Advertisement

OPINIONS

Opportunities behind P2P Lending - a comprehensive guide

I will be demystifying P2P Lending and shedding some good behind P2P Lending

Alex Chua

17 Feb 2021

Seedly student Ambassador 2020/21 at Seedly

Disclaimer: Please do your due diligence and research.

I believe recently people heard about the scam in China or the mishap for CoAssets. The first thought that comes to your mind regarding P2P lending is SCAM! I will compress my view about P2P Lending and hopefully, you can better understand the 2 sides of the coin.

TL: DR

About

How do lenders and borrowers benefit from P2P ecosystem?

Business model that survived 2008 financial crisis

Cut throat situation in Singapore P2P lending space

Social side of P2P banking

Tips

Recommendation

Conclusion

About

P2P Lending is a debt crowdfunding(prefer this terminology), a riskier version of bonds(debt instrument).

There are 4 types of crowdfunding

donation-crowdfunding(charity),

reward-based crowdfunding (Kickstarter or Indiegogo)

equity crowdfunding

Debt Crowdfunding- P2P lending

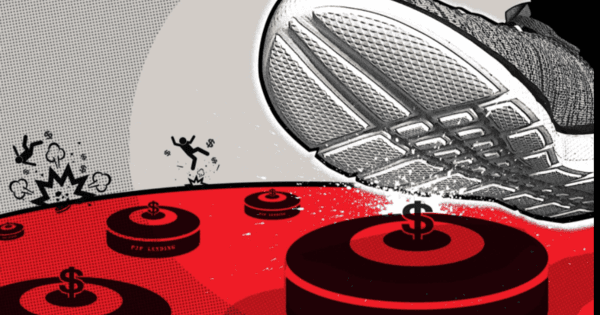

Debt crowdfunding pools money from individuals and accredited investors to help fund a loan needed by the borrower which is listed in the P2P lending platforms with detailed information of the loan agreement. This business model works like a bank. Bank attracts individuals to deposit their savings with them by offering interest rate while providing credits to business from these saving deposits you have given earning a higher interest rate. The bank profits the difference as a middleman. P2P lending "removes" this middleman via the platform. Thus, investors or lenders can now earn the average 8-10% from a business loan. BUT, YOU need to do your homework. You need to bear the risk.

^ This is me when Jumpstart and Singlife saving interest rate decreases. In my opinion, it is not unusual for people to seek better returns. Banks, on the other side, reduce interest rate to ensure they profit from the decreasing defaults rate.

How do lenders and borrowers benefit from this P2P lending, fintech ecosystem?

*NOTE that business who used bank facilities or with good credit used P2P Lending platform too.

FACT: The latest major default by Funding Societies, borrower ID 849694 involved across 30 different financial institutions with GOOD credit history. Just like HYFLUX case, some established business could go haywire. Funding Societies filed a fraudulent police report on the borrower. Status: Waiting for the result of the police investigation.

^summarised business model of P2P lending

LAW for Debt instrument: Does the business have the ability or willingness to repay the debt?

Ability = Cashflow, current assets turnover ratio

Willingness = has the ability to pay but CHOOSE to do last minute payoff OR financial impudence. Example: some invoice financing by business faced late payment due to late payments from invoice business partners (saw some established names). Business preference is keeping an account payable or receivable light with a short payment deadline

Business model that survived the 2008 financial crisis

P2P Lending started at the West in 2006. The first P2P company is called Zopa. I believe some came across Lending Club which established itself in 2007 on ARK invest by Cathie Wood.

Target audience: Serving the underbanked and unbanked. Underbanked refers to individuals or organisation with insufficient or unfair access to financial services and products such as credit services. In the western world, underbanked would be the majority of their customers such as Suburbans or rural communities or minority communities

A net annualised return of Lending Club (top); Growth of P2P after 2008 Global Crisis (bottom)

My hypothesis of rapid rise and emergence of P2P lending after the 2008 financial crisis is due to the strong dissatisfaction and distrust of the chaos, fragility of the western banking system. Bank failed to manage their lending risk, fail to manage their greed after the government support mortgage lending. This causes many to take advantage. As a result, 2008 sparks credit tightening. You will not be surprised if some individuals used P2P platform as "saving account"., business deems P2P platform as saving grace. To them, there is no alternative.

