Advertisement

Anonymous

Is it impossible for me to sign up for hospitalization insurance for a 35 year old with pre-existing conditions (diabetes & HBP)? How bad is it without coverage?

3

Discussion (3)

Learn how to style your text

Reply

Save

Pang Zhe Liang

24 May 2020

Lead of Research & Solutions at Havend Pte Ltd

MediShield Life

If you are a Singaporean or a Permanent Resident, then you will have coverage from MediShield Life. Above all, it includes coverage for pre-existing medical conditions.

More Details:

Is MediShield Life enough in Singapore

However, in order to control the size of the medical bill, you are encouraged to stay in Class B2 or C ward in public hospitals. Additionally, pre- and post-hospitalisation bills are not covered as well. Check out Part 3 of the link above for more details.

Integrated Shield Plan

Given its limitation, many of us opt to enhance the coverage with a private integrated shield plan.

More Details:

Integrated Shield Plan Singapore: A Starter's Guide

In this case, we will need to declare our health at the point of application. In order to do this, you may wish to speak to an experienced agent who may have handled similar cases in the past. The extent of coverage is dependent on your past medical records.

At the same time, we may also apply through preliminary underwriting. Check Part 1.3 of the link for more information on "what if I have a serious medical condition?"

Planning

All things considered, we need to know more about you, the coverage that you may have, and how you wish to plan for your future. Through comprehensive financial planning, we reduce the risk of exploding medical bills, while optimising your wealth. This helps us to live with a peace of mind.

I share quality content on estate planning and financial planning here.

Reply

Save

Hariz Arthur Maloy

23 May 2020

Independent Financial Advisor at Promiseland Independent

Hi Anon, if you're Singaporean or PR, you automatically have coverage called Medishield Life.

Howev...

Read 1 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Products

Income IncomeShield Integrated Shield Plan

4.4

306 Reviews

NTUC Income IncomeShield Integrated Shield Plan Preferred

$1,500,000

LIMIT PER POLICY YEAR

180 / 365 days

PRE & POST HOSPITAL

As Charged

OUTPATIENT BENEFITS

Private Hospital

WARD ENTITLEMENT

Raffles Shield Integrated Shield Plan

4.5

83 Reviews

AIA HealthShield Gold Max Integrated Shield Plan

4.2

20 Reviews

Related Posts

Advertisement

Hello!

As long as you are Singaporean, you will automatically be covered under the MediShield Life. Unless you do not have an integrated shield plan currently, when you actually sign up for the integrated shield plan, it will likely be declined due to diabetes and HBP as this will lead the team to process through an underwriter.

It is not about being bad without coverage, but more of having to fork out your own additional cash to actually pay for the bills. And if something happens and resulted in you staying in the hospital that's when your hospital plan comes in and will play an important part.

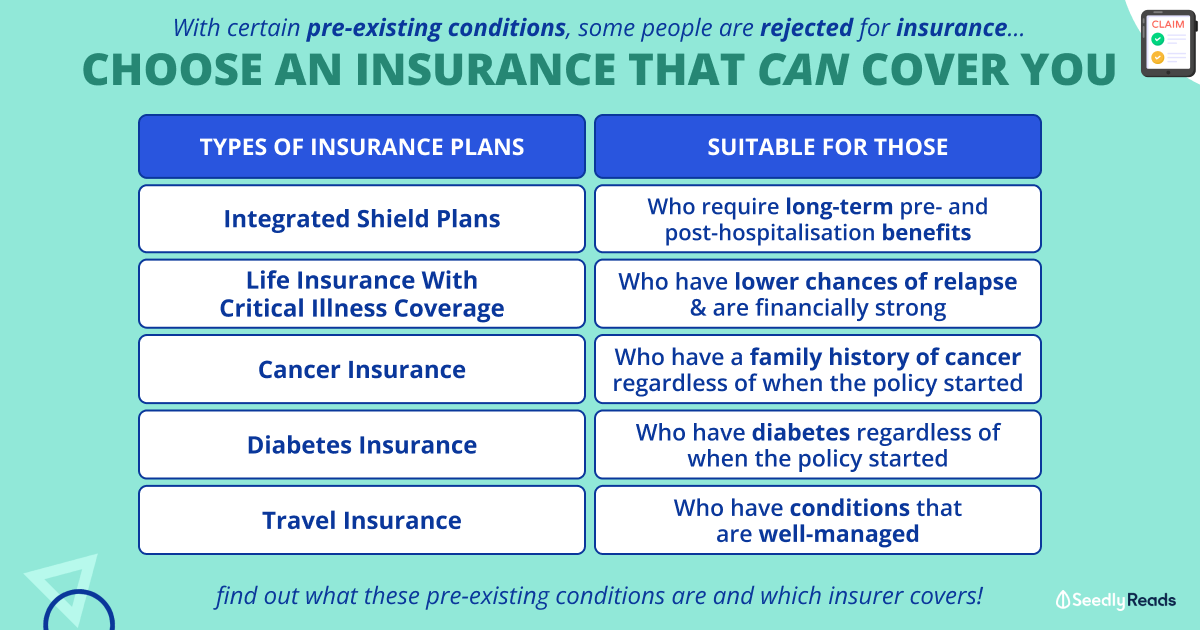

I hope the attached image will give you a better idea!

Nonetheless, at the end of the day is good to always do a policy review yearly to know what you are covered with and how much you are covered with! Protection is always very important! Especially when health care in Singapore is expensive.

Take good care of yourself during this period!