Advertisement

Anonymous

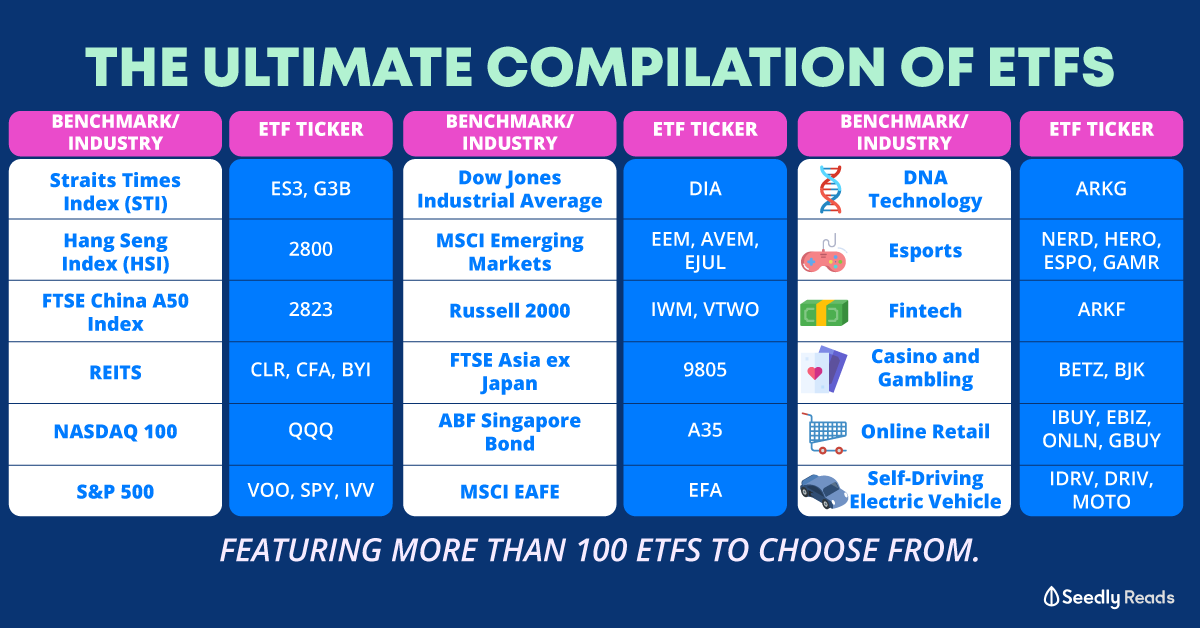

On the website it mentions that EndowUs offers "best in class mutual funds (or unit trust funds)". In this case, what are the total net fees? Won't ETFs be better?

Would ETFs be better than mutual funds?

https://endowus.com/how-we-invest

2

Discussion (2)

Learn how to style your text

Shengshi Chiam, CFA

26 Dec 2020

Personal Finance Lead at Endowus

Reply

Save

Usually is the Endowus access fee + the UT/MF annual expense ratio after any rebates. Depending on the portfolio, the fees differ.

Depends on whether you prefer to manage your own portfolio and do your own transactions with the ETFs?

Endowus provides a service and has to be paid for the service.

Reply

Save

Write your thoughts

Related Articles

Related Posts

Related Products

Endowus

4.7

658 Reviews

Endowus Cash Investments Portfolio

Equities, Bonds

INSTRUMENTS

0.25% to 0.60%

ANNUAL MANAGEMENT FEE

$1,000

MINIMUM INVESTMENT

N/A

EXPECTED ANNUAL RETURN

Web and Mobile App

PLATFORMS

StashAway

4.7

1295 Reviews

Syfe

4.6

934 Reviews

Related Posts

Advertisement

Hi Anon,

There are several factors that we take into account before using unit trusts as an investment vehicle.

We choose low cost SGD denominated/hedged unit trust that are low cost in the first place

ETF has a bid-ask spread that is a hidden cost of investment

It is impossible to invest a full, small amount into many different ETFs without comingling of funds (or fractionalising of ETFs). With Endowus you can invest $100 into 8 different unit trusts,

Hope this explains!