Advertisement

Just graduated awhile ago & started a job w about $2.4k take home. Starting with $0 in the bank. How much should I save before investing? How many % of my salary should I invest & any wise strategy?

As the title says. Am 25 this year and I think I am extremely behind all my peers whom at the very least have decent savings. I was unable to save previously as I was paying my school fees & allowance on my own.

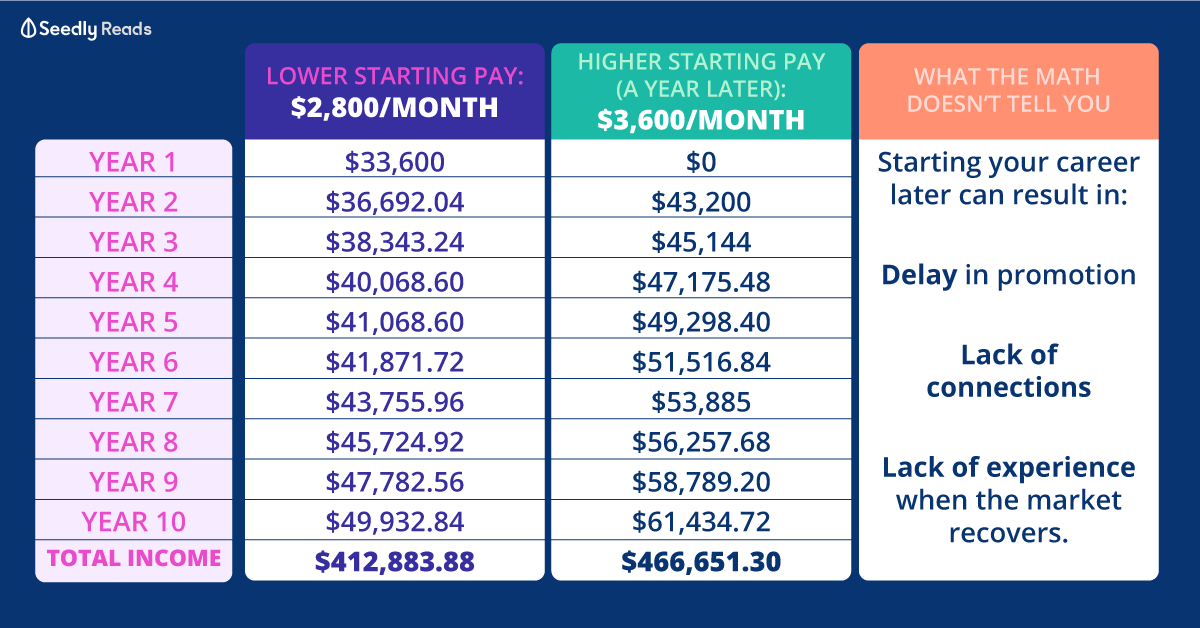

My current job has an average of 5%-10% increment YoY with a 1 - 3 month bonus package.

What should I be doing to save efficiently & when should I start investing? What would be my recommended DCA figure, the best investing strategy and market for me?

Am extremely lost right now :/ Thanks in advance!

12

Discussion (12)

Learn how to style your text

Reply

Save

Good that you plan to start saving/investing young!

Would suggest insurance, emergency fund and any high interest loans (like a study loan if any) be settled first before diving head on into investment.

Investing is great, but do it when the foundations are taken care of.

Reply

Save

Invest as much as possible. Time is on your side.

Reply

Save

Other commentors have great suggestions. I would like to add on by suggesting to check if you have any big ticket short term expenses coming up (e.g. marriage, bto) and put them in capital guaranteed/more liquid/less risky money market funds or (relatively) high interest accounts such as DASH/GIGANTIQ/singlife or short term endowments

Reply

Save

After emergency fund settled.

- Saving 20% of salary. U should have ~$30k saving in bank in 5 years...

Read 5 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

One thing, S&P 500. You have close to nothing to yolo in a single stock (and dont think you should, until you have enough cash). With your age and the power of compounding (1+r)^n, your wealth will increase exponentally in the next 10 years.

Keyword: Exponential. An exponetial graph initially does not show much increase, but as you move down the X axis (rightwards) you see your graph shooting up. Patience is key here!

The concept to have enough stash of money is simple. Money in money out. Investing is one way to increase money in as it is a good way to amplify your savings, but its kinda useless if you dont have enough capital to start with.

Advice to look at the big picture. You can increase your money in, as well as decrease your money out. Consider insurance (im not insurance agent btw) in terms of wealth protection, such that you wont lose money when something unexpected occurs (i.e major hospitalization). In addition, are there any pockets of opportunity in your spendings where you can cut back on? I personally cut off my spotify premium, cos i notice that i am working from home most of the time, so i can stream on youtube for free anws.

Saving more would then allow you to invest more too.