Advertisement

Anonymous

I am 30 years old and thinking of starting to build a dividend portfolio. Is the current stock market valuation too high for me to start now?

My biggest concern is that if a market downturn were to come soon I will be hit by huge capital loss.

10

Discussion (10)

Learn how to style your text

Presley Soh

24 Jun 2021

Trader at HFM

Reply

Save

CommonSense Investor

24 Jun 2021

Certified Professional at Biotechnology and Gene Therapy Industry

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

Reply

Save

Jason Sing

25 Feb 2020

School Of Hard Knocks And Life at School Of Hard Knocks And Life

Since your biggest concern is a market downturn, you may want to do dollar cost averaging of about $200 to $300 every month. This is because time in the market is better than timing the market. You never know when is the best time to enter the market. Just my humble opinion.

Reply

Save

Alex Chua

25 Feb 2020

Seedly student Ambassador 2020/21 at Seedly

You are asking an incomplete question. I guess I will throw back the questions back to u.

Do u think the valuation is high now? Price and value are different. Price is what you pay. Value is what u get. I believe that if u look hard enough, there are stocks that are undervalued.

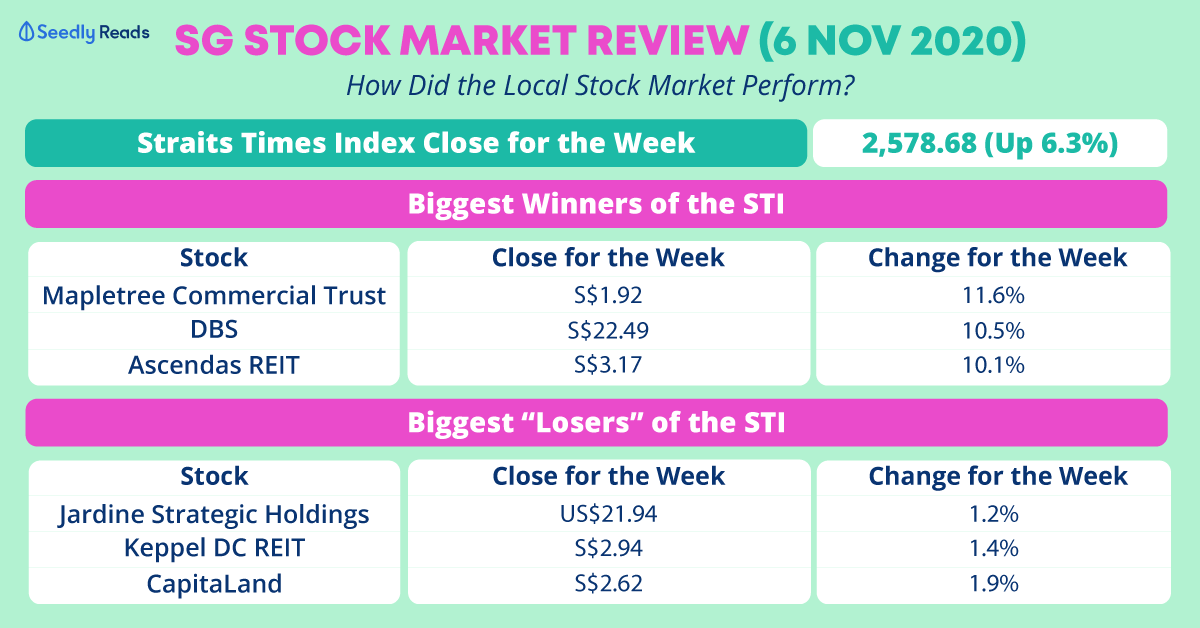

You mentioned that the current market valuation is too high. You seem to measure it from STI, but does STI show you the full picture of Singapore economic climate?

You mention that you want to start to build a dividend portfolio. So, I infer that you want to take a passive - active approach. You buy a stock to collect dividend. This means that you will be keeping the stock for more than 5 years.

So is there a need to panic over a market downturn? Isn't it a good time to buy the same good stocks at a cheaper rate?

Your homework then be defining a good stock so that you can jump right in when the price is right.

Thus, I feel that your concern is unjustified.

I believe the ans can be found in Seedly, yourself and/or the dividend/ investment workshop

Reply

Save

Usually when I have a lump sum, I try to split it up into 2 parts accordingly:

(1) 50% lump sum in ...

Read 6 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

My suggestion is to do dollar cost averging every month and average down on any stocks which you think may have potential for a comeback