Advertisement

Anonymous

I am 30 years old with only basic Medishield Life coverage. I have no pre-existing conditions (not that i know of). I intend to sign the PRUshield Plus plan. Any advice?

I did a company health check up 2 years ago and my blood pressure and cholesterol is a bit high for my age. I did not follow up with any doctor for post- consultations.

Should I

1) Do another medical check up and use the latest check up results?

2) Declare my previous check up results and see if there are any exclusions or loading to the plan?

Thank you all.

7

Discussion (7)

Learn how to style your text

Pang Zhe Liang

07 Jul 2020

Lead of Research & Solutions at Havend Pte Ltd

Reply

Save

Tan Li Xing

07 Jul 2020

Financial Consultant at Prudential Assurance Company (Singapore)

Hi Anon,

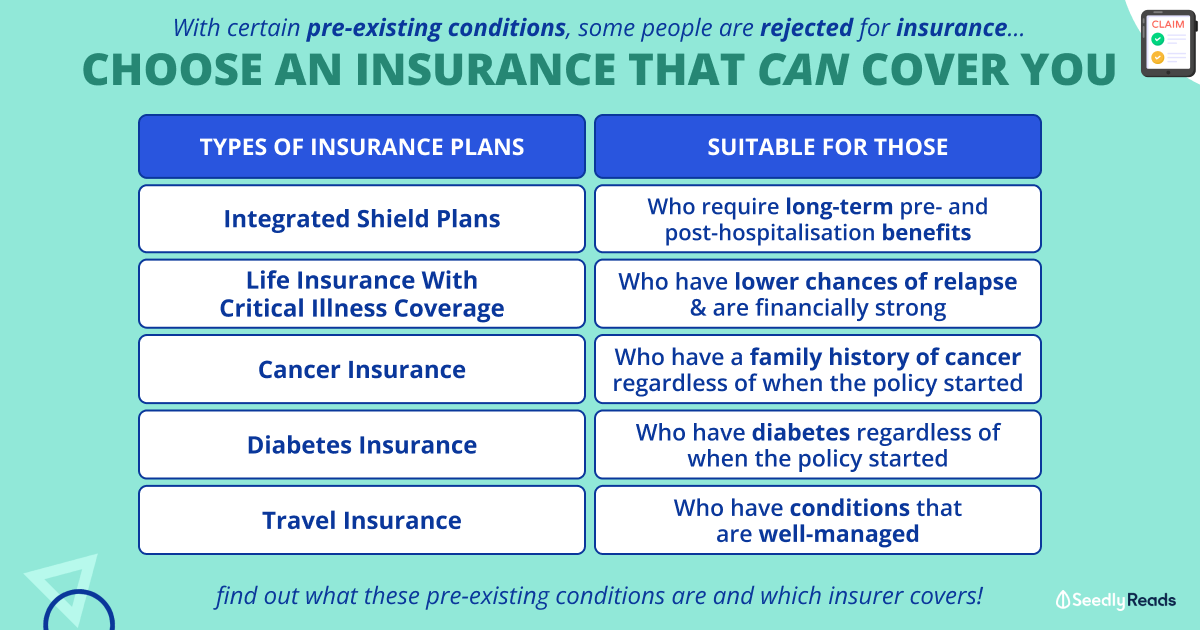

In regards to Integrated Shield Plans, there is only 3 conclusions;

Accepted at standard life, meaning you are accepted as someone with no health issues

Accepted at sub-standard life, meaning that there might be certain conditions that are excluded, like your case the high blood pressure might be excluded

Rejected, meaning your case is not accepted by the insurer

In regards to those excluded conditions, as Singaporeans we do have Medishield Life which will provide coverage to us as long as we choose to be warded in a B2/ C ward in a government restructed hospital.

Also like what Yi Ning said, it is always good to declare your conditions if you do have, because the insurer is able to find out if you have any medical history when you submit claims usually. And also you can always do a premliminary underwriting first to see what the insurer and then decide if you would want to proceed with the plan.

Do reach out if you have more questions

Reply

Save

Hey there!

You might want to submit a preliminary underwriting for your case for now. Ultimately, h...

Read 2 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Products

Prudential PRUShield Integrated Shield Plan

3.7

25 Reviews

PRUShield Integrated Shield Plan Premier

$1,200,000

LIMIT PER POLICY YEAR

180 / 365 days

PRE & POST HOSPITAL

As Charged

OUTPATIENT BENEFITS

Private Hospital

WARD ENTITLEMENT

Income IncomeShield Integrated Shield Plan

4.4

306 Reviews

Raffles Shield Integrated Shield Plan

4.5

83 Reviews

Related Posts

Advertisement

For your situation, you may wish to submit the case for preliminary underwriting. This process allows you to understand the understand outcome before you submit a formal application.

Generally, it gives the underwriters more accurate information when you are able to provide them with the latest medical report.

Of course, you may wish to submit an application first, and work with your agent on how to get insured to that end.

I share quality content on estate planning and financial planning here.