Advertisement

How much is enough for insurance coverage whereby he/she income is around $2.6k after CPF deduction?

Hi All,

I have this few insurance policy with me and I'm not sure whether did I over buy or did I even meet the rule thumb of what insurance agent always recommend. Would need some expert to advice.

VivoLife 180 - $40k

VivoCare - $30k

PruLife Multiplier Flex 70 x3 - $50k

MINDEF Group Term Life - $300k

MINDEF Personal Accident - $600k

AIA HEALTHSHIELD GOLD MAX A

Max Essential Saver A

5

Discussion (5)

Learn how to style your text

Reply

Save

Elijah Lee

12 Sep 2020

Senior Financial Services Manager at Phillip Securities (Jurong East)

Hi anon,

Based on the data you have provided (although I don't know the payment duration), you have $252K CI cover, of which at least $222K is late (from Pru and Vivolife) and $30K from Vivocare. Vivolife and Prulife Multiplier Flex come embedded with late CI coverage by default. Only early CI is optional but I do not know if you added the riders or not. Vivocare has early CI cover by default.

If you have added the early CI riders to PruLife and Vivolife, you may have more early CI cover than just $30K. This is okay also if you wanted early CI cover. No matter what you still have some early CI cover from Vivocare.

Based on your income of ~$40K/yr, you probably need $200K CI cover at least, so having $252K, while more than what you require, isn't exactly overkill (yet), since your income will rise over time. Again, excessive premiums or not would depend on your premium duration which determines the affordability of your plans. While it can be tempting to completely pay off your premiums fast, doing so may stretch you and it's recommended that you do not spend more than 10% of your gross income on insurance. We use gross because some part of CPF can be used to pay for coverage as well, such as DPS from CPF OA, and shield plan (main plan) from CPF MA.

You sound young, and MINDEF GTL and GPA plans are cheap at your age so you can keep them till 65 since it is only GTL and GPA if it is not stretching you. $300K of death/TPD cover may or may not be enough, depending on whether you have liabilities and dependents in the first place.

So in summary, a little more CI cover than what is needed at your age, but nothing too excessive. You have some death cover from GTL but remember that it is a group plan where ownership of the policy is not yours. Notwithstanding that, if you do have liabilities and dependents, then please consider increasing your death coverage as $300K probably isn't going to last very long.

Reply

Save

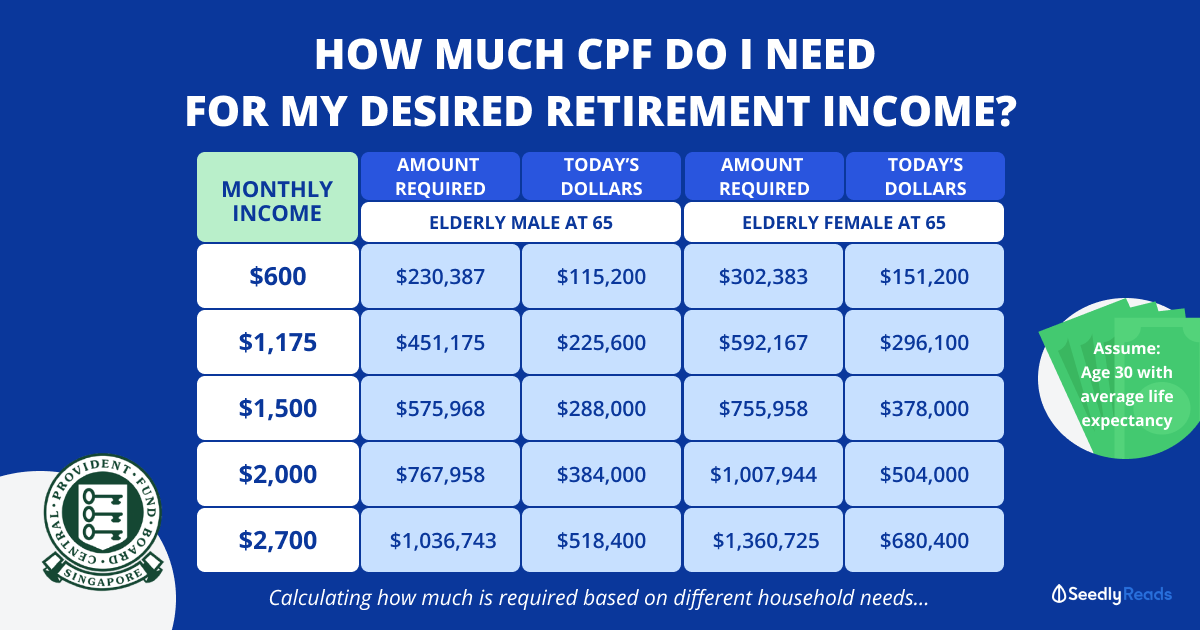

You can do your numbers here.

Genera...

Read 1 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Products

Manulife ReadyProtect Personal Accident

4.7

69 Reviews

ReadyProtect Signature

$1,000,000

ACCIDENTAL DEATH

$500 / week

TEMPORARY DISABILITY

Up to $10,000

MEDICAL BENEFITS

$1500

TCM & CHIROPRACTOR

Income PA Assurance

4.2

27 Reviews

Income PA Guard

4.1

17 Reviews

Advertisement

Hey there!

The rule of thumb for death coverage is 10x your annual income and for CI, it's 5x your annual income. The rule of thumb for CI is that the CI payout acts as an income replacement to ensure you are able to tide through a medical crisis in the event of a CI.

If your Prulife plan does not have a ECI rider attached to it, your ECI coverage may need beefing up since Vivocare covers dread diseases. You can consider getting a standalone CI plan and top up the remaining coverage.

You shouldnt be spending more than 10% of your annual income on insurance.

Do seek a licensed financial advisor to explore your options.

Financial planning is an integral part of life. You can reach me here to find out more