Advertisement

Anonymous

How proactive is the Seedly community in budgeting and tracking daily expenses?

Do you track every single expense religiously? Or do you take a more hands-off approach to budgeting, including only major expenses like housing and car instalments (which is what my parent does)?

Also, how do you generally budget for various expenses like food and transportation? How do I know how much I really need for each category each month?

Do provide your rough background and a brief rationale for your budget/choices!

39

Discussion (39)

Learn how to style your text

Reply

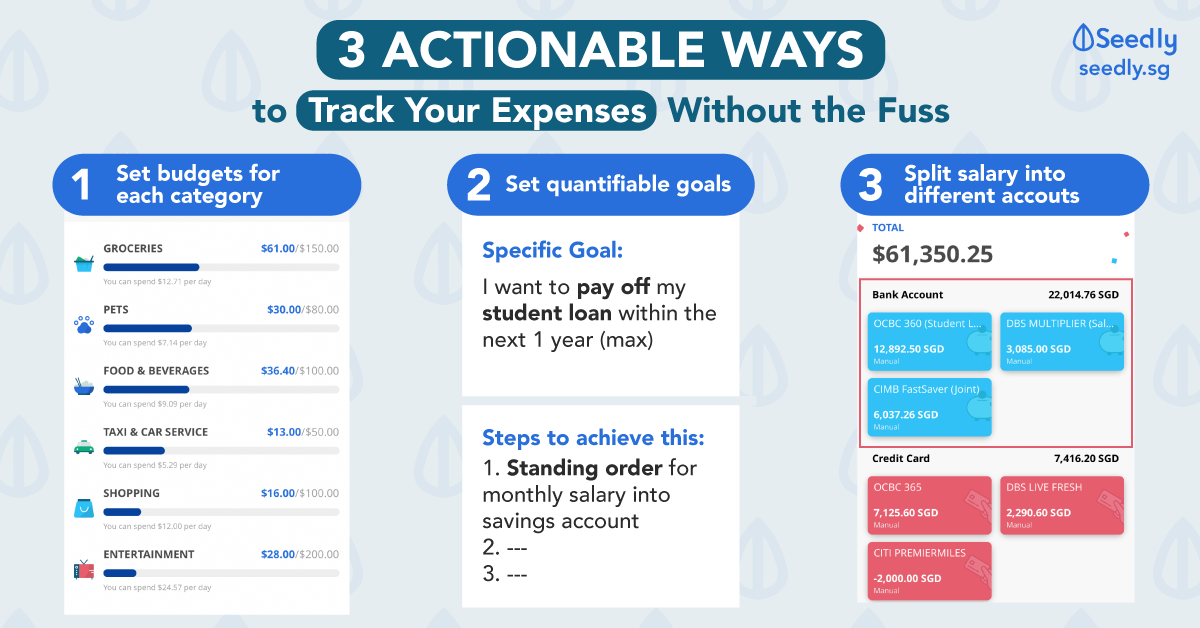

Save

For me i use planner bee to set and track my budgets, think it’s a rly good budgeting app because i love that they tell me how much more i can spend on a particular category per day based on my set budget :) at the end of every month i take a look at my expenses,’and see if i have any extra unnecessary purchases i can cut back on for future months!!

Reply

Save

I’m a uni student doing my internship and my expenses are mostly transport, food and other misc expenses.

I’ve managed to be quite consistent with tracking my budgets and expenses while using the app Planner Bee! I just set the budget for each category and let it recur every month. I also link my bank account to the app so any expense is automatically tracked which makes it so much easier and convenient for me. It’s really v helpful in making me more mindful of how much i'm spending to better plan my personal finances.

Reply

Save

I do. There are various apps which you can use to monitor. Once you are 80% close to hitting your threshold, they will alert u haha.

Reply

Save

I will use my own excel sheet to keep track of ins and outs. I am more suprised that there are more ...

Read 18 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

I am probably religious AF (not being dramatic). I track my expense everyday since Jul 2019 (1st day of 'adult' working life). My current spreadsheet allows me to easily include captions for the day's expenses, such that if I want to know what I did for 21 Nov 2019, I can refer to that and immediately recall that memory. Very good for me to remember stuff as I am forgetful. (see pic, top left picture).

Top left pic gets summarized in bottom left pic. The table is just a sumif function to categorize expenses by categories/subcategories (e.g. food and drinks, lunch), over each month. Bottom left pic then gets linked to the right pic which is the 'report', showing also my salary and family transfer (aka mom tax) at the top, and savings + metrics at the bottom.

BTW I breakdown yearly insurance bills into monthly payments to track the expense (though I only pay once a year). helps to make things more accurate.

The tables above aren't enough because due to e.g. your credit card payments which means your bank balance + savings does not equal bank balance as at end of month. This is for people who like to 'balance' stuff, what I do is just have another excel file tracking my net worth.

I have separate investment accounts to track, so iIl just have a table drawing from those separate tabs (expense tracker is not one of them bc as mentioned above, the payments are not actual cash outflows, rather is expensed). The separate tabs, combined with my bank account + CPF account balances, will give me a comprehensive pic of my networth.

Answering your qn, I used to budget in late 2019, but budgeting will fail when you reach a period where all your friends want to meet up. Can't be because of your budget you don't go out? So my idea of budget now is just a scale that I mentally keep track, aka if you spend too much, then don't spend so much going forward. It is also anchored by my investing & family/life needs like house and renovation.

"How do I know how much I really need for each category every month" to create a budget, you need to know your spending per month on your desired categories. Otherwise u don't know your upper limit. That can be 'solved' by tracking your expense (have convinced my partner to do so, now she is doing so by habit and don't find it a chore anymore). To 'keep' your mind at peace, tracking your expenses will help give you more of an alert of when you should stop spending so much.

All that aside, I'm a full-on data/numbers guy (& am pretty good with excel), so I like (or have an urge) to know what the balances of my various accounts are (usually 1x a month). This works well esp since I'm getting a house soon, would need to know your finances to understand how much cash u need to fork out, how much downpayment u can pay w OA etc.

Won't recommend this to everyone, since you need to know your stuff if you want to create these spreadsheets.

PS (if there is interest (pls indicate by liking this comment), I can create a simple template for expenses, as well as net worth tracking on google sheets then make it avail as a public link).

Cheers,

Joey