Advertisement

How should a 45 year old beginner investor with $150k savings start planning for retirement? Any advise for a noob investor for retirement?

After working for many years, I've managed to set a side over $150,000 in saving.

I'm thinking it is time for me to make my money work harder for me.

Thus I'm thinking of taking out $50k for investment. I'm thinking of putting $10k into STI ETF. Another $10k to StashAway Simple with monthly top up of $1k and another $30k to StashAway Investment.

Is this a smart thing to do? With all investment, I'm prepared to lose.

Any advise or recommendation from expert here greatly appreciated. Thanks.

16

Discussion (16)

Learn how to style your text

Reply

Save

Insurance settled? Esp medical insurance for self and wife.

Emergency funds done? About 3-6 mths living expenses.

How is CPF? Every year you can top up 7k to your SA if not yet hit FRS. You can do similar for your wife depending on her annual income. Total 14k tax relief.

You can contribute to SRS for another 15.3k tax relief, but make sure you have a plan for your SRS monies.

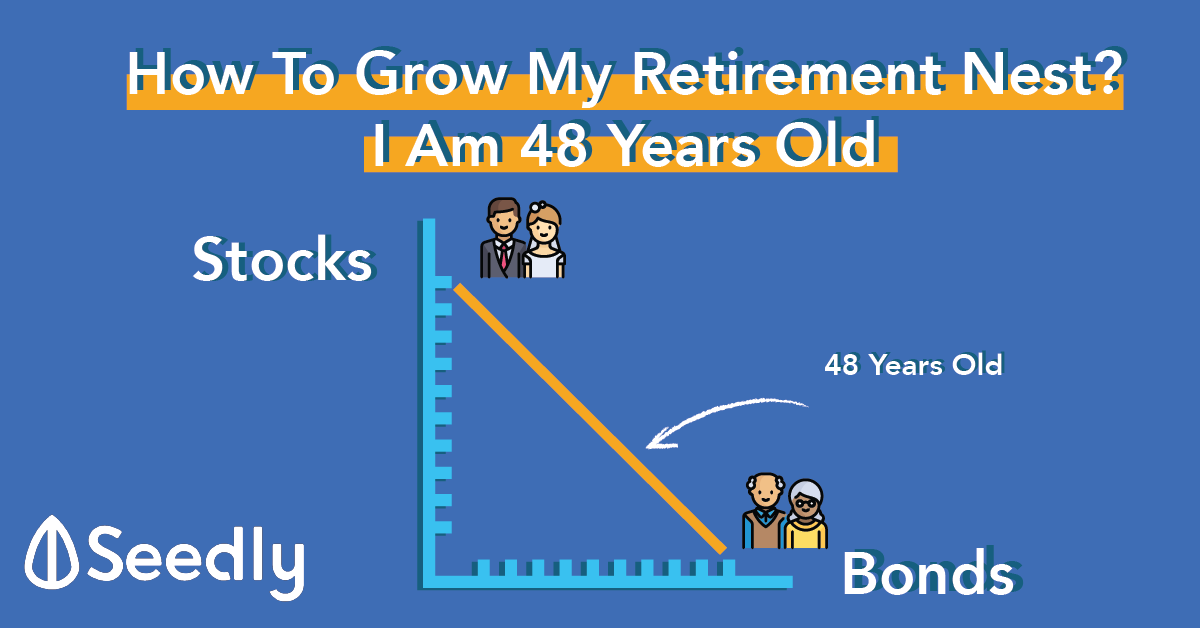

For investing, buy a global index of stocks, buy a global index of bonds. And you're done. No need to overcomplicate. More stocks if you feel more aggressive. More bonds if you're more conservative. The important thing is, if the market drops, can you hold through a downturn?

Make the investing part as simple as you can so that you don't have to spend too much time and energy on it. Spend that on your job and on your family instead.

Edit: Just to add. You are 45. By 55, you can withdraw from CPF. If you have yet to hit FRS in your SA, and are conservative and unsure of investing, 4% guaranteed returns from CPF SA is a pretty good deal, especially in these times of low interest rate returns.

Reply

Save

Hi, adding to what some others have said, the STI is a very narrow index (top-30 companies by market-cap). Contrast this with the US S&P 500.

Whether you eventually decide to self-manage / hire a financial advisor, be sure to consider the basics: ability vs willingness to take risk, liquidity needs, time horizon, most of which have been touched upon briefly by earlier replies.

Key data which appear to be missing from the Q (and reply) include your target retirement age, lifestyle post-retirement (e.g. lavish / simple? travel? gifting / charity? part-time casual work?), how many more yrs on the home loan, is 150k a small / so-so / substantial portion of your portfolio, what about CPF/SRS/rainy day funds, existing insurance coverage (and all the above for your wife / aged parents / siblings etc if they depend on you - can't plan in isolation).

May seem overwhelming but hope it triggers some thoughts. Realistically, most will have limited financial resources vs unlimited desires, so as long as the most important stuff is factored in, the rest is a bonus / good to have. Good luck!

Reply

Save

Sharon

11 Dec 2020

Life Alchemist at School of Hard Knocks

Assuming you plan to retire at 60-65 y.o., you still have 15-20 years runway.

I'd suggest you put the money to work into growth stocks. Don't settle for anything less, like STI ETF.

When you are a high income earner, investing in high quality companies will compound your money even further.

If I had that kind of money $150,000, in 3 months between Aug and Nov, my money will have work so hard for me that it will net another $30,000.

Understandably, at your position, you probably want something hassle-free and not monitor individual companies.

Perhaps you can consider Endowus via SRS. Kill two birds with one stone. Lower your tax while get good returns.

FYI I'm using them for CPF OA (lump sum) since Jun. Great results so far with 60% equities/40% bonds, or if you want, you can go 70/30 like Samuel, Endowus co-founder.

Endowus partners with quality fund managers that invest globally not just in Singapore market. Yes it's unit trusts but you don't need to worry about your investments under estate tax esp. from the US govt (18-40% estate tax on UK$60,000 and above) upon death.

If I remember correctly, ETFs are subject to estate tax.

Do take note yah. Hope this helps.

Reply

Save

Hi there!

I like to begin with the end in mind, which means knowing how much you need/would like to...

Read 6 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Hello! I think the best you can do is to set aside some emergency fund (good that you are spending less than 50% of income!) you can put them in higher interest payment instruemnt like singlife and Singtel dash.

thereafter, u can consider looking at some robo advisors for low to mid risk portfolio. SYFE REITS and equity100 portfolio is a good mix in my opinion.

for ETFs, try to avoid STI because they have the worst performance in the past 2 decades lol. I would go for s&p500 and nasdaq100 instead! :)