Advertisement

Anonymous

Should I use my CPF money as the bond component of my investment portfolio (as opposed to buying SSB or ABF bond ETF)?

3

Discussion (3)

Learn how to style your text

Reply

Save

Chris Chin

15 Jun 2018

Senior Supply Chain at Mnc

It really depends on your situation.

CPF money is illiquid if you need it earlier for other investment plans, unless you are already over 55 yo now and can draw out the excess above the retirement sum from your OA & SA.

SSB & ABF Singapore Bond ETF are more liquid than CPF, as you could draw out without tie down period.

However, ABF Singapore Bond ETF seems to have a higher return than SSB.

Reply

Save

Brandan Chen

15 Jun 2018

Financial Planner at Manulife Singapore

Technically you could. But have you fully paid your property yet?...

Read 1 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Products

Standard Chartered JumpStart Account

4.8

785 Reviews

Maximum Interest: 2.50% p.a. for balances up to S$50,000

INTEREST RATES

$0

MIN. INITIAL DEPOSIT

$0

MIN. AVG DAILY BALANCE

DBS/POSB Multiplier Account

4.3

329 Reviews

OCBC FRANK Account

4.7

213 Reviews

Related Posts

Advertisement

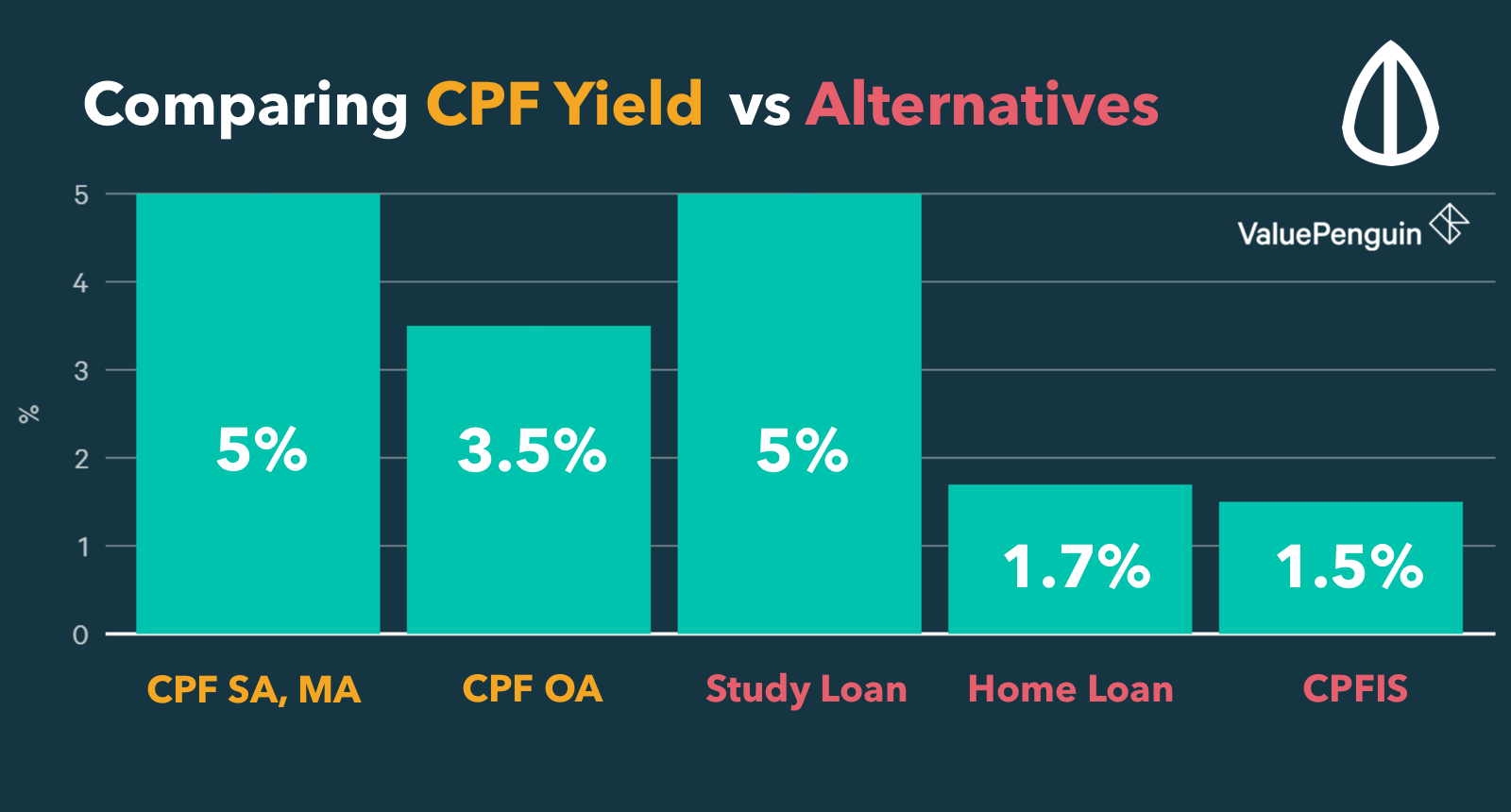

If your intention of using the bond component in your investment portfolio is to lower some risk in case of a downturn in equities, CPF can serve the same function, particularly for the longer term. At the end of the day, CPF is meant to be for retirement planning after all (same as the purpose of your investment portfolio presumably).

However, in addition to the illiquidity and requirements to pay back CPF used for housing (if the house is sold later) as mentioned by Brandan and Chris, you might also wish to consider (especially if you are young) that CPF policies might change over the next few decades and so impact your retirement planning. The exchange for that illiquidity is that CPF is almost risk free. If CPF collapses, all of us will have much bigger problems to worry about than retirement :p