Advertisement

Anonymous

Hi, I'm I am 55, CPF OA at $1M; RA = FSR; bank account = $2M. I have questions on retirement, stable passive income and the principle of not drawing down?

I am 55, CPF OA at $1M; RA = FSR; bank account = $2M; flat is fully paid for; stocks/reits/UT about $700K; I am thinking of retiring from work within the next 3 months, and leaving off passive income Appreciate some input on how best to get (1) stable monthly income of about $7K (2) not draw down my principal ie not asset decumulation (3) target till age 90. Thanks for any good suggestions.

3

Discussion (3)

What are your thoughts?

Learn how to style your text

Reply

Save

View 2 replies

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

You see if my calculation make sense:

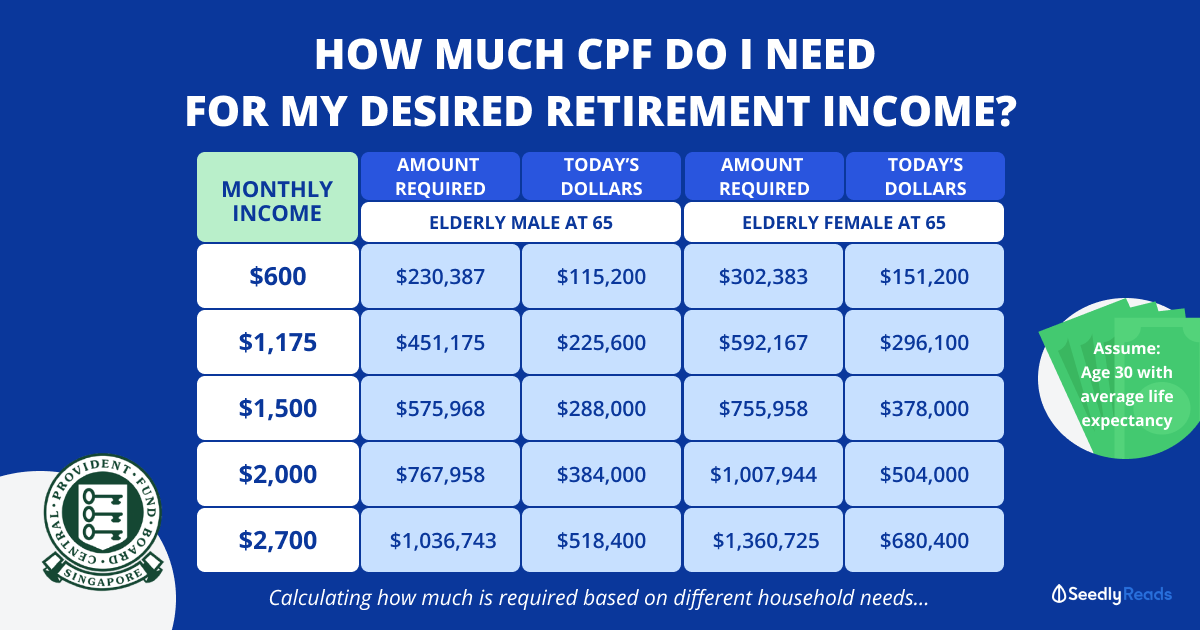

RA= FRS - monthly payout @65 ~ $1.4k

Assume your total dividend stock/reits/UT ~ 4%

($700000 x 0.04)/12 = $2333

Remain: 7000 - 2333 - 1400 = $3267

You need to invest: ($3267 x 12)/0.04 = $980 100 to your existing portfolio.

You will still have roughly 1 million in your bank account. You may put $500k to a general index ETF for some growth. And 500k as emergency fund?