Advertisement

Anonymous

Is now a good time to buy Singpost‘s shares?

I've got some liquid savings on hand and I've been looking at Singpost for some time. Is now a good time to buy Singpost's share?

4

Discussion (4)

Learn how to style your text

Vincent Tan Wen Bin

07 Jun 2019

Assistant Vice President at Thinkers Alliance

Reply

Save

Hi there,

Great timing for this question as SingPost has just released their full-year earnings report (for 2018/2019) earlier this month.

Citing sources from Yahoo Finance and Singpost's Financial Statement here are Singpost's 8 Key Earning Numbers:

1) Sales Revenue - S$1.56 billion (Up 2.9% YOY)

2) Operating Profit - S$136.3 million (Down 7.2% YOY)

- Q4 2018/19 was an outlier (Down 53.4% as compared to Q4 2017/28)

3) Underlying Net Profit - S$100.1 million (Down 5.8% YY)

- Net profit before exceptional item, net of tax

4) Earnings Per Share (EPS) - S$0.18 cents (Down from S$5.32 cents YOY)

5) Free Cash Flow - S$120.9 million (Down from S$136.1 million YOY)

- Lower operating cashflow this this year (S$186.8 million as compared to S$196.2 million last year)

6) Net Cash Position - S$101.3 million (Up from S$70.1 million YOY)

- Largely due to cash generated by operating activities

- Borrowing (S$290.9 million)

- Bank balance (S$392.2 million)

7) Revenue Growth Per Segement

- Post & Parcel (4.1% YOY Growth) - This was bouyed by a strong international mail revenue growth of 9.3%

- Logistics (Down 0.3%) - Revenue decline at Quantium Solutions Courier Please was impacted by the depreciation of the Australian dollar against the Singapore dollar

- eCommerce (Down 0.3%) - Exiting the U.S market due to intensifying competitive and cost pressures and an increase in customer bankruptcies in the industry

- Property (13.5% YOY Growth) - Comprising commercial property rental and the self-storage business derived from rental income from the SingPost Centre retail mall, which commenced operations in October 2017 after a period of redevelopment

8) Dividend of 2 cents per ordinary share (3.5 cents total dividend for this financial year)

Other points of consideration include:

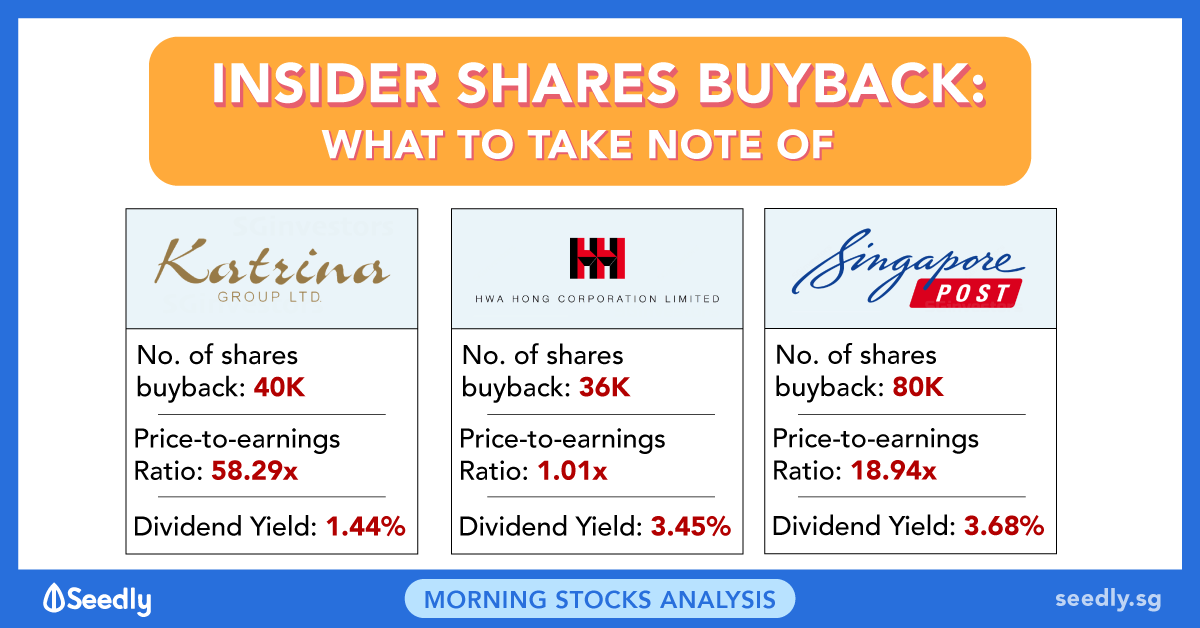

1) Buying back of shares (by Temasek Holdings) in September 2018 - Positive

2) Partnership with Alibaba - Positive

3) Partnership with Park N Parcel - Neutral

4) Exiting the U.S market eCommerce - Negative

5) Partnership with Synagie Corporation - Positive

In conclusion

My personal preference is to invest in companies that shows at least 1.3X share price growth over a 10 year period (plot a linear graph to see if it’s upwards trending overtime).

Unfortunately, if this was going to be my first long term investment in the public market, SingPost wouldn’t be where I would like to park my savings in over a 10 year period.

However, if you do not have a Post & Parcel/Logistics company in your portfolio, then sure, why not. After all SingPost's share price did manage to grow by 0.305 since their IPO in May 2003 (Highest Closing Price - 2.14 in Jan 2015).

P.S. You can learn more about SingPost's financial numbers here on Seedly within our community "(Stocks Discussion) SGX: Singpost [SGX: S08]?"

