Advertisement

Anonymous

Is it a wise choice to invest in OCBC's Blue Chip Investment Plan or use platforms such as StashAway or is it better to keep the money in my StanChart's JumpStart Account with 2% interest?

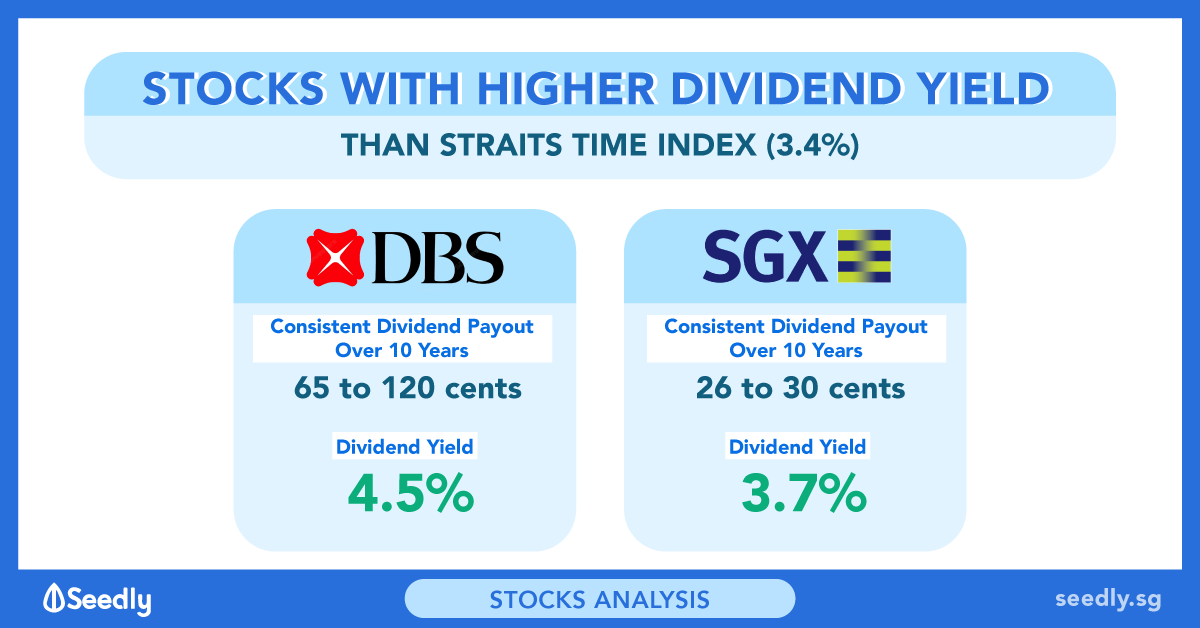

I am 22 years old and currently hold some units for CapitaMall Trust, DBS and Singtel which I bought through OCBC'S BCIP. I am thinking if it is worth it to buy more units for CapitMall Trust and DBS now since their prices are lower now.

4

Discussion (4)

Learn how to style your text

Cedric Jamie Soh

22 Apr 2020

Director at Seniorcare.com.sg

Reply

Save

Pang Zhe Liang

22 Apr 2020

Lead of Research & Solutions at Havend Pte Ltd

You need to know how you wish to plan for your future. Without knowing you in detail, there is no way to tell you which is a wiser move.

For example, investments are subjected to investment risks and therefore the returns are non-guaranteed. On the other hand, bank deposits will always yield a guaranteed rate of return. To put it another way, they are different asset classes.

More Details:

Types of Investment Risk that You should know

With this in mind, the general suggestion will be to conduct comprehensive life planning such that we know how to manage your money for the future. Thereafter, we can decide whether to invest (and through what tools) or to keep it in the safe box.

I share quality content on estate planning and financial planning here.

Reply

Save

I would put my emergency funds in JumpStart due to the high liquidity and interest rate. I woud not ...

Read 2 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Either OCBC Bluechip plan or Stashaway- both are better than 2% interest with SCB in the mid to long run :)

If you have specific SG stocks you like, go for OCBC bluechip plans.

if you prefer global exposure, Stashaway.