Advertisement

Anonymous

Does pre-existing mental illness affect eligibility for hospitalisation insurance?

A family member of mine in her 20s has pre-existing mental illness and is thinking of getting a hospitalisation plan. She has been diagnosed with major depression before. Will it affect her eligibility or will there be any premium loading due to mental illness?

4

Discussion (4)

Learn how to style your text

Reply

Save

Nigel Tan

19 Jun 2020

Executive Senior Financial Planner at Great Eastern Life

Generally yes. There is a specific question in the application pertaining to mental illness, depression & epilepsy etc.

It would affect her likelihood of getting covered, especially since H&S is so strict with the underwriting process. Whether she is offered or not really depends on the insurer. The reason being, it is difficult to ascertain whether the injury/ illness cause was due to self harm.

However, if the condition has been discharged over a couple of years without any relapses or recurrence, your chances of getting accepted would probably increase. I know of someone who was depressed during his NS days but was eventually cleared by psychological wellness centre later on. The process took quite abit of back and forth though.

Reply

Save

Pang Zhe Liang

19 Jun 2020

Lead of Research & Solutions at Havend Pte Ltd

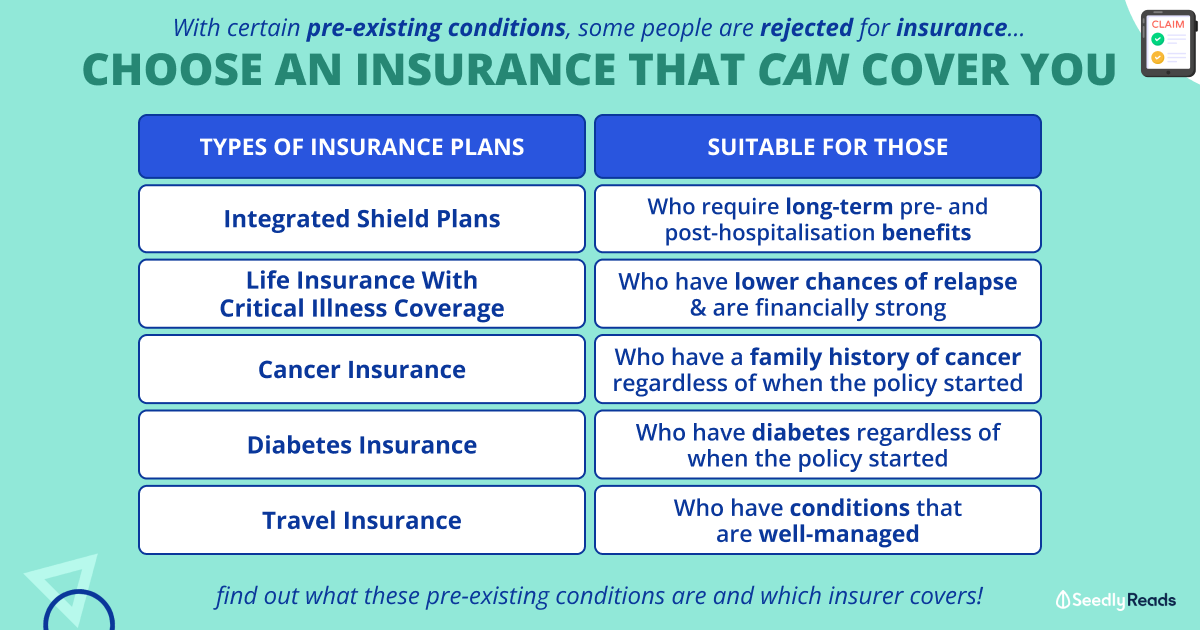

It depends on the severity of the condition and the situation now. Accordingly, I will suggest for y...

Read 1 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

There will be no loading for hospitalization plans. There will be exclusions and in the worst case, outright declined.

Mental illness is a condition where the underwriting is strict, even more so if it was a severe case. There is no harm trying to apply, but I would manage expectations and do expect lengthy back and forth between the insurers on medical requirements.