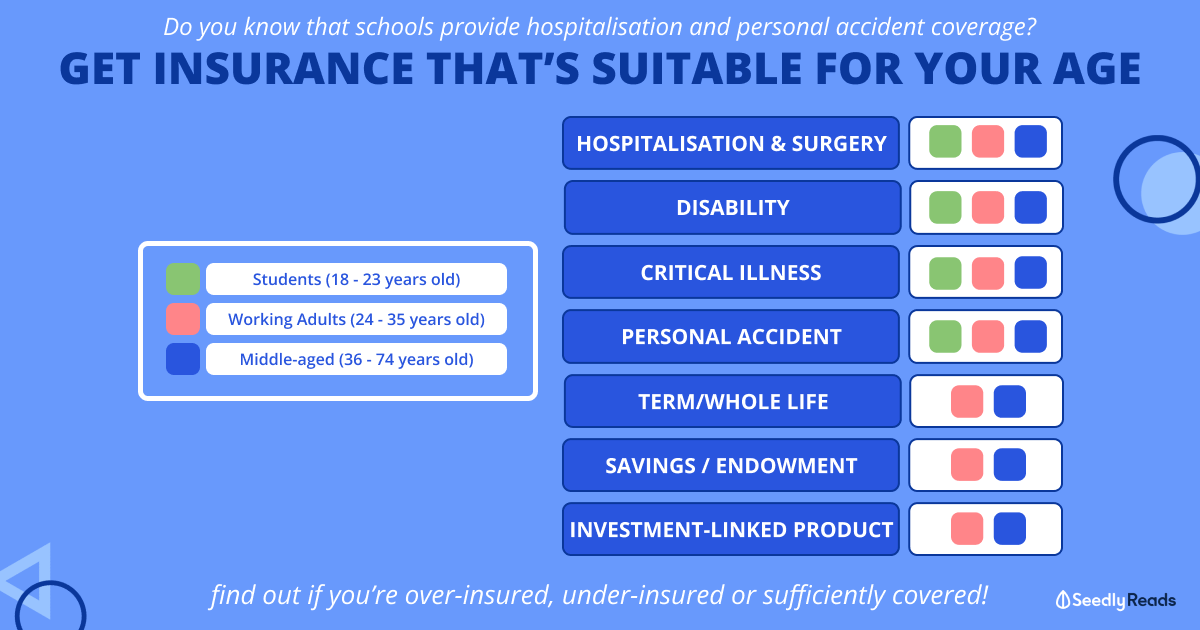

I would say that in order of importance, here is what you should be looking at:

Hospitalization plan. This covers any hospital bills and associated pre/post hospitalization costs. This would be from an integrated shield plan, with a rider to take care of the deductible/co-insurance portion of the bills. You have settled this already so that is one less thing to worry about.

Critical Illness coverage. This provides a sum of money for you to cover your expenses and other out of pocket costs should you fall critically ill and are not able to work. Usually recommended to cover at least 5 years of expenses and an additional sum to cover out of pocket. This is usually via a limited payment life plan, or a term plan, depending on your budget/needs. You can consider multipay plans also. As you are working already, this is also another important type of coverage to have. You don't appear to have this at the moment.

Death coverage. This provides a lump sum of money should something happen to you. Not mandatory if you have no dependents or liabilities. Usually takes the form of a term plan. For the coverage amount, you could use a multiple such as 10 x of your current income, or calculate based on your current liabilities. Your MINDEF group term life plan would fall under this category.

Personal Accident. For the minor stuff like TCM claims, etc. MINDEF Group personal accident falls under this category but the scope of coverage is quite limited.

Disability Income. This pays out up to the amount you have chosen (which is typically 75% of your salary) in the event that you cannot perform the 'material duties' of your occupation. This is probably more important if you have a very specialized job that requires niche skills (e.g. a surgeon) or require high qualifications and specified certifications.

I would say that 1 and 2 are must haves, and 3/4/5 depends on your personal circumstances.

You can seek out an independent financial advisor who can distribute multiple insurers' plans and get an explanation in detail on what you will need to know about the types of insurance as well as the options from various insurers before you come to a decision, especially with respect to cost effectiveness as well as the minor differences between the plans.