Advertisement

Anonymous

CPFIS - Is it a good idea to use CPF OA for investing?

What would you recommend?

2

Discussion (2)

Learn how to style your text

Pang Zhe Liang

02 Jan 2020

Lead of Research & Solutions at Havend Pte Ltd

Reply

Save

Shengshi Chiam, CFA

02 Jan 2020

Personal Finance Lead at Endowus

If you are going to pay for your housing in the short term, probably not. a good idea to invest using CPF.

Just to disclose, I am working with Endowus so my opinion might be biased.

If you were to invest through stock picking, you can do up to 35% of your CPF investable amount (which is total amount - 20k). This makes it restrictive, and because of agent bank charges, this is not an attractive option.

If you were to invest through unit trusts, you can invest up to 100% of your CPF investable amount. Certain platforms are zero charges, but what happens is that the fund managers pay these platforms a fee.

For Endowus, we rebate all these fees to our customers and charge a clean 0.4% fee from them. We also attempt to bring in lower cost, diversified funds into the CPFIS portfolio. In our advised portfolio, we have the S&P500 passive fund in our portfolio. We are constantly working withe the fund managers to bring in more low cost passive funds into the portfolio.

This makes investing through us a more fuss-free, cheaper option if you are looking to be globally diversified. Else you can still invest in STI ETF for your OA money, but that is only 30 companies with more concentration risk

Reply

Save

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Before you start investing, it will be best to understand your objective. Here are some questions to help you:

What is your capital?

How will you want to invest your capital? E.g. lump sum or an amount on a regular basis

How long will you want to stay invested? E.g. 10 years

What is your risk appetite? E.g. How do you feel about short-term volatility?

What is your objective for investing?

Since different individuals have different objectives and risk appetite, it will depend on your objectives for wanting to invest your CPF money. Additionally, you may wish to understand your cashflow and the use of your money in the Ordinary account, e.g. education, housing needs.

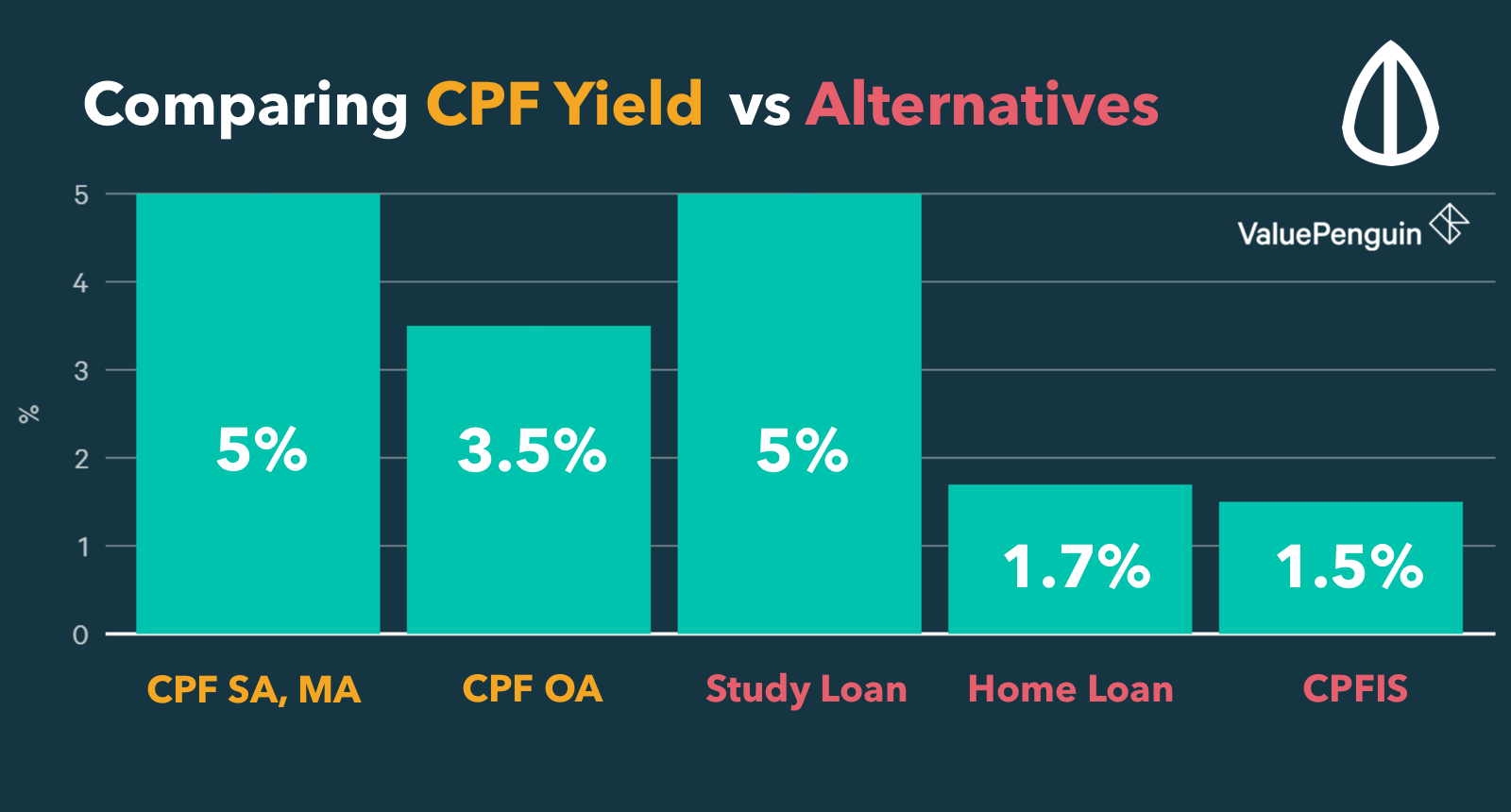

Now, once you decide to invest your CPF money, you must understand that the investment return is always non-guaranteed. As a result, this can be higher or lower than the floor rate given by CPF Board, i.e. a base of 2.5% for Ordinary account.

As a study of how CPF Investment Scheme fares in 2019, here is the result:

Q1 2019: 7.82%

Q2 2019: 1.9%

Q3 2019: 0.18%

There are various tools that you can invest into using your CPF money. Professionally, I help my clients to grow their money through a customised portfolio with bonds and equities. Thereafter, I will apply various investment strategies and risk management techniques to create an expectation for the portfolio.

The rest of the available investment tools can be found here: https://www.cpf.gov.sg/Assets/members/Documents...

Here is everything about me and what I do best.