Advertisement

Anonymous

I’m 23, poly grad currently working and have about $500 every month to save. I see most people here recommends DCA into ETF which I look forward to. Any other suggestions?

EP holder, I have 1 year worth of family’s expenses/ emergency fund saved in Singlife & SCB Jumpstart as parents are not working. Insurance coverage are in place. Deferred my studies so that my sibling can continue studying given it’s difficult to get a job back home. Also, I’ve got an interest free loan of $20K that I will need to pay for my parents starting 2022. If there are alternatives besides DCA into ETF, do advice what shall I do with the $500 every month. Thanks in advance!

1

Discussion (1)

Related Articles

Related Posts

Related Posts

Advertisement

Need to do abit homework.

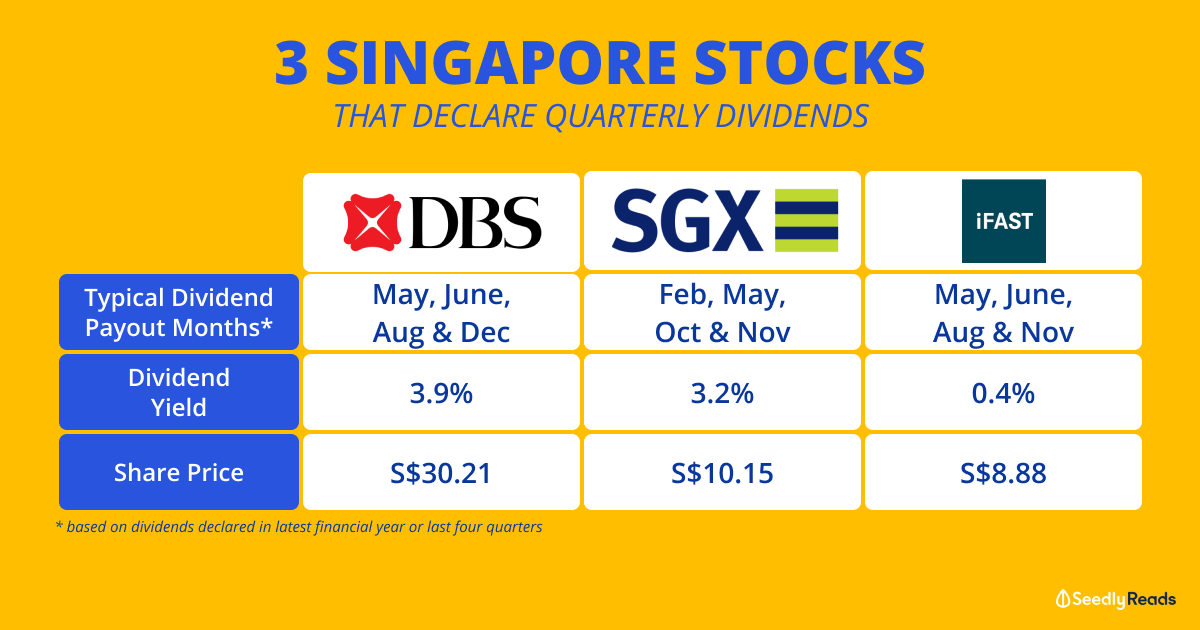

-ETF

-Unit trust

Just put money in.

-robo-adviser