Advertisement

Anonymous

How can I efficiently pay of my credit card debts? I’m a fresh grad, 6 months into my first job, average pay. And I’ve already accumulated $3k worth of debts that I can’t pay. Should I cancel my credit card? ?

16

Discussion (16)

Learn how to style your text

Yeap Ming Feng

07 Jun 2019

CEO at TradingKey

Reply

Save

Kenichi Xi

21 Sep 2018

nᴉʍ oʇ dǝnᴉʇsǝd 不能说的秘密 at Tag Team with Gabriel Tham

Short Answer

Yes. Cancel your credit card and use a debit card instead if you are really into saving with spending when the debit card offers cash back.

Making money as you spend is better then paying more when you spend due to late payment or interest from credit card debt.

$3k is still a manageable sum so is better to clear it asap and work towards savings.

You need savings to propel toward your future and not just striking or rich.

Hope my reply helps.

If you feel this reply have Quality, please upvote and check other Quality Reply.

https://seedly.sg/profile/a-kenichi-xi

Thank you.

Reply

Save

First off, read the budgeting articles in seedly, and set up your spending budget

- for now avoid using credit card (lock it at home) until you learn how to control your spending.

- make sure you are using the current account with the best interest rate (every penny counts here)

- set a target monthly amount to pay back the loan.

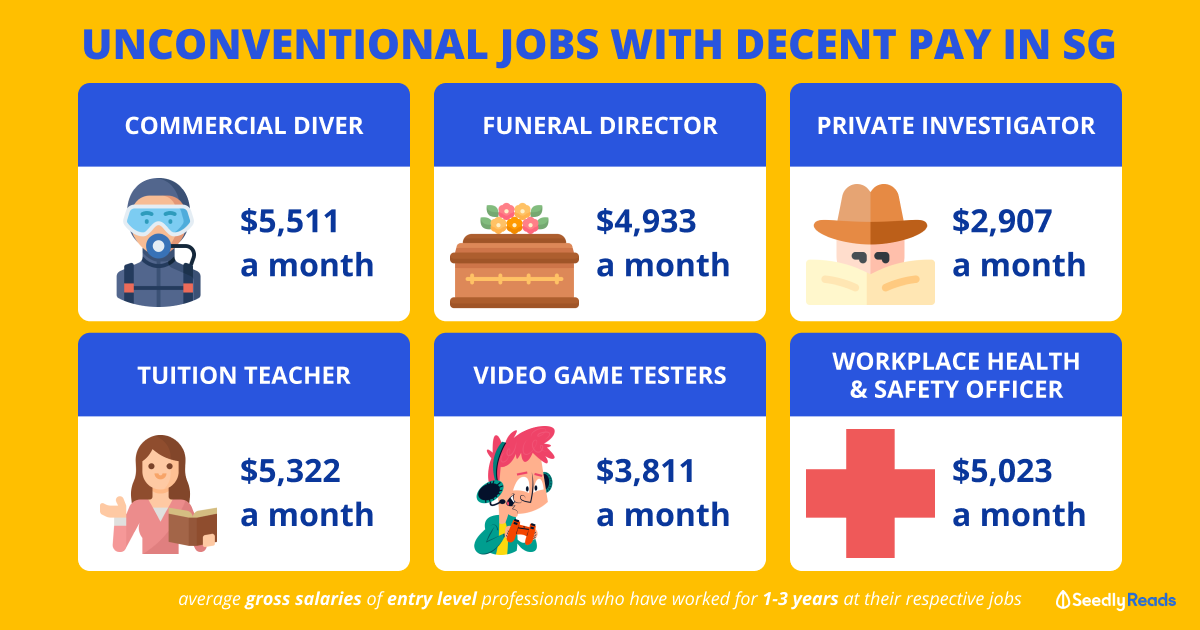

- consider how to get extra cash, e.g. sell off any unwanted items on carousell, give tuition, etc

- most efficient way is to live an austere life for a short period to clear the debt, then you can start to relax...a bit. If you are getting $2000 - 2500, I would target to clear the debt within a year, extremely doable, less than 6 months if your really stingy on yourself, packed lunch, no cabs, etc.. (please do not plan for holiday, or sign up for any grooming / gym packages until after you pay back your debt) Chinese saying, chang tong bu ru duan tong. Short term pain better than Long term pain

- basically clear your debt before you start seriously saving. The interest for the debt is way higher than what you are getting for your savings.

- and think on the bright side. If you can target $X per month for the debt, and get use to living this way. That's the extra savings you can get for retirement & investment after you clear your debt.

This is a bad example, but if your parents are well off, can consider getting a loan off them for this credit card loan, but have to be discipline to pay them off monthly at a smaller interest then what the bank is charging. You need to agree with them the monthly amount and how long you'll take to pay them back (This is purely to lower the interest charge). Key Word, LOAN, INTEREST, PAY THEM BACK

Reply

Save

wow 3k cannot pay?

u need to stop ur lavish spending

Reply

Save

3k debts in credit cards, every month you will need to pay off your credit monthly financial charge....

Read 11 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Products

Standard Chartered Simply Cash Credit Card

4.1

176 Reviews

Standard Chartered Simply Cash Credit Card

Up to 1.5% on eligible spend

CASHBACK

Unlimited

CASHBACK CAP

$30,000

MINIMUM ANNUAL INCOME

UOB One Card

4.1

166 Reviews

POSB Everyday Cashback Credit Card

3.9

199 Reviews

Related Posts

Advertisement

Where is this $3K worth of debts from?

I personally had credit cards when I first started working (just so I can enter Zouk for free). It wasn't long before I realised it is a huge mistake.

This is mainly because:

1) Having just entered workforce, our salary will not be able to handle possible late payments

2) Having just entered the workforce, we tend to have a shopping spree mentality, purchasing things we cannot afford when we are schooling.

These contributes to us spending recklessly. Cancelling all the credit card was the best thing that happened to me then. Of course, when you form a good habit of budgeting, get your preferred credit card for Cashbacks or Miles!

Now, priority will be to clear those debts.

Here's are two methods to help you:

Snowball Method and Avalanche Method, both proven to work.

Read about it here: https://blog.seedly.sg/hacks-to-clear-your-debt...