Advertisement

Anonymous

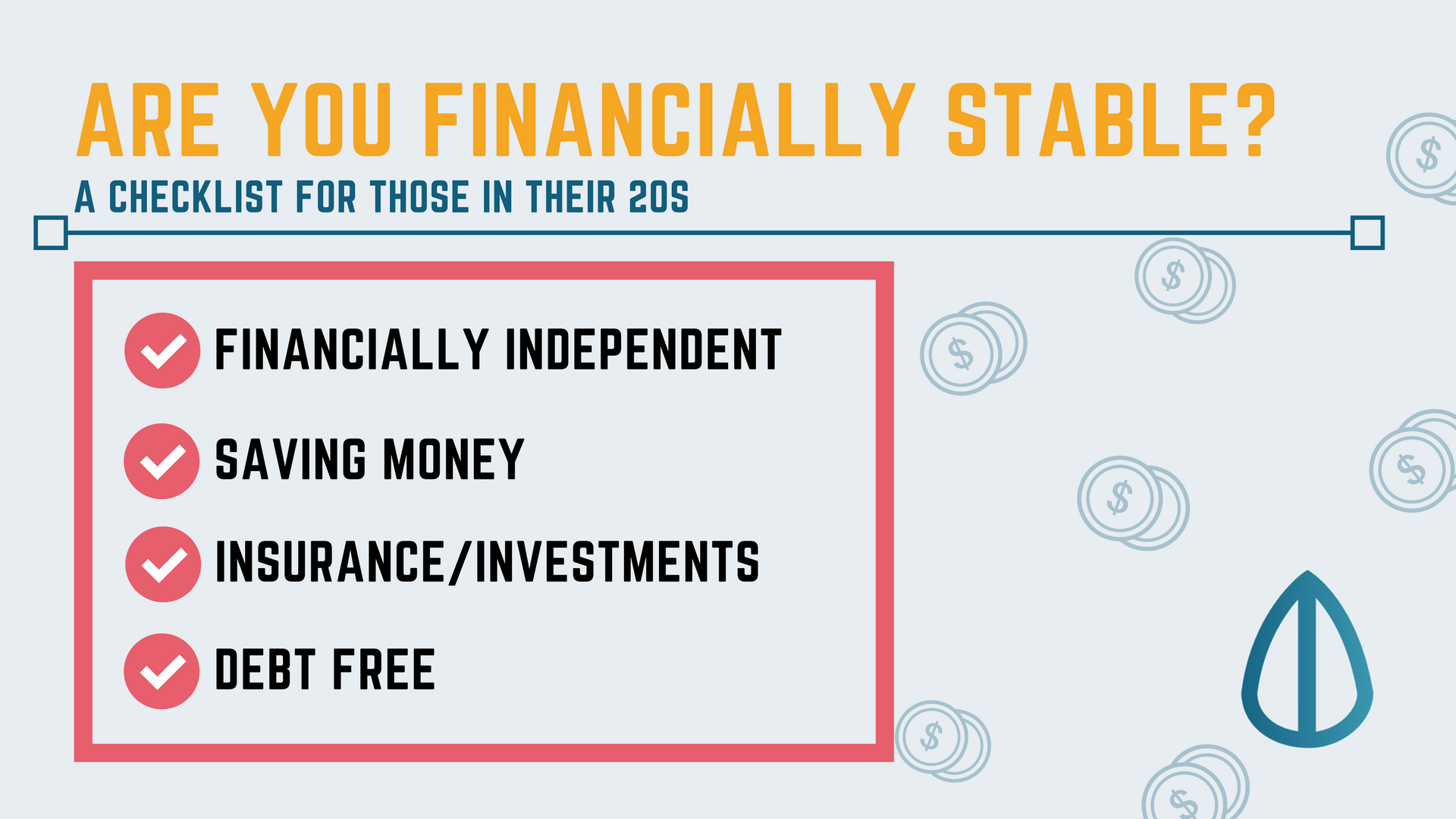

How do i know if i am on the right track to financial freedom? I try to invest 50% of my salary every month but I am not sure what stage I am at.

Not sure if i am doing things correctly?

11

Discussion (11)

Learn how to style your text

Reply

Save

Whats your definition of financial freedom?

Reply

Save

You're already doing better than most by investing 50% of your salary every month! The real question is—what's your target for financial freedom? Are you aiming for a specific net worth, passive income level, or FIRE (Financial Independence, Retire Early)?

A good way to gauge your progress is by calculating your FI number—basically, how much you need invested to sustain your lifestyle using the 4% rule. If your expenses are $3K/month, you'd need around $900K invested to cover it.

Also, diversification is key. Are you mainly in ETFs, stocks, or other assets? I personally DCA into ETFs like VOO and QQQ through Tiger since it's cost-effective for US stocks. Do you have a plan for when to shift from accumulation to preservation mode?

Reply

Save

Kent Toh

27 Mar 2025

Consultant at Sprinklr

As you grow older, you will know if you are on the right track.

But at this stage, 50% is good.

Reply

Save

For me, Consistency & Time and it will pay off....

Read 4 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Wow that is a lot of discipline