Advertisement

Anonymous

Best credit card for cash back on $1k / month expenditure on transport, dining, bills, online spend?

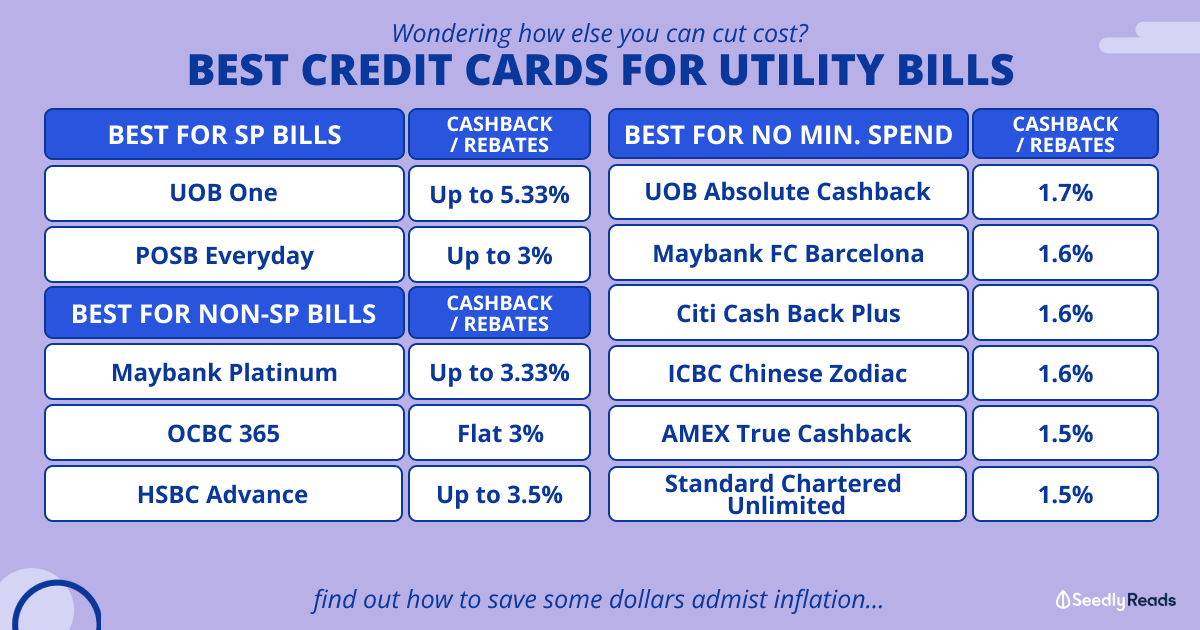

My cc expenditure is around $1k / mth incl groceries, transport, dining, insurance, online spend and I currently only use the stanchart unlimited card for cash back. Should I switch to uob evol for the 8% cash back? If not, which credit card is better?

2

Discussion (2)

Learn how to style your text

Reply

Save

thefrugalstudent

Edited 21 Jul 2021

Founder at thefrugalstudent.com

Hi Anon,

Since UOB EVOL excludes insurance as eligible spending, you should make sure that you're able to comfortably hit the $600/month min spending excluding insurance payments. If you're able to do so, then the EVOL card is definitely better than the unlimited card.

I believe it's one of the best high cashback cards around already, though I think there are some that award 10% cashback with a higher min spend (CIMB?)

Hope this helps!

Regards,

thefrugalstudent

Reply

Save

Write your thoughts

Related Articles

Related Posts

Related Products

Standard Chartered Simply Cash Credit Card

4.1

176 Reviews

Standard Chartered Simply Cash Credit Card

Up to 1.5% on eligible spend

CASHBACK

Unlimited

CASHBACK CAP

$30,000

MINIMUM ANNUAL INCOME

UOB EVOL Card

3.7

13 Reviews

UOB One Card

4.1

166 Reviews

Related Posts

Advertisement

Whenever I see you OB credit card. I need to warn you on this. Be careful of this lousy company charging you the credit card one annual fee ~200. Annual fee waiver subject for approval. Super 'effective' way to do the waiver. Maybe you need a few days to follow up.