Advertisement

Anonymous

Is fixed or floating interest rate cheaper when taking home loans?

What are some other considerations I should keep in mind?

2

Discussion (2)

What are your thoughts?

Learn how to style your text

Reply

Save

Cedric Jamie Soh

23 Sep 2019

Director at Seniorcare.com.sg

Currently, the floating interest rate is lower than the fixed interest rate.

Fixed has a higher rate to compensate for providing stability to the clients (and hence the bank is bearing the risks of interest rate going up).

You like stability = go for fixed rates

You like the potential of lower rates in the middle term to long term = go for floating rates.

Personally, I am refinancing next month for floating rates, because I have an opinion of lower interests rate in the future.

Reply

Save

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

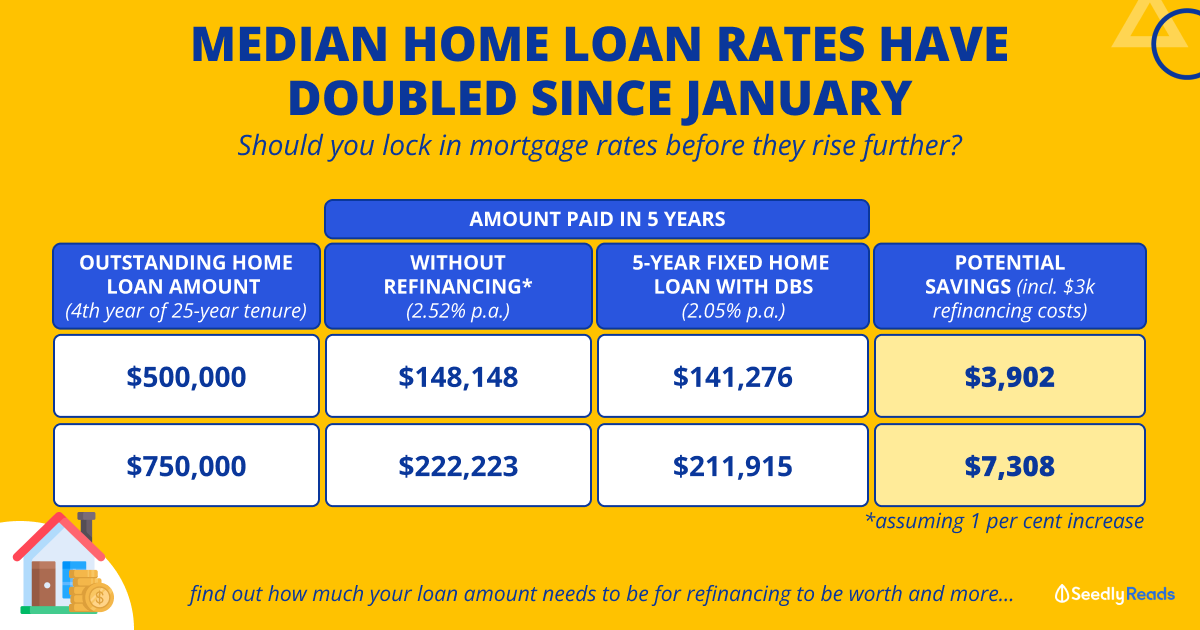

As unsatisying as it may sound, the answer is "it depends". When rates are generally stable or declining (as they have been lately), it is typically cheaper to go with a floating rate. However, if you expect rates to increase, you can save money by locking in a good mortgage rate before market rates rise.

It is also important to understand each loan offering's lock-in period, as this restricts your ability to refinance in the future. For more on this topic, and to compare the cheapest mortgage rates available, please refer to this guide.