I hope this will help!

Reply

Save

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

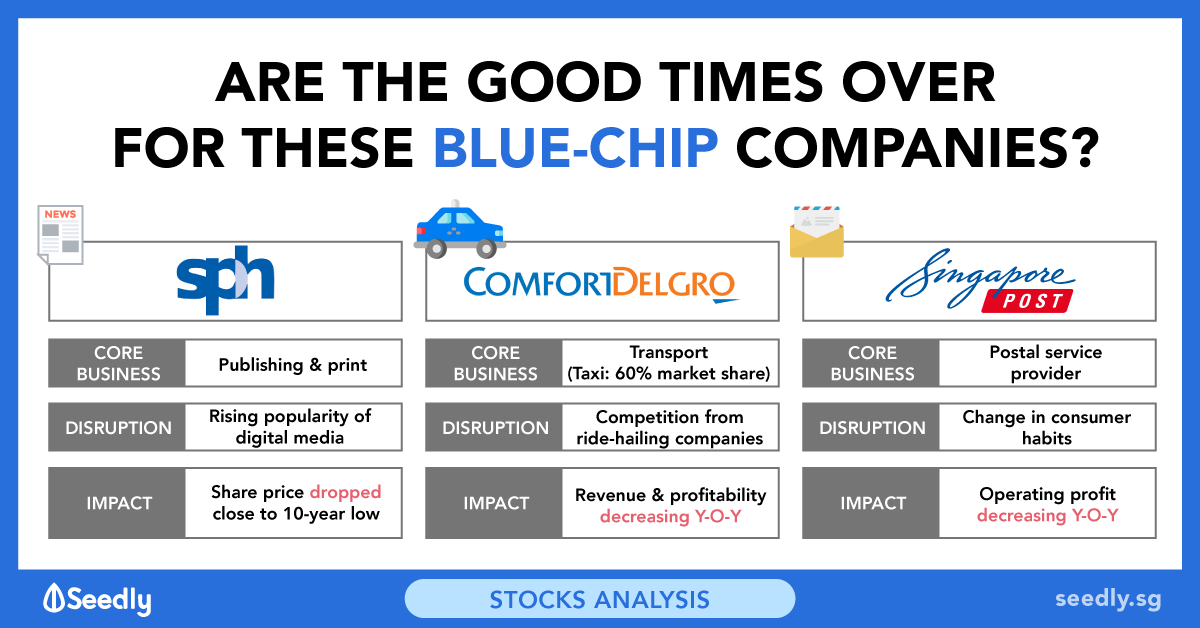

My personal take is you need to understand what you're buying into.

Is Singpost a business model that you understand and think that in the next 3,5,10 years will still be fundamentally sound?

How is their ROE for the past 5 years.

Price has been dipping for the past few years, what are the reasons? Is it market sentiment or is something fundamentally wrong?

These are some key factors that you might want to explore before investing.

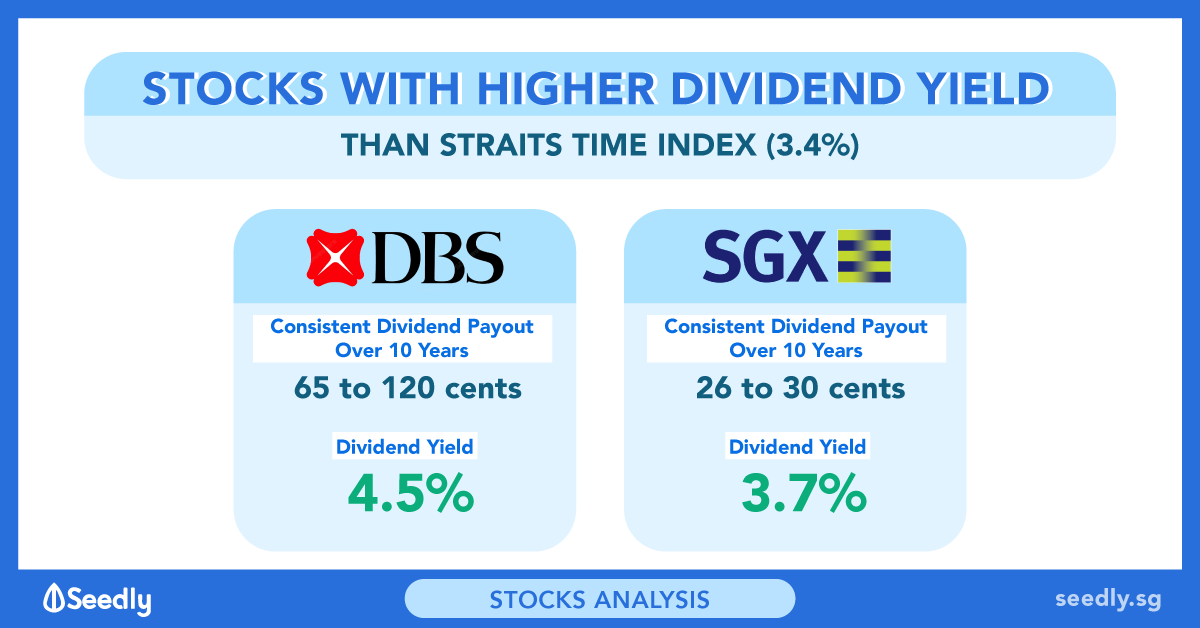

If you're investing for yield, there are many alternatives that will allow you to get a higher yield as compared to Singpost now too.

If you would like to discuss more, message me back in this thread,