Advertisement

Anonymous

How do I calculate the sum of money I need to be assured for insurance policies?

3

Discussion (3)

Learn how to style your text

Elijah Lee

20 Jul 2020

Senior Financial Services Manager at Phillip Securities (Jurong East)

Reply

Save

You can use the calculator here:

Reply

Save

Pang Zhe Liang

18 Jul 2020

Lead of Research & Solutions at Havend Pte Ltd

As a general rule,

10% to 20% of your annual income on healthcare insurance and life insurance

Bas...

Read 1 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Products

Great Eastern GREAT CareShield

4.1

18 Reviews

$5,000

MAX MONTHLY BENEFIT

Unable to perform ≥ 1 ADL

MONTHLY PAYOUT CRITERIA

300% of first monthly benefit

MAX LUMP SUM PAYOUT

Unable to perform ≥ 1 ADL

LUMP SUM PAYOUT CRITERIA

Singlife Careshield Standard

4.3

3 Reviews

NTUC Income Care Secure CareShield

No rating yet

0 Reviews

Related Posts

Advertisement

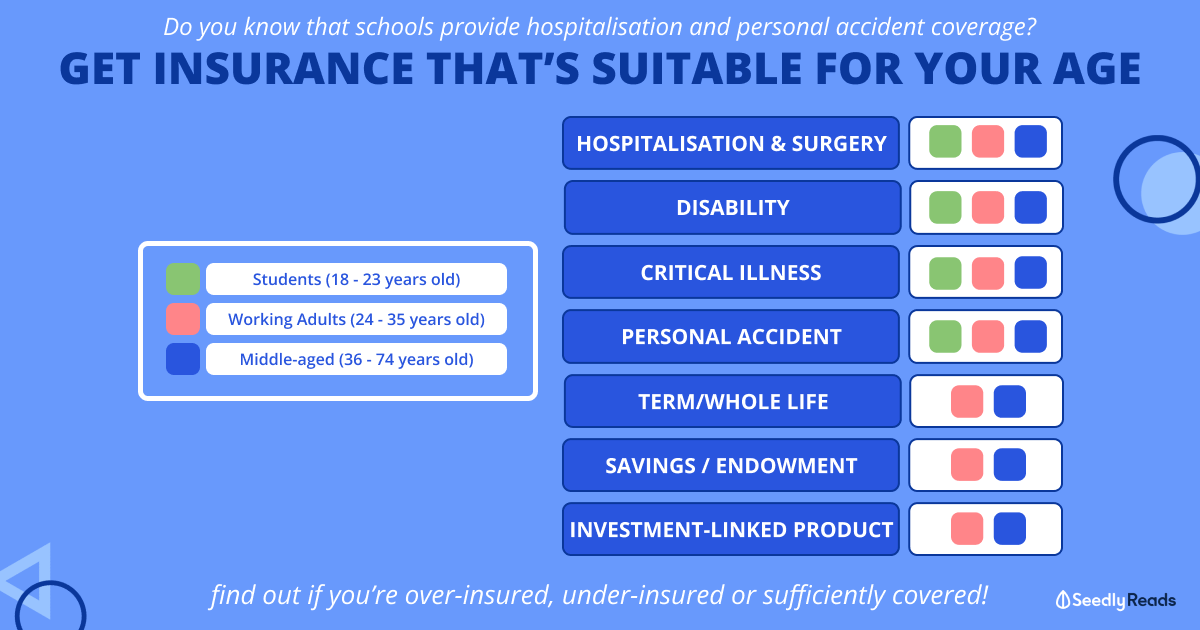

Hi anon,

For death/TPD, you would want to be covered for usually at least ten times your annual income, or for the equivalent of what it will take to pay off your liabilities and provide for dependents till they are financially independent, minus existing coverage. There may also be a need to provide for the surviving spouse if necessary.

For CI, you'll want at least enough to take care of 5 years of expenses as well as an amount for the treatment costs that aren't covered by hospitalization plans.

For Disability Income, the maximum is 75% of your last drawn income so there's a cap there.

For long term care, there's no real formula, but you should at least strive to get a decent payout within affordability limits.

These are very general rules and your situation may call for a deeper analysis before a more accurate range of coverage can be suggested.