Advertisement

Anonymous

I came across FSMOne RSP for ETFs. What are the benefits of RSP into ETF with FSMOne vs doing it yourself monthly via other broker apps?

I am very new to investing and looking to get my hand into VOO and VXF. Not sure what's the best way to do it and would like to get my hands in before the market rise again.

1

Discussion (1)

What are your thoughts?

Learn how to style your text

Chris

28 May 2021

Owner and Writer at Tortoisemoney.com

Reply

Save

Write your thoughts

Related Articles

Related Posts

Related Products

FSMOne Fundsupermart

4.3

259 Reviews

$8.80

MINIMUM FEE

0.08%

TRADING FEES

Custodian

STOCK HOLDING TYPE

Related Posts

Advertisement

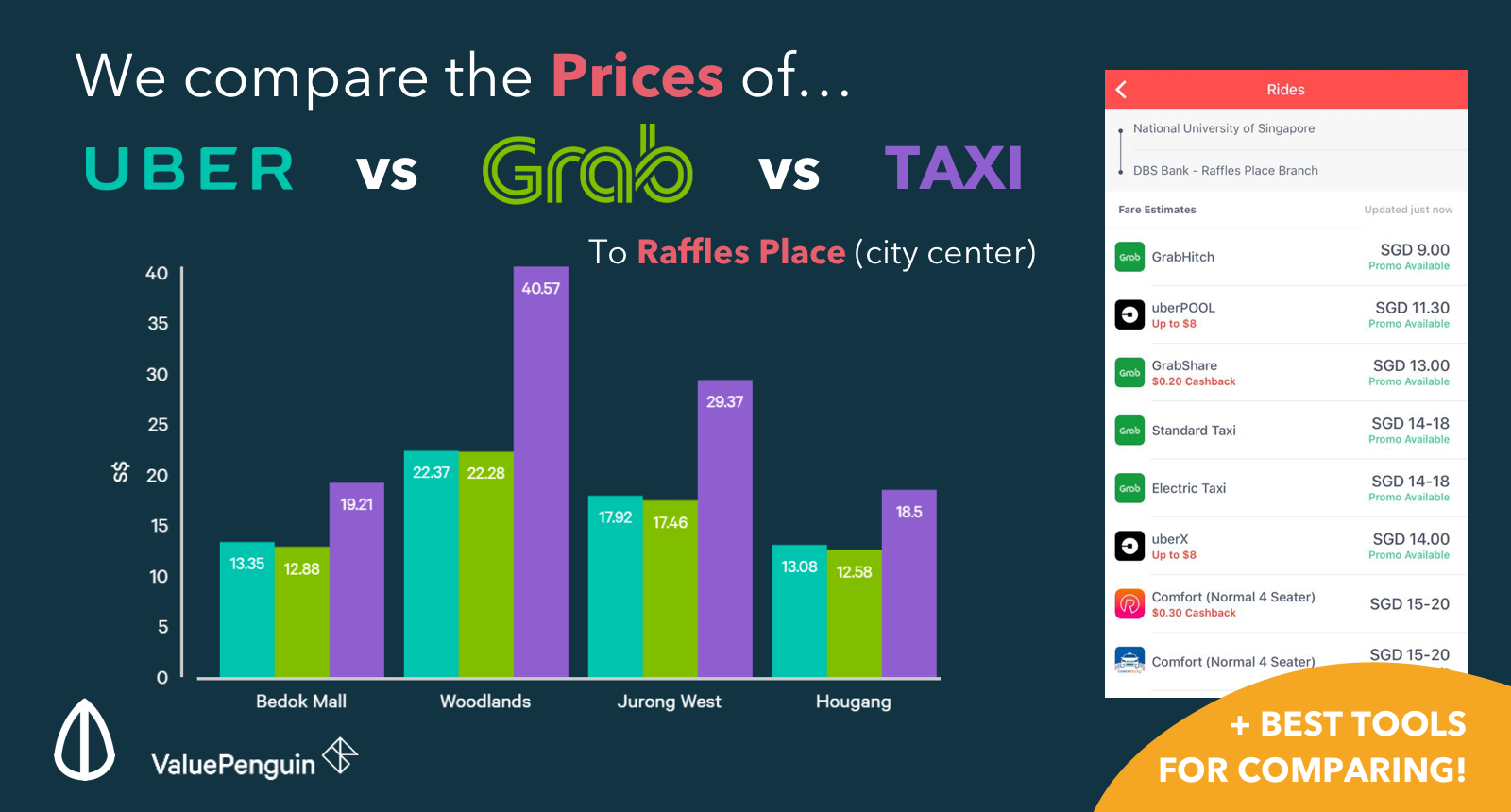

So, usually the main consideration is cost. FSMone's RSP offers quite competitive comms (0.08% min USD1) for purchases through their RSP*.

If you compare this against other brokers, even the low cost ones, you'll find that even moomoo and Tiger are at min USD1.99! The only brokers that would beat this price would be TDA (free comms) and IBKR (USD0.35 at the lowest). Of course, we also know that these brokers come with other 'issues', namely, TDA's ridiculous account approval time and IBKR's inactivity charge.

So in this sense, FSMone beats most of their competition in terms of cost of buying.

Moreover, FSMone's RSP allows fractional shares since they allow (for the main ETFs like VOO), minimum investments of SGD50 which is much lower than VOO's current trading price (~USD385). This is one key difference over traditional brokers.

However, looking at the downsides, a clear downside is that if you want to purchase individual stocks, you'll be faced with a hefty commission on FSMone (0.08% min USD8.80).

*Note that selling incurs their normal commission rates (0.08% min USD8.80)