Advertisement

Discussion (4)

Learn how to style your text

Reply

Save

Pros and Cons.

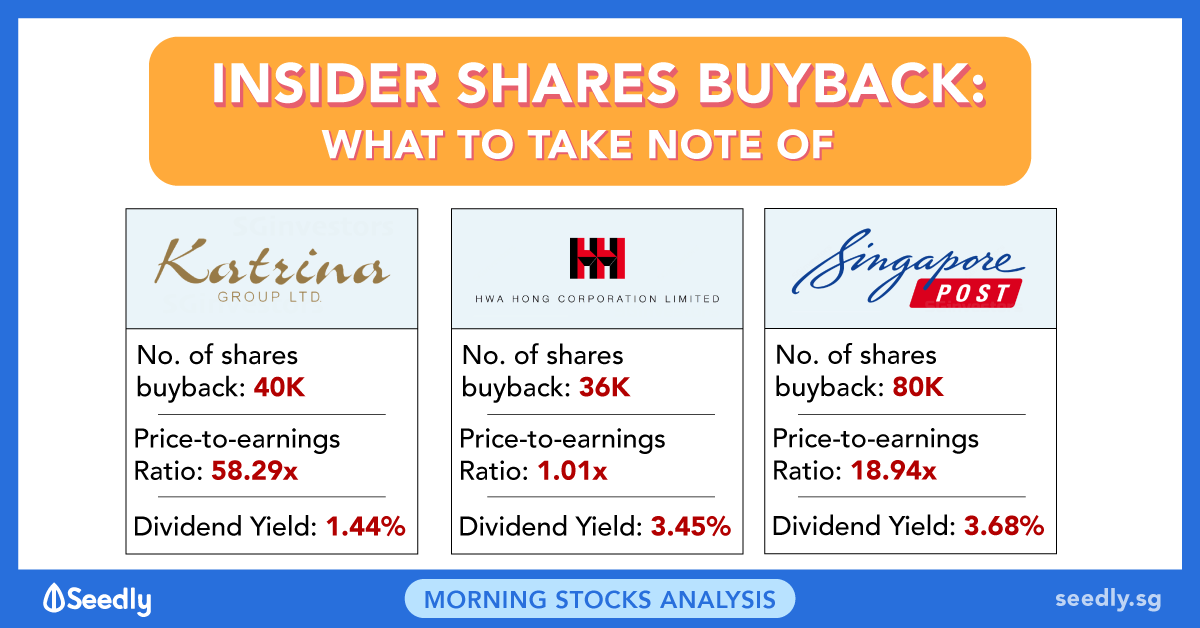

Typically the argument goes that the stock is undervalued and a good buy at the current market price. It also creates a level of support for the stock, especially during a recession or market correction. Additionally, it increase share prices as a decrease in the number of outstanding shares often is followed on by a price increase, ie. increasing stock valuation.

However, consider the EPS ratio:

EPS: Company's total earnings / number of outstanding shares

Through a share buyback, a company decreases the number of outstanding shares and immediately increases the EPS ratio without actually increasing earnings.

So when analyzing share buybacks, keep in mind their rationale for it, and triangulate that understanding with looking at the other financial metrics.

Reply

Save

Isaac Chan

12 Mar 2019

Business at NUS

There was a separate post on this recently also. (https://seedly.sg/questions/why-do-investors-frown...

Read 2 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Hello!

It can be both good and bad when the company buys back shares.

In terms of the shareholders of the company, when the company buys back shares it may be beneficial for them since share prices will increase when companies buy back shares. this is because the number of shares available decreases thus resulting in an increase in share prices. when companies buy back their share, it will also help to create a level of support for the stock.

However, it may be bad since the EPS ratio may increase without the company doing anything. EPS ratio can be a judge to a company's financial position. Thus, should the company buy back shares just to increase this ratio it may be misleading to investors.

Ultimately it will boil down to why the company decided to buy back these shares to determine whether it is good or bad.