Advertisement

Anonymous

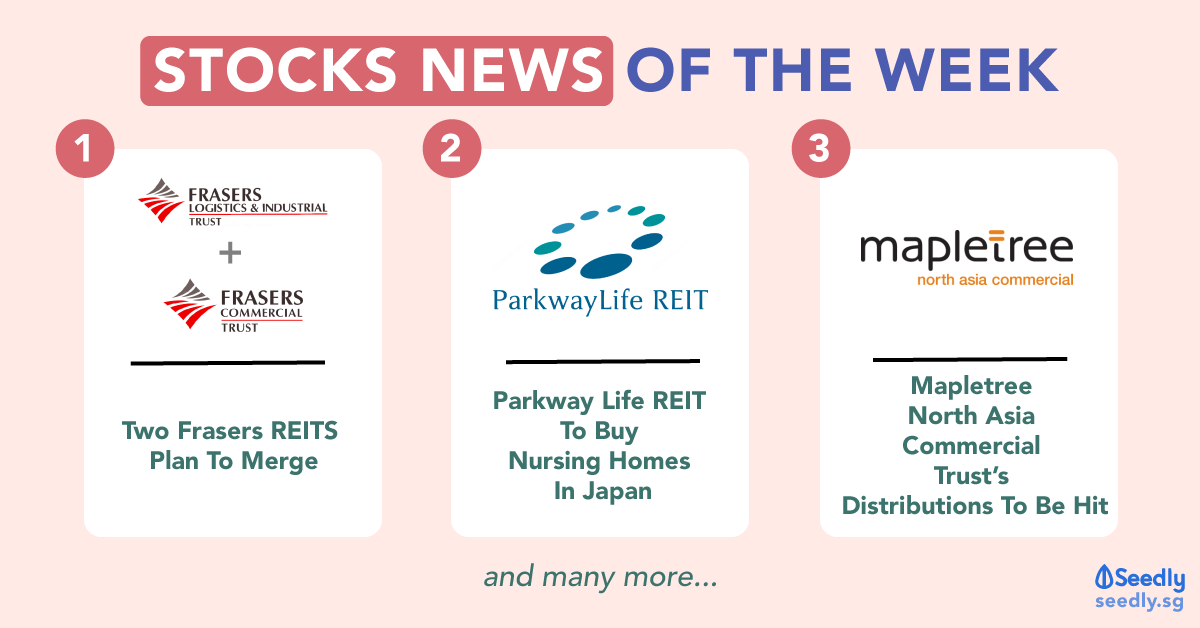

(Stocks Discussion) SGX: Parkway Life REIT (SGX: C2PU)?

Discuss anything about ParkwayLife REIT SGX: C2PU share price, dividends, yield, ratios, fundamentals, technical analysis and if you would buy or sell this stock on the SGX Singapore markets. Do take note that the answers given by our members are just your opinions, so please do your own due diligence before making an investment in ParkwayLife REIT SGX: C2PU

4

Discussion (4)

Learn how to style your text

Reply

Save

TL;DR: Acquiring its 50th property in FY2018, Parkway Life REIT has 46 properties in Japan, three in Singapore and one in Malaysia. Parkwaylife is not the cheapest at the moment but it has good potential for growth with its diversification. This post will look at Parkway Life REIT’s portfolio, diversification, opportunities and risks ahead.

TL;DR: Acquiring its 50th property in FY2018, Parkway Life REIT has 46 properties in Japan, three in Singapore and one in Malaysia. Parkwaylife is not the cheapest at the moment but it has good potential for growth with its diversification. This post will look at Parkway Life REIT’s portfolio, diversification, opportunities and risks ahead.

Business overview

Singapore boasts one of the best healthcare systems in the world. With subsidies and schemes in place, Singaporeans can get the ease of access to quality healthcare; and with the technology and quality, the healthcare sector in Singapore is one of the most trusted.

Parkway Life REIT (PLife REIT) is one of SGX’s three listed healthcare REITs and one of the largest listed healthcare REITs in Asia. The REIT has 50 properties in the healthcare sector across three countries – Singapore, Japan and Malaysia.

Share price movements

Credits: Yahoo Finance

Financials

Currently, Parkway Life REIT is trading at $2.86 (as of writing on 14 May 2019), close to its 52-week high at $2.94.

Dividend yield is pretty stable over the years.

Portfolio

As seen, PLife REIT comprises mainly properties in Japan. With Japan’s ageing population, the properties there greatly favours the portfolio. These properties in Japan are nursing homes and care centres. Parkway Hospitals Singapore stills hold the largest percentage of their portfolio at 59.8% of its portfolio revenue. Properties in Japan allow for diversification and especially with the ageing population faced in Japan, there is demand for more of healthcare.

Lease expiry

59.79% of their lease will expire in 2022, but it is not very perplexing as this is the expiry of the first part of the first 15-year term of the master lease agreement, and there is the option of extending for the next 15 years. Most of their leases are long-term due to the nature of the industry and thus subjected to lower leasing and credit risks.

SWOT Analysis

Strengths

- Good Strategy

PLife REIT has rolled out a total of 14 AEIs for its Japan portfolio and 1 AEI for its Malaysia portfolio. They also have a “Targeted Investment” approach in 2018, as seen from the selective acquisition of a nursing rehabilitation facility in Japan, taking into account the strategic location.

- Low cost of debt

With funding from various sources, the Group managed to get a low all-in-cost of debt of 0.97% per annum, having no near term refinancing risk till the year 2020.

- Occupancy rate

Occupancy rates of Singapore and Japan properties are at 100%, with Malaysia properties at 94%.

Weaknesses/Risks

High exposure to the Japan market would mean high financial risks (forex risks etc). Cognizant of their foreign currency exposure, they prudently manage their exposure in JPY. The Group adopts a natural hedge strategy for its Japanese investments, and further extended its JPY net income to act as a shield against the fluctuations of exchange rates.

Opportunities

In the long-term, the healthcare industry is driven by the ageing population, in Singapore and especially in Japan, which is important especially for their large exposure in Japan. The demand for better and quality healthcare is increasing.

Threats

The global economic growth this year is expected to slow down and there will still be volatility in the markets. The short-term demand for healthcare may be affected negatively, and this is something that the Group has to pay attention to.

Conclusion

REITs are pretty good investments due to their strong dividend yield and relatively low volatility. Although Parkwaylife REIT does not offer the highest dividend yield among REITs listed in Singapore, the strategy and future of outlook seem pretty stable, and their large exposure of almost 40% into the Japan markets allows the REIT to ride along with the ageing population of Japan and tackling their high demand for healthcare needs and space.

Reply

Save

Write your thoughts

Related Articles

Advertisement

Wow, this is a really impressive post. I find that the material that you have supplied for me is both quite helpful and very wonderful. Continue to disseminate useful knowledge.Your blog is one of my bookmarks because I was able to get some very useful information on it. globle game