Above all, you need to know your needs. Altogether, there is no one-size-fits-all answer to this end. For example, how much do you treasure working with insurance agent A vs B?

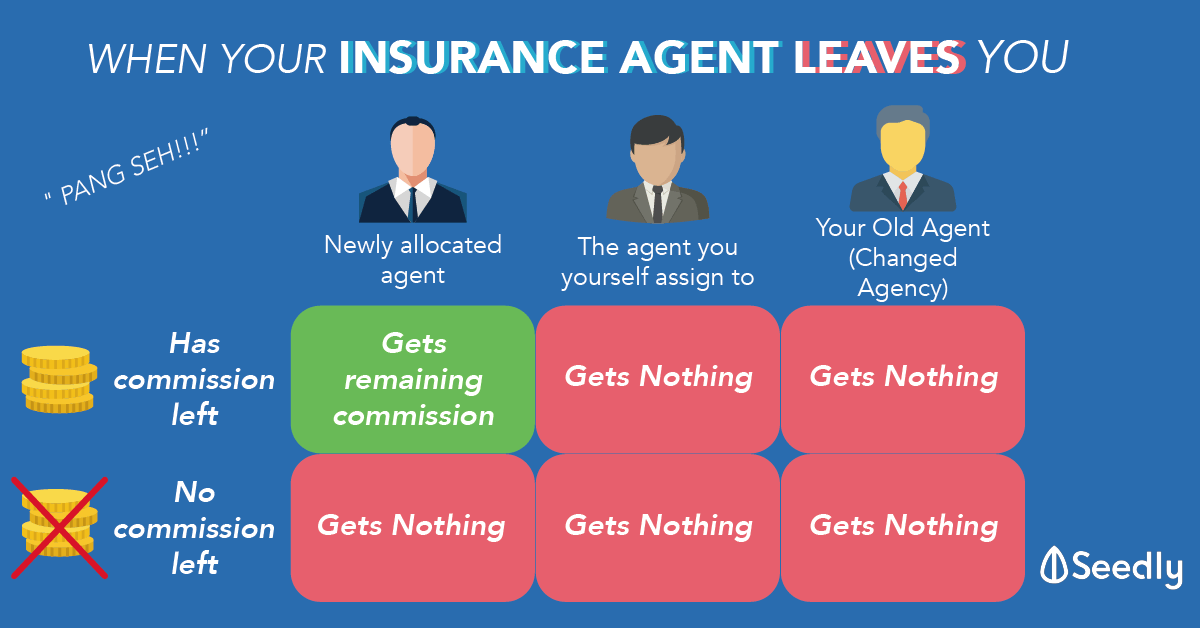

If after-sales service is important to you, then you may need to assess whom is more likely to stay in the long term as well. This is because the insurance industry tends to have a high turnover rate. Therefore, this is certainly a point for consideration.

Meanwhile, it may be worthy to study the plan that you are getting, as well as what you are coverd for. This is because the scope of coverage may not be the same at all. For instance, Life Insurance Association Singapore (LIA) only mandate the use of its Critical Illness Framework for the standard 37 conditions at the severe stage.

Since you are getting early critical illness coverage, there exists a need to ensure that you are getting the right level of coverage that fits into your expectation. You may find out more about the framework here: Life Insurance Association Singapore (LIA) Critical Illness Framework 2020

All in all, I will personally prefer to work with a more responsible and capable agent that has proven to have the ability to take care of my needs and answer my answers. This is because time is money, and if I can pay a bit more for a peace of mind, I don't mind doing so.

I share quality content on estate planning and financial planning here.

Above all, you need to know your needs. Altogether, there is no one-size-fits-all answer to this end. For example, how much do you treasure working with insurance agent A vs B?

If after-sales service is important to you, then you may need to assess whom is more likely to stay in the long term as well. This is because the insurance industry tends to have a high turnover rate. Therefore, this is certainly a point for consideration.

Meanwhile, it may be worthy to study the plan that you are getting, as well as what you are coverd for. This is because the scope of coverage may not be the same at all. For instance, Life Insurance Association Singapore (LIA) only mandate the use of its Critical Illness Framework for the standard 37 conditions at the severe stage.

Since you are getting early critical illness coverage, there exists a need to ensure that you are getting the right level of coverage that fits into your expectation. You may find out more about the framework here: Life Insurance Association Singapore (LIA) Critical Illness Framework 2020

All in all, I will personally prefer to work with a more responsible and capable agent that has proven to have the ability to take care of my needs and answer my answers. This is because time is money, and if I can pay a bit more for a peace of mind, I don't mind doing so.

I share quality content on estate planning and financial planning here.