Advertisement

Anonymous

I'm in my early 40s with 3 dependents. I've little savings and over $200k remaining on housing loan. Total household income is around $7k. Can you advise what I should do to prepare for retirement?

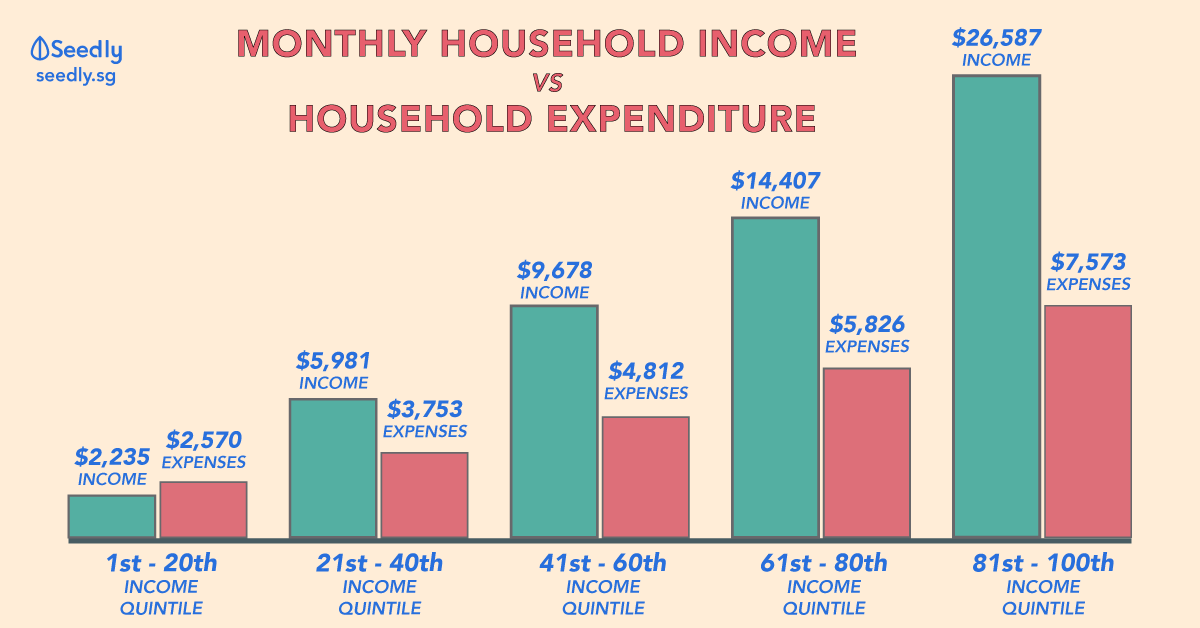

I'm in my early 40s, sole breadwinner with 3 dependents. I've very little savings and over $200k remaining on housing loan, no outstanding debt. Total household income is around $7k. Can you advise what I should do to prepare for retirement? My current monthly expenses is around $4k.

2

Discussion (2)

What are your thoughts?

Learn how to style your text

Duane Cheng

16 Aug 2020

Financial Consultant at Prudential Assurance Company Singapore

Reply

Save

View 1 replies

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Hi there,

The first step is to ascertain the health of your CPF accounts. Namely your OA and SA, as they will be converted to your Retirement Account (RA) at age 55. Using a financial calculator, you can do a projection to see whether you are able to hit your FRS without drawing down your value of your house.

The second step, to help the growth of your CPF OA, is to explore the option of refinancing, so that you lower your interest rate on your housing loan, ergo allowing more of your principle owed to be paid, and possibly lower the tenure of your loan.

The first two steps do not impinge into your liquidity, as the options care mostly tied to your CPF. The last option is to start building up your emergency funds, which might be 3-6 months of your current income, and in tandem, use a portion of your disposable income to plan either for annuities or investments, to pay out during your retirement phase.

That is a rough outline of the possible options. To plan better, you will need to seek a financial consultant, so that an action plan can be created.

If you do need help, you can reach out to me for a consult. Hope I was able to address your queries!