Advertisement

Anonymous

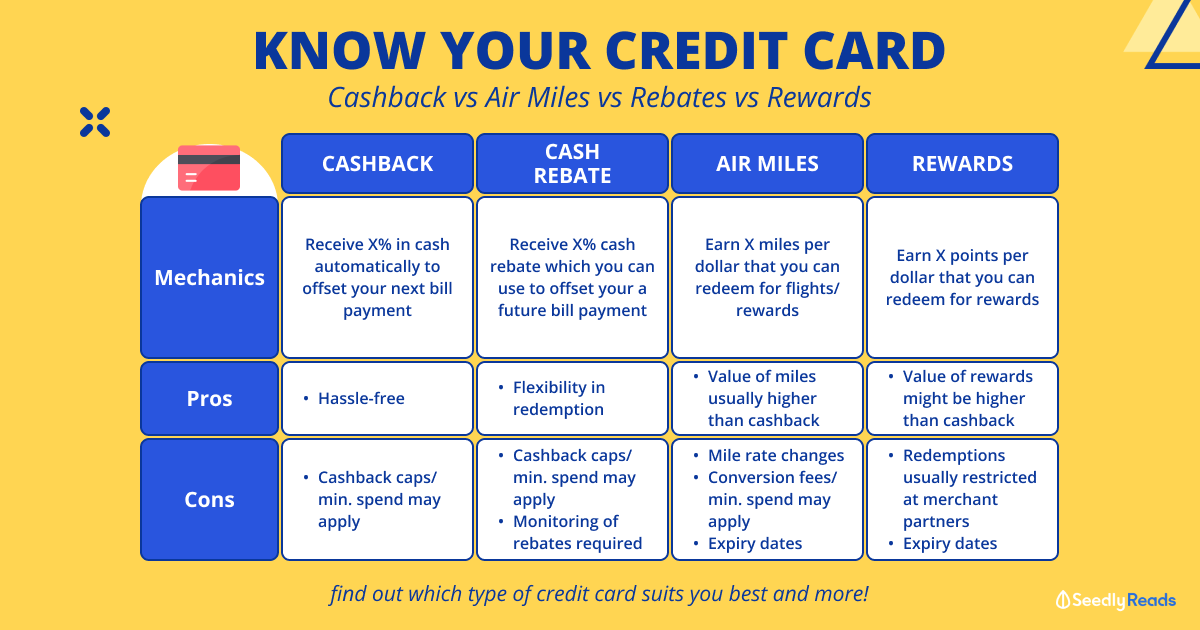

Is there any credit cards that can be make use of to pay school fees? I am able to pay the bills but just wondering if I am able to reap any benefits like air miles etc..?

It would be even better if I am able to earn air miles from recurring payment such as insurance and spotify

8

Discussion (8)

Learn how to style your text

Reply

Save

HC Tang

07 Jun 2019

Financial Enthusiast, Budgeting at The Society

Yes. Use cardup.

Note: They charge 2.6% service fee!

So apply for Bank CC such as BOC Family or UOB one card and make sure your cash back % is more than 2.6% to earn some cash back after deducting card up 2.6% fee:

https://blog.cardup.co/best-cashback-credit-car...

Note that there's a min services fee:

For credit cards issued in Singapore:

A 2.6% fee applies on each transaction, subject to change for promotional rates. Do note that for payments of $130 or less, a minimum fee of $3.40 applies.

For credit cards issued outside of Singapore:

A 3.3% fee applies on each transaction. Do note that for payments of $1,000 or less, a minimum fee of $33 applies. Promotional codes are not eligible for use on payments made with credit cards issued outside of Singapore.

Source:

https://carduphelp.zendesk.com/hc/en-us/article...

If you're keen to earn miles rather than cash back, you can refer to Mileslife blog as their website to find out more.

Cheers!

Reply

Save

Hm if u are not working im not sure whether the banks etc will give u these cards, but here goes:

1...

Read 2 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Products

Standard Chartered Simply Cash Credit Card

4.1

176 Reviews

Standard Chartered Simply Cash Credit Card

Up to 1.5% on eligible spend

CASHBACK

Unlimited

CASHBACK CAP

$30,000

MINIMUM ANNUAL INCOME

UOB One Card

4.1

166 Reviews

POSB Everyday Cashback Credit Card

3.9

199 Reviews

Related Posts

Advertisement

Using ipaymy.com is similar to using cardup. Usage fees are the same,except that they will run some monthly promos that will bring down the usage fees to 1.99%. You save money while earning miles at the same time!