POSB SAYE Account

- Key Features

- Reviews (43)

- Discussions (0)

- More Details

Advertisement

POSB SAYE Account

POSB SAYE Account

This product has not been claimed by the company yet.

Summary

POSB SAYE Account Review 2024

Account Features & Details

1) Key Features

- Enjoy additional 2.00% p.a interest for the first 2 years when you credit your salary, set a fixed monthly savings amount and make no withdrawals from your account

- Determine your fixed monthly savings from S$50 to S$300 in multiples of S$10

2) Interest Rates

- Base interest rate: 0.05% p.a

- Maximum interest rate: 2.00% p.a

- Monthly fixed savings of:

- S$50 – S$290: 0.05% p.a

- S$300 – S$790: 0.20% p.

- S$800 – S$1,490: 0.25% p.a

- S$1,500 – S$3,000: 0.05% p.a

3) Eligibility

- Age: 16 years old and above

- Citizenship: Singaporeans, PRs, and Foreigners

- Others: Already have a DBS/POSB Savings/Current Account as your salary crediting account

- Minimum initial deposit: S$0

- Salary must be credit via GIRO with transaction reference codes ‘SAL’ or ‘PAY’

4) Fees

- Minimum average account balance: S$0

- Monthly account fees: S$0

5) Application Process

How to apply?

- Apply online through POSB’s website

- For new to POSB customers, you will first have to open a new POSB account

- For existing POSB customers, you may apply through iBanking or your Debit/ATM Card and PIN

Supporting documents (new customers)

- Using SingPass

- Passport (for foreigners)

- Proof of residential address

- Proof of tax residency - Not using SingPass

- NRIC (for Singaporeans or PRs); Passport/ Employment Pass/ S Pass/ Student Pass/ In-Principle Approval (for foreigners)

- Proof of residential address

- Proof of tax residency

Popular Products

4.8

785 Reviews

4.3

329 Reviews

4.7

213 Reviews

4.3

207 Reviews

Summary

POSB SAYE Account Review 2024

Account Features & Details

1) Key Features

- Enjoy additional 2.00% p.a interest for the first 2 years when you credit your salary, set a fixed monthly savings amount and make no withdrawals from your account

- Determine your fixed monthly savings from S$50 to S$300 in multiples of S$10

2) Interest Rates

- Base interest rate: 0.05% p.a

- Maximum interest rate: 2.00% p.a

- Monthly fixed savings of:

- S$50 – S$290: 0.05% p.a

- S$300 – S$790: 0.20% p.

- S$800 – S$1,490: 0.25% p.a

- S$1,500 – S$3,000: 0.05% p.a

3) Eligibility

- Age: 16 years old and above

- Citizenship: Singaporeans, PRs, and Foreigners

- Others: Already have a DBS/POSB Savings/Current Account as your salary crediting account

- Minimum initial deposit: S$0

- Salary must be credit via GIRO with transaction reference codes ‘SAL’ or ‘PAY’

4) Fees

- Minimum average account balance: S$0

- Monthly account fees: S$0

5) Application Process

How to apply?

- Apply online through POSB’s website

- For new to POSB customers, you will first have to open a new POSB account

- For existing POSB customers, you may apply through iBanking or your Debit/ATM Card and PIN

Supporting documents (new customers)

- Using SingPass

- Passport (for foreigners)

- Proof of residential address

- Proof of tax residency - Not using SingPass

- NRIC (for Singaporeans or PRs); Passport/ Employment Pass/ S Pass/ Student Pass/ In-Principle Approval (for foreigners)

- Proof of residential address

- Proof of tax residency

POSB SAYE Account

POSB SAYE Account

Up to 2% p.a.

INTEREST RATES

$0

MIN. INITIAL DEPOSIT

$50

MIN. AVG DAILY BALANCE

4.3

43 Reviews

Service Rating

Customer Support

Ease of online banking

High to Low

Posted 07 Jan 2023

Purchased

POSB SAYE Account

About 2 years ago, I was looking to increase my savings with low risk approach. My total interest was about 2.2% (base+additional interest). Just setup the standing instruction to make automatic transfer from your POSB bank account to SAYE account. Don't take out or make any transfer from SAYE account, otherwise you'll lose the additional interest, unless due to emergency. I have closed the above SAYE account after the additional interest is credited after 24 mth. And open a new account, this time POSB is offering 3.5% additional interest. My calculated total interest is about 3.7%. Recommended for those who do not want to touch their monies and lock in for a total of 24 mths plus a few days.0

What are your thoughts?Posted 01 Nov 2022

Purchased

POSB SAYE Account

Started SAYE 'cos of the measly interest rates everywhere was offering bout 1 year back. (Yes, 2% was considered great then if capital was small.) Now that interest rates are up again, I've stopped my SAYE after the 1-year mark. Yup, no penalty for closing your SAYE account after at least 1 year and you still get to keep the 2% bonus interest for the 1st 12 months.0

What are your thoughts?Posted 12 May 2022

Purchased

POSB SAYE Account

It is a guarantee 2% and interest is really good for short-term two years however it requires that the money comes from salary credited so make sure you have a stable job if not you will not be eligible and forfeit the interest. When you cannot maintain for one year at least0

What are your thoughts?Posted 14 Sep 2021

Purchased

POSB SAYE Account

Easy to sign up but A little difficult to get to the hotline to request verification for the cancellation policy. Do note before starting that you need a salary crediting account that links to this post SAYE account for min of 2 years if not you would NOT enjoy the rewards!0

What are your thoughts?30 Jun 2021

Purchased

POSB SAYE Account

Application process is breeze through with posb digibank. easy to use and set up very fast. Good to set up a regular amount every month for 2 years giving the prevailing low interest climate 2 percent interest is a steal. Note the no withdrawal is allowed Thank you0

