Advertisement

Anonymous

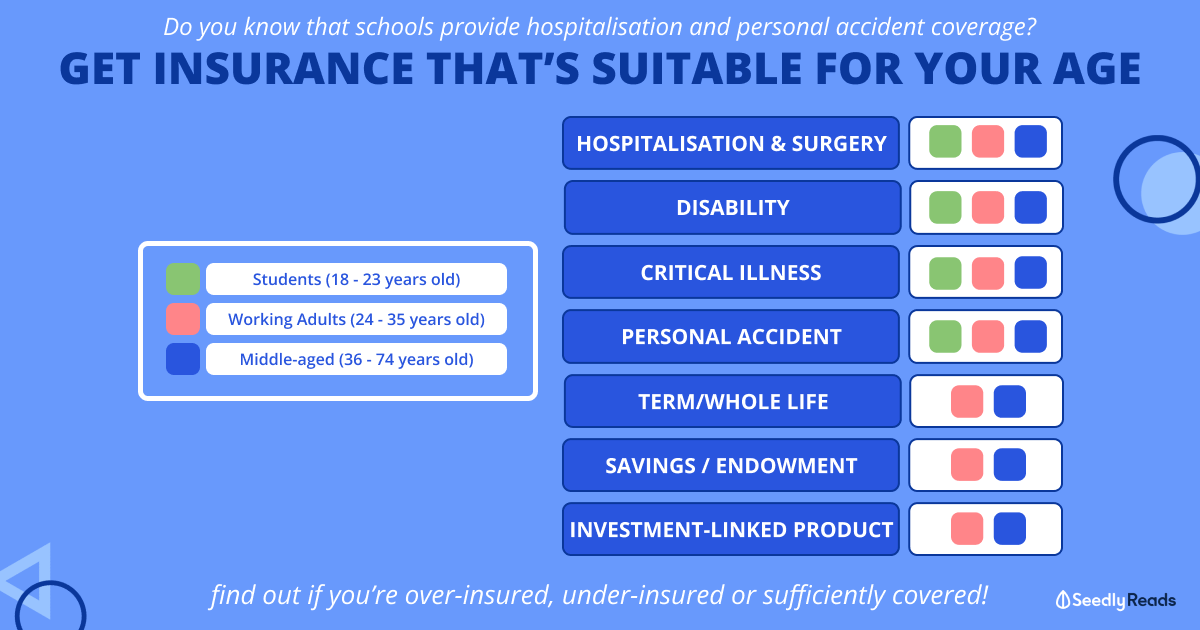

Can someone help list down all the Singapore citizen/PR policies and insurance coverage that we have in Singapore?

Because I'm doing an insurance review before I meet my agent next weekend. I'm want to be very clear what we are already protected before being sold the additional layers on top with all the glitter and sparkles.

7

Discussion (7)

Learn how to style your text

Hariz Arthur Maloy

07 Jun 2019

Independent Financial Advisor at Promiseland Independent

Reply

Save

Luke Ho

07 Jun 2019

Founder and Director at CFX Money Maverick Pte Ltd

Uh. Sounds like you're starting off pretty wrong - if you don't trust your agent, don't meet them, or at least give them the opportunity to establish trust.

If you want to be clear of your current protection, bring your policies to the meeting. At the very least, you'll be able to establish your agent's competence.

If someone has an old policy that doesn't require surrendering in favor of better opportunities (higher returns) or burdens (paying till age 88 for example, where the client has shown frustration), the agent should account for the existing policy and give you recommendations to make up the coverage lacking.

For the answer to your question, all Singapore citizens can buy (in relation to Life Insurance), not the others.

Death: And Terminal Illness

Disability: Eldershield, Eldershield upgrades, Work disability, Total and Permanent Disability Plans

CI: Early Critical Illness, Intermediate Critical Illness, Late Critical Illness, attached to anything from a Term to a Whole life to an Investment linked policy

PA: Personal Accident (standalone), Personal accident plans with glitter and sparkles (such as hospital benefits and reimbursements, etc)

Hospitalization: Shield plans and riders

You may or may not need all of these, depending on your specific situation and what coverage you already have. I suggest you have that agent reviewing help you categorize your existing policies for you, so you can mark it off like a checklist.

If you want a second opinion, you can always reach me: https://www.facebook.com/luke.ho.54

But honestly, don't go into that meeting with that kind of negativity. You'll likely only compromise yourself. If you're really terrified of being sold something unnecessary, either you find someone more ethical or someone who has no temptation in that area because you've paid them thousands of dollars upfront (eg. Providend).

Reply

Save

Brandan Chen

15 Oct 2018

Financial Planner at Manulife Singapore

Luke has already done a pretty good summary of the type of insurance.

If you would like to understa...

Read 1 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Dependent's Protection Scheme: A $46000 Term to 60. Payable with OA.

Home Protection Scheme: A Mortgage Reducing Term that pays for any outstanding HDB mortgage owed. Payable with OA.

Medishield Life: A Hospitalization & Surgical Insurance that covers you for life that subsidizes B2/C Ward Stays and certain limits to certain surgical procedures up to $100k/yr. Payable with Medisave.

Eldershield/Careshield Life (soon): A Long Term Care Insurance plan that covers you for life and pays you for life in the event of the inability to perform 3/6 Activities Of Daily Living starting from $600/m escalating at 2% per annum. Payable with Medisave.

CPF Life: An Annuity Payout from 65 for life @ 9.5% drawdown payout of the Full Retirement Sum when you turn 55. Payable with your OA + SA.

These are the most basic of coverage and gives you an idea of what you need to do extra. All of them should be "Upgraded" by getting private plans for yourself.

Govt care if you die, get disabled, cannot pay for house, need to go hospital, or live too long, but don't care if you get a Critical Illness. There's no provision made for this yet.