Advertisement

Anonymous

Greeting all! We have combined saving of SGD 7k a month which can be invested in anywhere.All insurance and household spending etc are well taken care of.

We are thinking of:

- sell some options for premium. ( either call or put as we don't mind picking up shares)

- DCA into some ETF ( dimensional's etf , some indices, using endowus )

- DCA into crypto / staking

- DCA into dividend paying stocks? ( not sure should we or just go into growth directly)

we can stomach risk and we understand it fully from a financial perspective.

Appreciate your wildest/boldest input! =)

13

Discussion (13)

Learn how to style your text

Robin

26 Oct 2021

Administrator at SG

Reply

Save

The 4th point will give you the lowest return. This one is obvious and no need to consider at all.

Point 3's return is the highest among all but you need to spend the most amount of

time as well to find out which crypto to go into.

Point 1 and 2 complements each other. Can do both meaning DCA into some ETF and sell put options for premium. This one is the most stable and least risk among all the ideas.

Reply

Save

Not relevant to the question you're asking because I'm not good enough to give advice on that BUT I would definitely recommend splitting your investments with your partner.

I have seen firsthand how a couple sharing investment accounts may start having differing views on "how or where the money should be invested" and ended up being on very bad terms.

my suggestion is to manage your own pot of investments - even if you make a loss or a bad decision, your partner can't blame or resent you 🤷🏻♀️ 🥲

good luck!

Reply

Save

All those are good assets to include in a diversified portfolio, here is how I portion mine:

20% - SG dividend stocks (banks and REITs)

5% - Crypto

everything else - S&P500 etf (CSPX), World index (VWRA) and individual stocks

As I am still young, I plan to only accumulate dividend stocks if they are selling at huge discounts (as they were last year). With markets recovered since then, I have been DCA-ing into S&P500 etfs and indiv stocks for greater growth to maximise returns

Reply

Save

Zac

23 Oct 2021

Noob at Idiots Invest

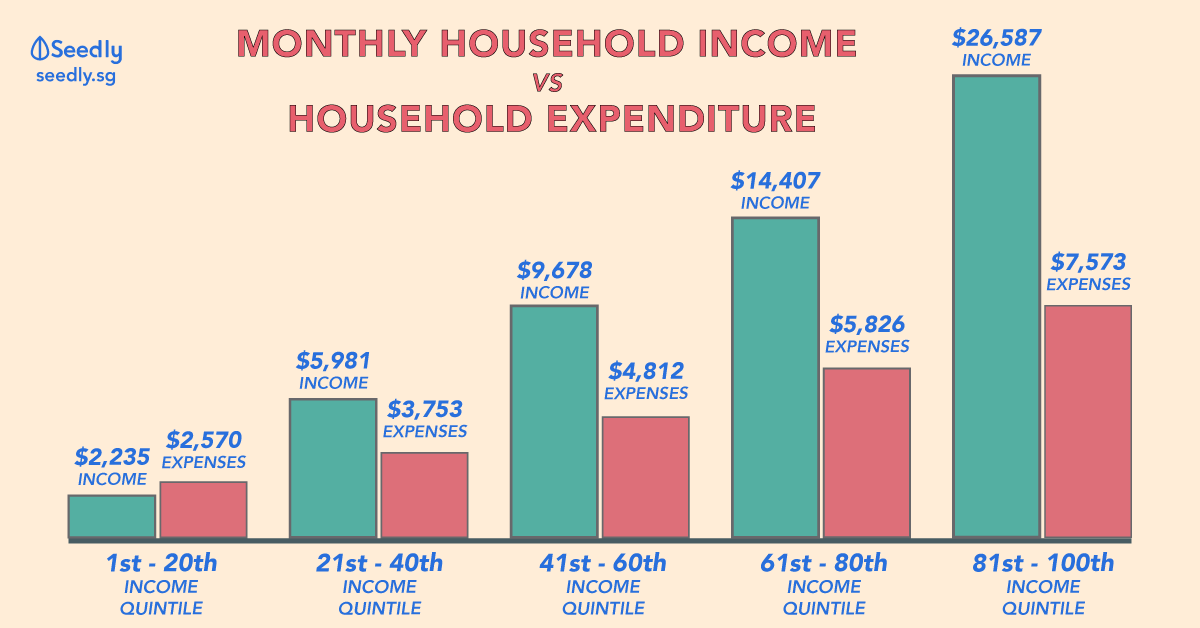

With insurance and expenses taken care of and a household savings of $7k a month, you guys sound ric...

Read 5 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Products

StashAway

4.7

1295 Reviews

StashAway Simple Guaranteed 3.55% p.a. (Guaranteed rate)

Cash Management

INSTRUMENTS

None

ANNUAL MANAGEMENT FEE

None

MINIMUM INVESTMENT

3.5%

EXPECTED ANNUAL RETURN

Mobile App

PLATFORMS

Endowus

4.7

658 Reviews

Syfe

4.6

934 Reviews

Related Posts

Advertisement

90% US market and 10% crypto. No SG and no dividends.