Advertisement

Anonymous

Is it really possible to save half your monthly income? Should I?

Was talking to a close friend who earns about the same as me (since we both started work at the same time and at the same place) and she shared that she's been saving half of her pay every month. Is this normal? And is it really possible? Should I be doing so too?

13

Discussion (13)

Learn how to style your text

Reply

Save

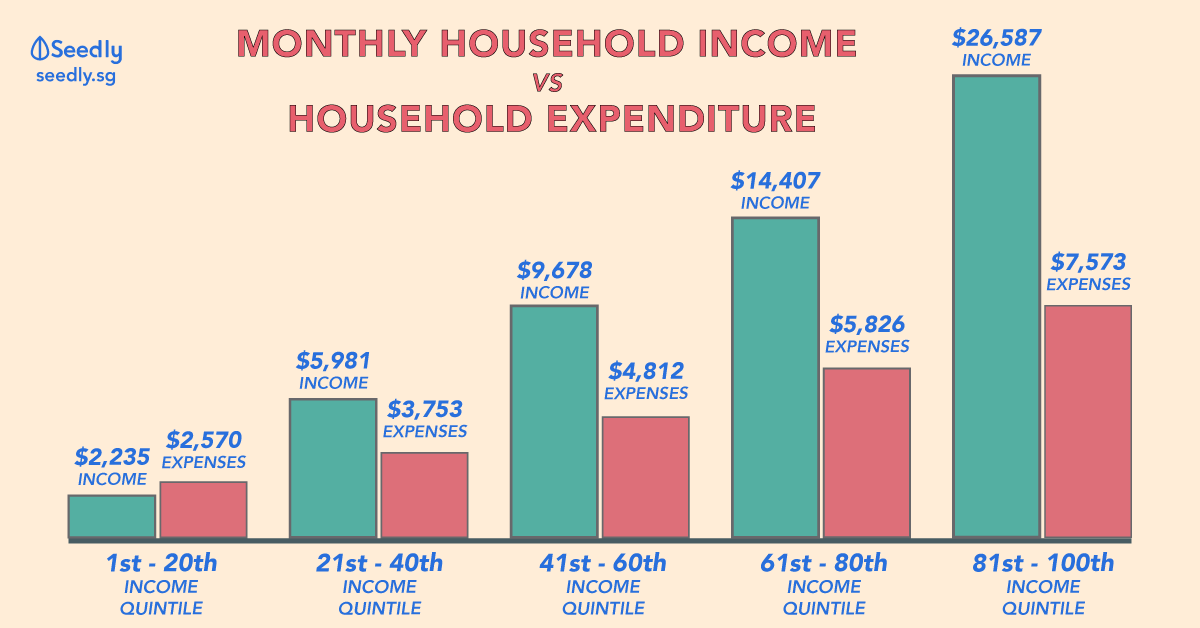

Depends on how much your monthly income and expenses are.

Regarding your friend who is able to save up 50%, both of your financial circumstances may differ. She may have less financial liabilities compared to you. Just don't compare and have your own game plan in terms of saving up.

Reply

Save

Elijah Lee

Edited 28 Sep 2021

Senior Financial Services Manager at Phillip Securities (Jurong East)

(Edit: This was typed on mobile and I can't figure out why the formatting turned out like this. Sorry for the 'wall' of text. Not sure if someone from the Seedly team can help with the paragraphing...)

Hi anon,

Whether or not this is normal is really dependent on many factors, but generally I would say that unless you are working part time, you should be able to save half or more than half your salary.

This of course requires one thing: sacrifice.

You first have to believe it is possible, and then set out to do it. I think the best example is just to highlight how I did it myself when I started working 11 years ago. I was paid $2300/mth, which after CPF was around $18xx.

I did the following things:

- Cut out all drinks of any sort except those available in the company pantry

- Skipped breakfast

- ate lunch at hawker centers, dinners at home

- stayed home all weekend for months

- cut all entertainment. And I mean all.

- calculated which bus stop to board from and which to alight to save 10 cents on the bus fare

- to top it all off, I kept track of everything in an excel spreadsheet to see where every cent went

Was it fun? No. Did it work? Yes. I probably saved at least $1200 a month which was half my salary then. That's how I ramped up my emergency funds quickly.

So, it's possible.

It didn't last very long of course. That sort of lifestyle may make your friends alienate you. You'll question your sanity time and again. You will wonder why you would even embark on something like this.

I lasted maybe 9 months before I started going easy on myself. And that leads me to the next part: knowing when you've reached rock bottom in terms of how low you can go. (Spending wise)

So what I did 3 months into this was to come to the realization that the next best thing I could do for myself was to improve myself and my own finances. Which was basically a fancy way of saying: get a better job, a side income, what ever works. I gave tuition to increase my income by a bit, I started to look for better paying jobs, and I planned how I really wanted my finances to look like in the long run.

With a goal in mind, at least you have something to work towards.

Whatever it takes. Don't settle till you have improved your situation.

Fast forward to today, I definitely still save more than half my income, but I am past the stage of deciding on $2.20 chicken rice for lunch because its 30 cents cheaper than $2.50 nasi lemak set B. It doesn't mean I eat at cafes and restaurants all the time though. But at least I don't have to think that hard now.

So to answer your question of should you be doing so? I'd say yes. You will know the value of money. You will know the meaning of delayed gratification. And you will learn about sacrifies. All are invaluable lessons that cannot be taught in theory, only experienced. And even if you only managed to save 49% instead of 50%, you would have tried nonetheless.

Good luck. I hope this gives you some clarity. You sound young, so there is time on your side. All the best.

Reply

Save

Eric Dadoun

28 Sep 2021

CEO at DeZy

Easiest thing in the world is to compare yourself to friends (or even worse, what you see on social media) and start second guessing yourself. Dangerous and risky line of thinking!

Another question you should be asking yourself is not only whether or not you work at the same place and make the same money but how do you live? Do you both live at home with family or on your own? What are your expences ("needs" AND "wants")? etc

I think you should focus on saving what you can afford to save and make sure you're progressing towards your goals.

Easy to compare but someone could be a better situation, advancing faster than you and that dampens your own progress even if you're actually doing great within your circumstances and plans.

Reply

Save

I personally think it's possible, it really depends on how much determination you have. Before the p...

Read 7 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Others have talked about the mechanics about achieving the 50% savings. I think it’s good to also understand the why behind the 50% savings.

You should read about FIRE and decide if you want to be on this path. I believe your friend might be aiming for FIRE. An aggressive savings rate is one of the steps to start on FIRE.

It will be helpful to understand the thinking of your friend first and see if it aligns with yours. If it doesn’t align, you should not be concerned as both are on different paths.

https://blog.seedly.sg/fire-financial-independe...