Advertisement

Can you recommend your favorite Singapore REIT?

I am from Hong Kong, and I am not familiar with Singapore REIT but I have an interest in investing in the Singapore market. Please share with me your fav!

4

Discussion (4)

Learn how to style your text

Lim Qin Da

20 May 2020

Finance & Business Analytics at National University of Singapore

Reply

Save

Depends on how long you are looking to stay vested.

If looking long term, malls and properties are quite cheap now due to the pandemic. However you need to do quite abit of research to ensure that the company is able to recover from this pandemic well.

For now, SG has closed down quite a number of shops and malls to prevent the spread of COVID. For the next quarterly report, there will definitely be a drop in profits and most likely dividend cut. That may be the time to enter when the market is low.

Then hold for the next 5 to 10 years and wait for the economy to recover

Reply

Save

Parkway Life Reit, nothings beats hospital assets during a pandemic...

Read 2 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Products

Moomoo Singapore

4.7

487 Reviews

From $0

MINIMUM FEE

0.03%

TRADING FEES

Custodian

STOCK HOLDING TYPE

Saxo Markets

4.5

961 Reviews

Plus500

4.7

144 Reviews

Related Posts

Advertisement

Answers from the panel!

Stanley (Value Invest Asia): I have not invested much in Singapore REITs, but my favourite would be Mapletree Commercial Trust.

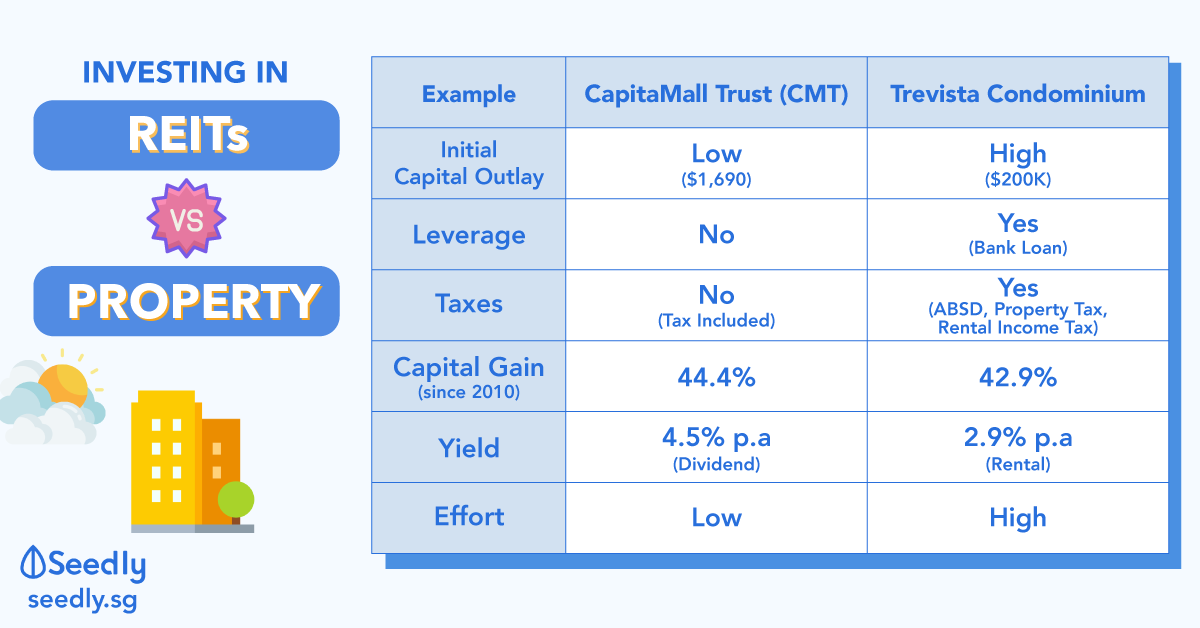

Sudhan (Seedly): I prefer another REIT, which is Capitaland Mall Trust. CMT is getting hit left right centre now because of COVID-19, but I think in the long term they will still do well because of their malls which are well positioned all over Singapore. Furthermore, Singaporeans like to go shopping and visit retail malls in Singapore, so they are something that would not die in Singapore in the long term.

Ser Jing (The Good Investors): I wouldn't pick one, but I think the Mapletree family of REITs are generally very well run. When I consider REITs, I would also consider the sponsor/organisation/people backing the REITs. So I think the Mapletree entities have been very well run in general.

Follow-up Question: If each of you have $1000, how would you allocate your portfolio?

Ser Jing (The Good Investors): I would go for the Robo-Advisors, because I think they give instant diversification. Because with just $1000, it is actually very difficult to achieve adequate diversification. Investing with any of the robos would be a much safer bet.

Stanley (Value Invest Asia): For me, most likely I would buy the S&P 500 Index. If you try to buy an individual stock with just $1000, it might be a little too risky for investors.

Sudhan (Seedly): I would go for STI ETF. I think the Singapore Index is grossly misunderstood as many people are going for US stocks. Most of the STI is made up of the banks, which are well capitalised in Singapore and growth potential in Asia. For foreigners looking to invest in a stable country, I think Singapore is a stable country to invest in. Even though the returns would not be as high as the S&P 500 in the long term, with dividends in, 6-7% would not be too shabby. If value investors like to invest in undervalued stocks, I think STI ETF is something to consider.

For more discussions on SeedlyTV S2E05, you could check out the video and Q&A here!