Advertisement

Anonymous

After setting aside emergency funds(DBS Multipler/uob one ect) how much investment returns can one expect by passively investing in singapore REITs or Blue chips shares?

Testing out stashaway and seedin for now, so far performance has been alright and within my risk appetite, was wondering how would i have fared if i passively invested in Reits or shares.

5

Discussion (5)

Learn how to style your text

Reply

Save

Jonathan Chia Guangrong

10 Dec 2019

SOC at Local FI

I assume you are referring to dividend returns when you asked this question.

For reits it will depend on the sector you are vested in. It can range from 4% onwards to about 7% or so.

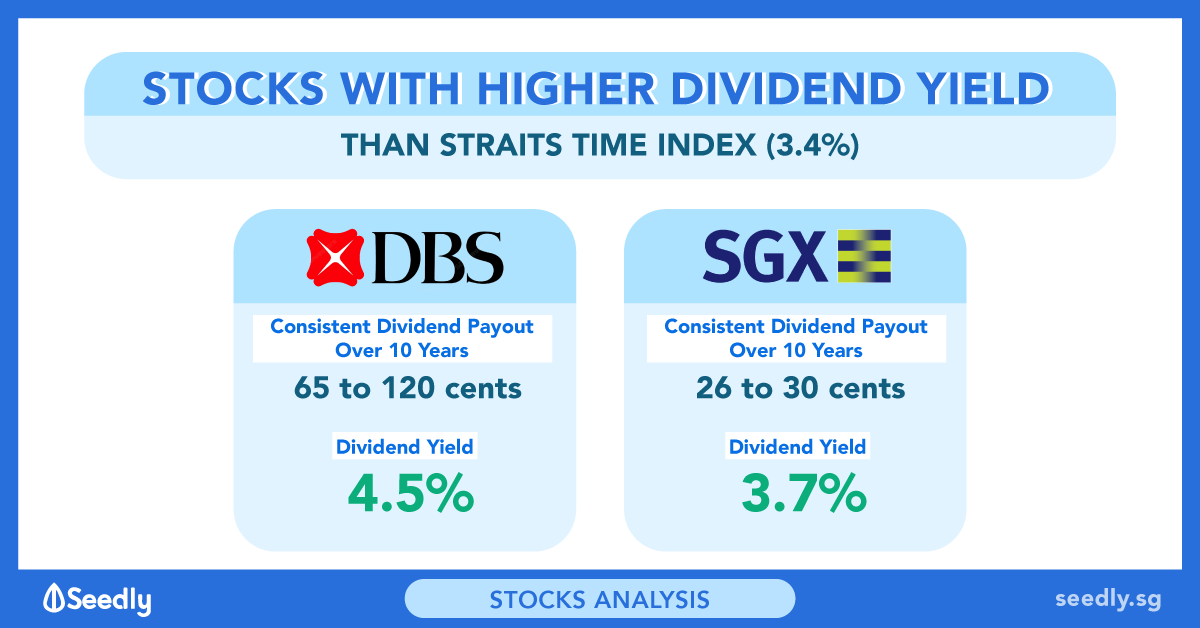

Blue chip stocks wise, it's typically about 3% or so.

Reits listed here are enjoying a spectacular run so far this year. Not sure if it is an outlier or it will continue its run for some time. If there is an increase in interest rates, you may expect prices to fall.

Reply

Save

REITS wise. We always invest only when the yield is > 5%. So technically is 5% without taking capita...

Read 3 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Products

StashAway

4.7

1295 Reviews

StashAway Simple Guaranteed 3.55% p.a. (Guaranteed rate)

Cash Management

INSTRUMENTS

None

ANNUAL MANAGEMENT FEE

None

MINIMUM INVESTMENT

3.5%

EXPECTED ANNUAL RETURN

Mobile App

PLATFORMS

Standard Chartered JumpStart Account

4.8

785 Reviews

DBS/POSB Multiplier Account

4.3

328 Reviews

Related Posts

Advertisement

Based on the Singapore REIT ETF and STI ETF prospectous on their past perforamnce, one can expect a 7% annualised returns over the long run. The past eprformance are stated in the prospectus of the ETFs which are on the front page, so it is easy to gauge