Personally, I am not a fan of modern fractional banking system behind the bank-credit creation or money creation regulated by Central bank. I do not know what bank do with my money. Easy Credit gives business buying power to do anything they want. Example, accelerating global warming.

Luckily, Singapore savings are protected by the Deposit insurance scheme and did not suffer from the bank run after the last incident.

Cutting throat of Singapore P2P platforms accelerated by Covid

Covid did a good job consolidating the P2P market. Moolahsense Down. Coassets probably next. COVID is a test for Singapore p2p platforms to improve their business models. The west had survived 2008 financial crisis so I don't see why Singapore P2P couldn't survive the COVID trials. Singapore made up of 99% SMEs and foreign small traders. This is the gap that banks failed to fill up.

Unlike the West, Singapore has the choice of having a 'safe' bank and higher interest rate debt instrument from p2p lending. In fact, banks, government agencies and p2p lending are cooperating well. For example, DBS partners with Funding Societies in better serving these SMEs by referring and participating in loan funds in P2P platforms. P2P platforms are collaborating with the Economic Development Board(EDB) in distributing SME help funds. Singapore truly deserved the hosting rights for Singapore Fintech Festival.

Social side of P2P platforms

Indonesia presents an untapped fintech opportunities due to high mobile penetration and more than 50% unbanked population.

Example

Amartha: empowering women to be more financial independent and resilient

Crowde: Working on improving unbanked farmer's working capital. To solve this, CROWDE differentiates themselves from other agriculture lenders through a strong community integration program, in which their team introduces to the farmers' educational programs, behavioural tests, and financial literacy classes

Tips for P2P platforms

Start with the minimum $500-$1000 as per allowable starting capital. : Start with a mindset of testing out the revolutionary fintech business model. Moolahsense and Coassets have been blacklisted by Seedly community (referred to seedly products review)

Diversify. Diversify. Diversify. Diversify is the best way to reduce your risk of defaults, reduce your chance of losing money. Diversify across platforms. Diversify across loan types. Diversify across borrowers. P2P platforms are like a basket of loan or as a bond ETF. It is a number game. Choose your odds.

You are the Legal 'LOAN SHARK.' You mind your own money and your risk. Just be prepared to lose the money that you can afford.

Who is managing your money? Know the professionals behind your money? Who is backing the p2p platforms?

What is the p2p platforms safety net? By regulation, p2p platforms are not legalised to withhold investor's money. Most p2p platforms carry out skin-in-the-game: they participate the funds too. The amount is dependant and varied by the platforms.

Communication is key. Lending is still a service-centric company. Technology is the enabler that innovates lending space. I will prioritise security and customer service.

No one likes defaults. Low defaults are preferable but not no defaults. I want to see and know and actions behind recovery - They have a ready and competent task force for defaults recovery.

Recommendations

Funding societies

Lowest loan amount of $20 with the lowest starting capital of $100 (referral minimum: $200, recommendation $500 — 1000). The reason is to diversify; maximise risk-reward for starter or beginners

responsive customer service

most differentiated or variety of loan products

The factsheet is just nice but can be more transparent.

*If you want more tips for maximising FS or referral codes award, either look upon my past seedly p2p commentary or Facebook private message me from my seedly profile.

2. Brdge (previously Seedin)

lowest default rate

yet to be vested but they prioritise service more than funding societies. Seem to be an opposite approach from funding societies

most transparent factsheet in my opinion: you can do a ground check of the borrower

3. Minterest

most unique crediting algorithm

Made up of management previously from Citibank

moving towards making private investors' opportunity to the mass, example real estate

Only p2p platforms that awarded issuance of consumer loans

Conclusion

Don't jump to a conclusion before understanding the situation. If P2P platforms had not been popular and viable, scammers would not have used this scheme to attract greed of the masses. Same things had happened for bitcoin. Financial institutions previously declared bitcoin a scammer. Now, most of them rushed to hold it.

Comments

1164

5

ABOUT ME

Alex Chua

17 Feb 2021

Seedly student Ambassador 2020/21 at Seedly

A sustainable analyst and an undergraduate pursuing Engineering System Design in SUTD. Be the master of $ and be slaved by $

1164

5

Advertisement

No comments yet.

Be the first to share your thoughts!