What are your thoughts?11 Jun 2021

Purchased

POSB SAYE Account

Application process was super smooth and easy, especially if you are already a POSB or DBS account holder! And that 2% interest rate is pretty cool, especially during this period of time when interest rates are at an all time low!0

What are your thoughts?02 May 2021

Purchased

POSB SAYE Account

[Fuss Free] It deposits from my account monthly automatically [Application Process] Easy to apply for in the app Overall great to use during the 2 years NS, but it's not as appealing once you're out0

What are your thoughts?29 Apr 2021

Purchased

POSB SAYE Account

Started during NS and had no regrets since NS didn't require me to spend a lot. I saved $500 every month and after 2 years, I have saved 12k excluding interests. [Fuss Free] Very easy to apply online. [Salary Crediting] You don't have to worry about manually transferring funds over to the account as it is automated. [Interest] Monthly Deposit | Interest $50 - $290 |0.050 $300 - $790 |0.200 $800 - $1,490 |0.250 $1,500 - $3,000 |0.250 Fail to deposit |0.05 Cash gift interest |2% * cash gift is deposited after 12 months and 24 months.0

What are your thoughts?25 Jun 2020

Purchased

POSB SAYE Account

This is my go- to option if you want to restrain yourself from excessive spending. I use it during my 2 years of NS and I park most of my salary inside. SAYE is less liquidate with high interest rate. If you have the discipline to save, probably SC Jumpstart is the best alternative0

What are your thoughts?24 Jun 2020

Purchased

POSB SAYE Account

[Customer Service] Was good and efficient. [Application Process] Was pretty simple. [Online Banking] Pretty much you can access anywhere and anytime. Highly recommended for us singaporeans0

What are your thoughts?

Discussions (0)

Recent Activity

No Posts Found.

Popular Products

4.8

785 Reviews

4.3

329 Reviews

4.7

213 Reviews

4.3

207 Reviews

How does POSB SAYE Savings Account Work?

- SAYE savings account holder has to have an existing DBS/POSB account which your salary is credited to.

- This would be the primary debiting account to the SAYE Account whereby a set amount, also known as 'Monthly Savings Amount', from your existing primary account will be automatically transferred to your POSB SAYE Account every month.

- This automatically helps you save a standard amount of cash without you conducting any transfer processes every monthly.

- The set Monthly Savings Amount credited to your SAYE account determines how much base interest rate you will earn - which ranges from 0.05% - 0.25% p.a.

- Additionally, you can get to enjoy bonus interest rates of 2.00% p.a. on top of the base interest rate if you sustain crediting a fixed amount of your salary for 2 years straight, without withdrawal.

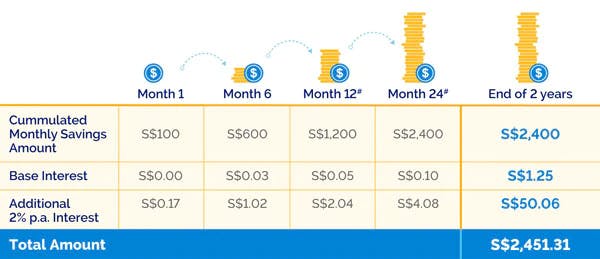

Below is an illustration of the interest earned when you make a successful S$100 monthly contribution into your POSB SAYE Account on the 1st day of each month:

Interest Rates for POSB SAYE Account

Monthly Savings Amount | Rates (% p.a.) |

|---|---|

S$50 - S$290 | 0.05% |

S$300 - S$790 | 0.20% |

S$800 - S$1,490 | 0.25% |

S$1,500 - S$3,000 | 0.25% |

If there is a failed crediting of monthly savings amount, withdrawal made or account is closed during the month | 0.05% |

Bonus Interest Rates for POSB SAYE Account

Cash Gift Interest Conditions | Bonus Interest Rate |

|---|---|

when you credit your monthly salary to the linked debiting account + make no withdrawals for 24 months | 2.00% p.a. |

How to maximise the interest rates for POSB SAYE?

- Credit your monthly salary via GIRO (Transaction Reference Code: SAL or PAY) into a POSB/DBS account and select it as the debiting account for the monthly savings contribution into the POSB SAYE Account.

- Determine a fixed monthly savings amount from S$50 to S$3,000 (in multiples of S$10)

- Choose your preferred monthly savings date (between the 1st and 25th day of the month)

- Keep up the monthly regular monthly deposit AND Make no withdrawal from the POSB SAYE Account for 24 months to enjoy 2.00% bonus interest of Cash Gift Interest

- If any withdrawal is performed, all past months accumulated 2% Cash Gift Interest amount will be forfeited

Is SAYE the Best Savings Account for you in 2021?

Pros

- Helps you save without you needing to conduct extra processes

- Simple savings account mechanics does not require strategic spending

- Ideal for people to park their funds and create a regular saving habit

Cons

- Primary Debiting Account must have enough funds to sustain your SAYE account

- No withdrawals can be made for 24 months, this fixed period might be too long for some people

- Any withdrawal made will automatically forfeit all the bonuses that you have managed to accumulate before the 24 months cut-off.

Want to know how POSB SAYE compares with other savings accounts? Here's a compilation of The Best Savings Accounts in 2021

Eligibility: who can apply for POSB SAYE Account?

- For all Singaporeans and Permanent Resident (PR) and Foreigners:

- Aged at least 16 years old to open this account, and already have a DBS/POSB Savings/Current Account

- Aged below 18 years old must have a valid iBanking login or ATM/Debit Card to apply

How to apply for POSB SAYE?

- Apply Online through the 'Visit Site' button above

- Visit POSB or DBS branches

Contact us at [email protected] should you require any assistance or spot any inaccuracies.

Advertisement